- Cardano may be entering Wave 5 of its cycle, with analysts eyeing a potential surge to $14.

- ADA’s technicals look solid, with RSI near neutral and price holding above key long-term support.

- Strong fundamentals and growing network activity could fuel a major rally if market conditions stay favorable.

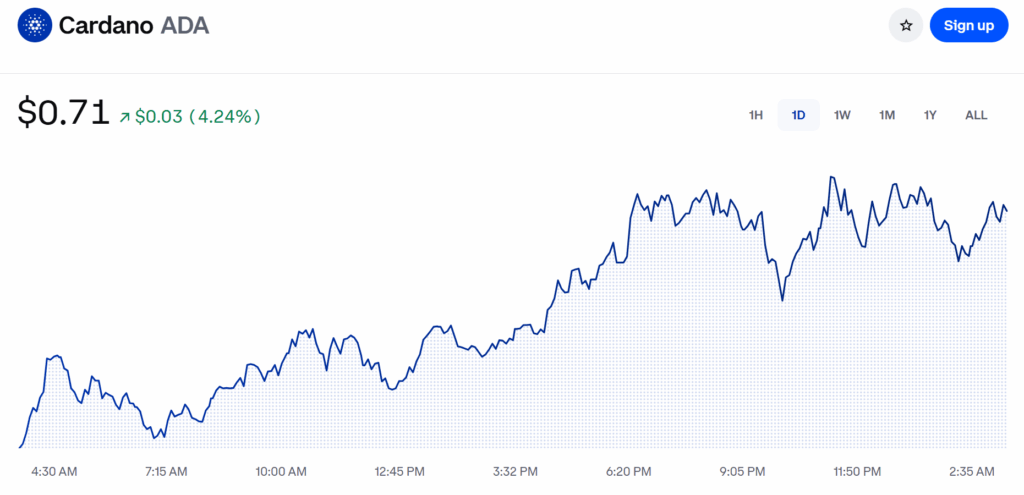

There’s a bit of buzz building around Cardano (ADA) again—this time thanks to a fresh Elliott Wave analysis from TapTools. According to their charts, ADA might be on the edge of kicking off Wave 5… and if that happens, they’re throwing out a target as high as $14. Yep, $14. It’s bold, but the wave structure? It lines up a little too well with past cycles to ignore.

The setup looks eerily familiar

TapTools points out that ADA has already knocked out Waves 1 through 4. That means, technically speaking, the next big push—Wave 5—could be the most aggressive of the cycle. And if you’re having déjà vu, that’s because something very similar played out between 2020 and 2021 when Cardano exploded from under 10 cents to more than $3.

They also noted some symmetry in the structure and timing. Not a perfect mirror of the past… but close enough that a lot of traders are starting to watch this one more closely.

Technicals are lining up, too

ADA’s RSI is sitting around 49.5 right now—not overbought, not oversold—so there’s room for a move without it looking overheated. And it’s currently floating above the 200-week EMA, which sits near $0.55. Historically, that level’s been a pretty strong support zone during past uptrends.

So, from a technical angle? Nothing’s broken—if anything, it’s looking like it’s holding firm.

Fundamentals aren’t lagging either

Cardano isn’t just moving on chart vibes. The project’s pushing through its Basho and Voltaire phases, which focus on scalability and governance—pretty big upgrades. Plus, its DeFi ecosystem is expanding, and there’s more interest in real-world asset tokenization on the network.

Developers are showing up. Use cases are growing. There’s an actual foundation under this forecast—not just hopium.

$14 won’t happen overnight… but the window is open

Elliott Wave theory suggests this run—if it happens—could take 6 to 12 months to fully play out. And typically, with these types of moves, most of the action happens in the last few months. You get some slow build-up, then suddenly everyone notices at once and things just go vertical.

Volume trends right now are showing increased buying during rallies and lighter selling during dips. That kind of setup often comes before a breakout.

A few things could still go sideways

Nothing’s guaranteed. Even though the setup looks solid, stuff like unexpected market shifts, regulation surprises, or strong competition from other smart contract platforms could mess with the timeline—or derail the rally altogether.

Also, let’s not forget ADA’s got to push through old resistance levels if it wants to set new highs. That’s never easy.

So… is this the start of something big?

If Elliott Wave theory holds up—and the market doesn’t throw a curveball—Cardano might be lining up for one of its biggest rallies yet. The $14 target is ambitious, sure, but it’s not totally out of reach.

ADA’s technical structure and network progress suggest that, if the stars align, 2025 could be the year it makes its mark again.