- Polkadot (DOT) rebounds to $5.26 amid triple bottom pattern, signaling a potential 120% surge to $11.60.

- ETF applications from 21Shares and Grayscale could attract major institutional inflows, boosting DOT’s outlook.

- Polkadot 2.0 upgrade improves scalability, slashing block times and enabling elastic scaling on the network.

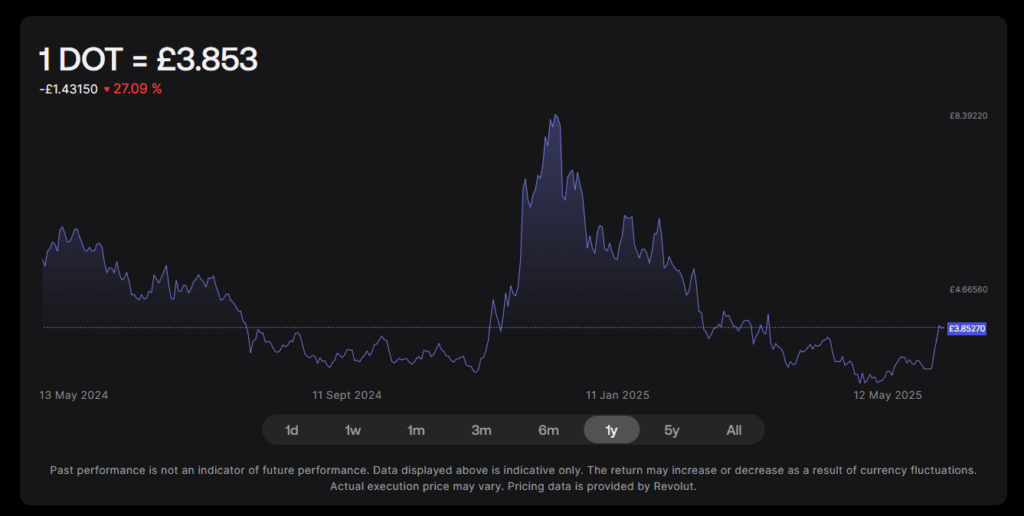

Polkadot’s showing signs of life after bouncing back from its April lows. The token’s up to $5.26, a solid recovery from $3.25, and now, technical indicators are flashing strong buy signals. A triple bottom pattern is forming on the charts – a classic bullish signal – suggesting DOT could be gearing up for a run to $11.60. If that target hits, it’d mean a 120% surge from current levels. But a drop below $4 could spoil the setup, so it’s not a done deal just yet.

ETF Hype and Institutional Interest

Big money might be about to pile into Polkadot too. Both 21Shares and Grayscale have applied for spot Polkadot ETFs, hoping to get the green light from the SEC. If those ETFs get approved, it could open the door to a wave of institutional investment, similar to what happened with Bitcoin ETFs last year. Back then, Bitcoin saw over $40 billion in inflows, and a similar effect on DOT could add more fuel to the fire. The SEC’s already shown some favor toward proof-of-stake networks like Ethereum, so Polkadot might just get the nod.

Polkadot 2.0: Network Upgrades and Scalability Boost

On the technical side, Polkadot’s gearing up for some serious upgrades with its 2.0 overhaul. The three-phase upgrade is already in motion – asynchronous backing has cut block times in half, slashing them from 12 to 6 seconds, doubling throughput. Agile coretime now lets developers buy computational resources directly, skipping the parachain auction hassle. And the final phase, elastic scaling, is currently being tested on Kusama. Once it rolls out on the mainnet, projects will be able to allocate extra resources during high-traffic periods, addressing long-standing scalability issues.

Market Context: Crypto Rally and Broader Sentiment

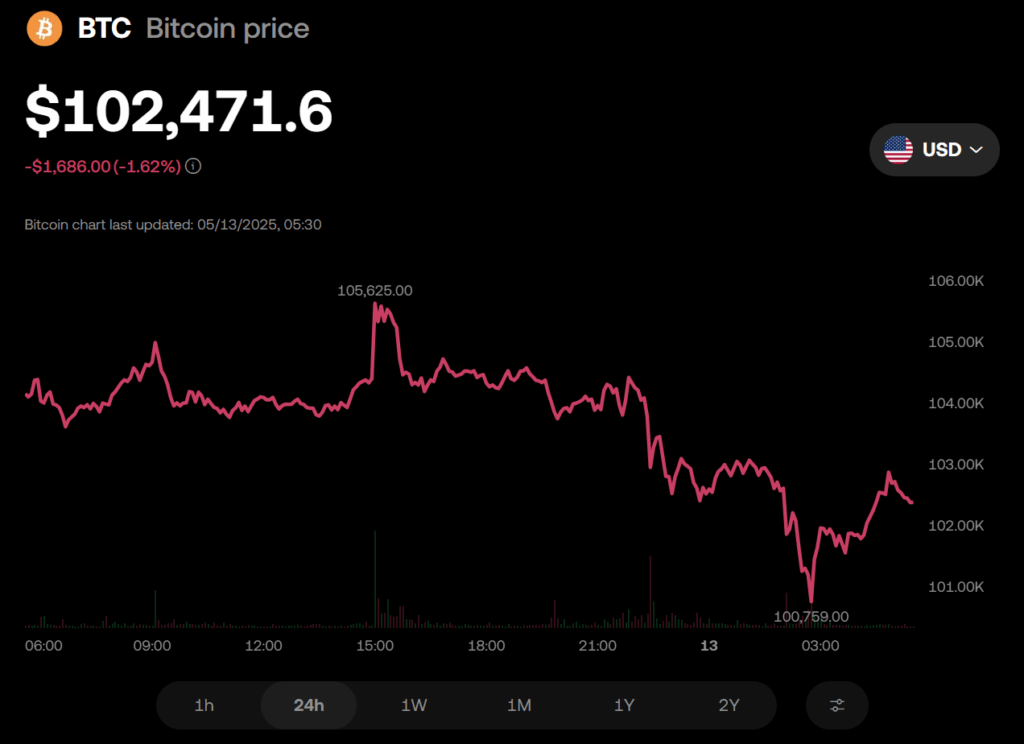

The broader crypto market’s in rally mode, with Bitcoin hitting $105,000 and the total market cap climbing above $3.3 trillion. Traditional markets are also trending up, buoyed by improved US-China trade relations. Analysts are eyeing Bitcoin at $200,000, and if BTC keeps running, capital could start spilling into altcoins like DOT. That said, the “sell in May” strategy hasn’t exactly played out this year, so traders are keeping a close watch on momentum shifts in the weeks ahead.

Investment Risks and Considerations

Despite all the bullish indicators, Polkadot’s not without its risks. The crypto market’s infamous for wild price swings, and DOT isn’t immune. Regulatory uncertainty remains a factor, especially with ETF applications pending and ongoing scrutiny around proof-of-stake networks. Polkadot 2.0 addresses some of the network’s previous scalability issues, but if adoption doesn’t pick up or if regulatory setbacks occur, those gains could evaporate fast. Still, for those bullish on cross-chain capabilities and layer-1 networks, DOT could be a compelling bet – if the pieces fall into place.