- SOL held strong above $140 for a week, sparking talk of a possible rally toward $200.

- Despite rising open interest, bearish bets are growing as traders expect a pullback.

- Solana’s DEX volume leads the market, with ETF approval odds hitting 90% for October.

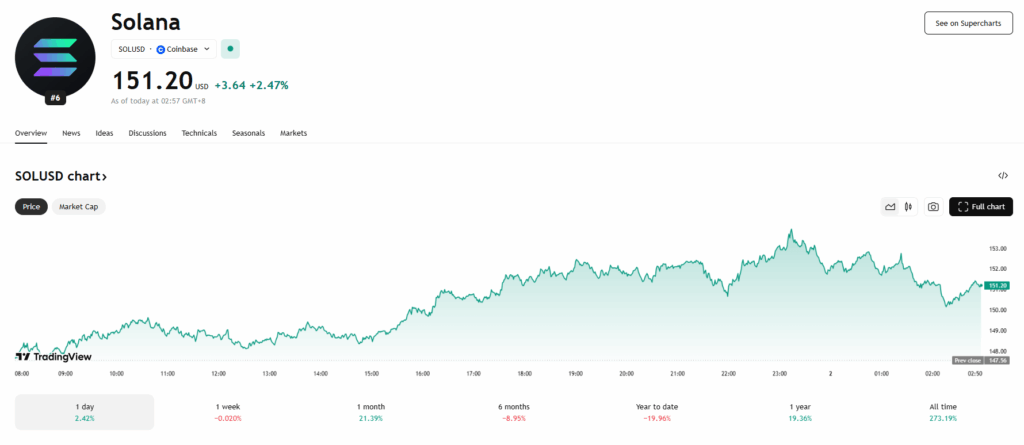

Solana’s token, SOL, slipped about 4% between April 29 and 30. Not a great look—but here’s the thing: it held the $140 support level for a full week, and that hasn’t happened in months. So even though it dipped, some traders are feeling… oddly confident. That kind of price stability has been rare lately.

Now with demand for leveraged SOL positions hitting some crazy highs, people are starting to wonder—could we actually see a move past $200 soon?

Derivatives market heating up (like, a lot)

On April 30, open interest in SOL futures hit 40.5 million tokens. That’s a 5% jump from last month, putting the dollar amount at a hefty $5.75 billion. That makes SOL the third-largest derivatives market in crypto right now—yep, it even beat XRP by more than 50%.

This kind of futures activity usually signals institutional interest creeping in. But here’s the twist: more traders are actually betting against SOL right now.

Bearish bets piling up, despite recent rally

Even though open interest is way up, the funding rate on SOL perpetuals is sitting in the negative. That basically means there’s more appetite for short positions—folks are expecting a drop. The last burst of optimism fizzled out on April 25 when SOL couldn’t break above $156. Some of that hesitation might come from the fact that SOL already jumped 43% between April 8 and 29… that’s a big move in just three weeks.

A $200 target? Maybe ambitious. But not impossible. The token was right around $195 back in mid-February, even when activity on Solana dApps had fallen off a cliff.

Solana isn’t just about memecoins (seriously)

People like to clown on Solana for being memecoin central, but there’s more going on under the hood. Right now, Solana’s got $9.5 billion locked up across its ecosystem—staking, lending, yield platforms, synthetic assets… you name it.

Meteora pulled in $19.1 million in fees in just a week. Pump.fun wasn’t far behind with $18.6 million, and Jito brought in $14.6 million. These aren’t just hype numbers—they show real activity, and real usage.

Solana crushing it on DEX volume

Despite Ethereum’s base layer fees dropping to around $0.65 since mid-April, Solana’s decentralized exchanges (DEXs) have seen nearly 90% more volume. Even when you throw Ethereum’s layer-2s into the mix, Solana still came out ahead last week—$21.6 billion in DEX volume.

There were big gains across the board too. Raydium volumes jumped 87% week-over-week. Meteora was up 58%. Those numbers kinda speak for themselves.

SOL ETF approval odds rising fast

And then there’s the ETF angle. If a spot Solana ETF gets approved in the U.S., it could bring in a whole new wave of retail and institutional buyers. Analysts say there’s a 90% chance the SEC gives it the go-ahead by October 10.

That said, SOL might not even wait that long to move. Between the solid on-chain activity and growing market interest, a run past $200 could happen way before the SEC makes up its mind.

Want this turned into a thread or key highlights? Just say the word.