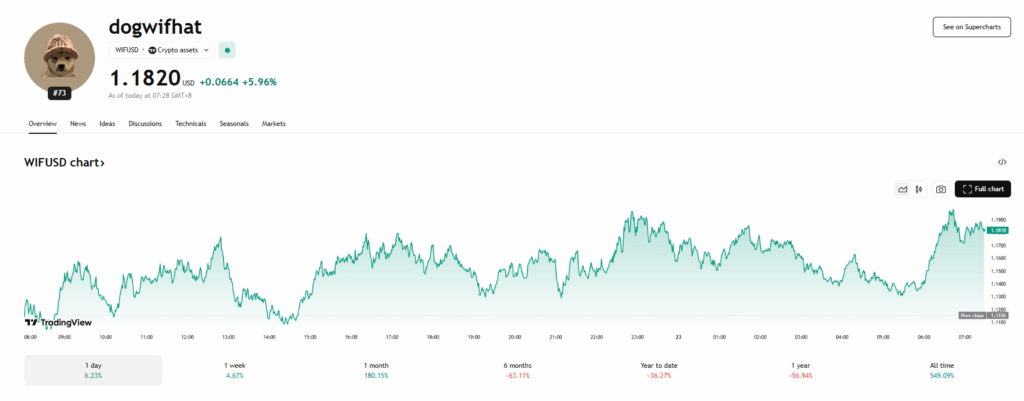

- Dogwifhat (WIF) surged 168% this month, riding Bitcoin’s breakout to a new all-time high.

- BTC’s rally, boosted by over $3B in BlackRock buys, has reignited investor confidence across the market.

- WIF could dip to $0.37 or push toward $3 if Bitcoin stays hot and the Fed cuts rates.

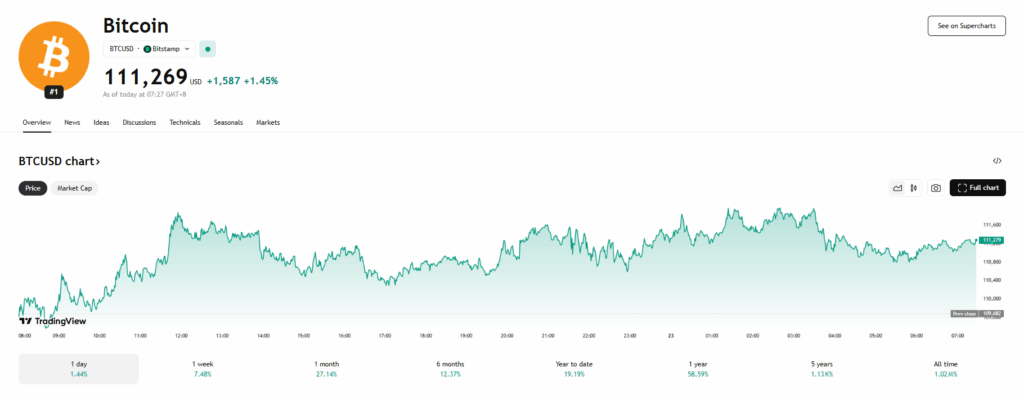

The crypto scene’s on fire right now. On May 22, Bitcoin (BTC) hit a brand new all-time high of $111,544, dragging the whole market up with it. The global crypto market cap? It jumped 2.6%, now sitting around $3.63 trillion. And yep—memecoins are riding the wave too. One in particular? Dogwifhat (WIF), which has been absolutely pumping.

WIF shot up 21.1% in just the last 24 hours, 8% over the past week, 86.4% in two weeks, and a mind-blowing 168% for the month. Wild stuff. But just to ground things a bit—WIF is still down roughly 59% from where it was in late May last year. So, yeah… a comeback, but not without some scars.

WIF Catches Fire After Bitcoin’s Institutional Boost

So, what’s behind the memecoin mania? A lot of it seems tied to Bitcoin’s big breakout. BTC’s rally has been fueled largely by institutional buys—and we’re not talking small fries here. BlackRock alone has scooped up over $3 billion worth of BTC since May 2. That kind of movement tends to wake people up.

And the macro backdrop isn’t hurting either. There’s some buzz around the GENIUS stablecoin regulation act, which just cleared a big hurdle. Even White House crypto/AI advisor David Sacks chimed in, claiming stablecoins could unlock trillions for the U.S. treasury. Confidence is running high—and assets like WIF are soaking up that bullish energy.

Could WIF Hit $3? Maybe… Maybe Not.

Now, let’s talk price targets. According to CoinCodex, WIF might not keep flying forever. They’re predicting a dip to around $0.37 by June 11, which—brace yourself—would be a 67.9% correction. Definitely not the scenario holders wanna hear, but hey, it’s crypto. Swings happen.

Still, there’s another path. If Bitcoin keeps climbing, there’s a real shot WIF could reclaim the $3 level in the coming weeks. Add in the chance of a Fed rate cut, and things could get even weirder. Lower rates usually spark more risk-on behavior, and memecoins? They’re basically the definition of that.

Bottom line: WIF’s in a sweet spot right now, but whether it holds or flips depends on the bigger market moves—and maybe just a little bit of memecoin magic.