- XRP is gaining momentum in the U.S. ETF race, recently surpassing Solana in liquidity and market depth.

- The launch of Teucrium’s 2x leveraged XRP ETF brought in over $5 million on day one, marking a strong start.

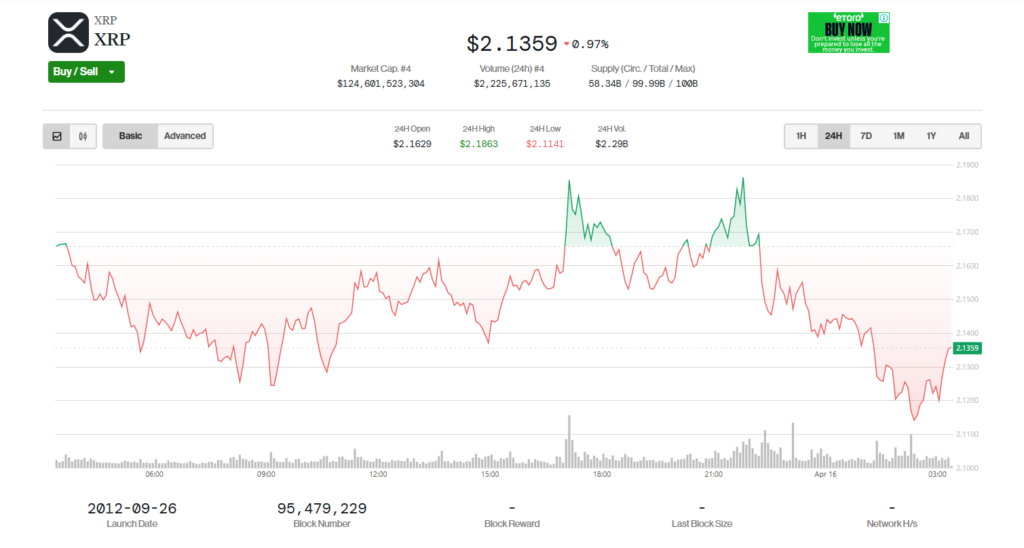

- Despite optimism, Deribit’s options market shows traders are hedging downside risks ahead of the April 18 expiration.

XRP and Solana (SOL) are neck and neck in the race toward U.S. spot ETF approval—but XRP could be inching ahead, according to analysts at Kaiko. Both tokens are seeing solid liquidity, but XRP’s been quietly building momentum that might give it the edge.

Kaiko’s Monday report breaks it down: XRP and SOL are showing the deepest 1% market depth on vetted exchanges. That means there’s real liquidity behind the trades, and XRP in particular has surged past Solana since late 2024. In fact, it’s now got twice the liquidity of Cardano’s ADA.

Here’s the thing though—unlike Bitcoin, which got its ETF blessing after Grayscale’s big court win over the SEC, XRP is taking a different path. It doesn’t have the kind of futures market BTC does, and most of its trading action still happens offshore. But that hasn’t stopped its U.S. presence from growing—the token’s domestic share just hit a post-lawsuit high.

Meanwhile, Solana’s U.S. volume has slipped, dropping from its 2022 highs of around 25–30% to just 16% now. Oof.

Adding fuel to XRP’s fire? Teucrium just rolled out a 2x leveraged XRP ETF, and it popped off—racking up over $5 million in volume on day one. Kaiko called it the firm’s “most successful launch” so far.

“This improving market structure and the recent launch of a 2x XRP ETF give XRP a strong shot at being first in line for spot ETF approval,” the report stated.

They also flagged Litecoin (LTC) as another possible candidate, thanks to its similarities with Bitcoin when it comes to consensus mechanisms and its commodity-like traits.

Still, the options market tells a slightly different story. Deribit data shows traders aren’t exactly all-in on XRP’s near-term future. For April 18, there’s a bearish tilt in the implied volatility curve—a sign some are bracing for a dip.

That said, the SEC has acknowledged multiple XRP ETF filings already. Grayscale’s application is a big one to watch, with a key decision date set for May 22. Could that be the day XRP breaks through?

Only time (and maybe the SEC) will tell.