- Ethereum is hovering just above the critical $1,500 support, with low volatility and weak momentum suggesting a possible breakdown toward $1,100 if sellers step in.

- Short-term price action shows ETH trapped between $1,500 and $1,600, with a breakout either way likely to trigger a sharp move—$1,800 if up, $1,100 if down.

- Onchain data hints at possible smart money accumulation, but further downside may still come before any meaningful recovery rally kicks off.

Ethereum’s been, well… kinda stuck. Price action is flat, energy’s low, and volatility? Almost nonexistent. And that’s not great news—because when ETH goes quiet like this, something big usually follows. Unfortunately, at the moment, all signs are leaning a bit bearish.

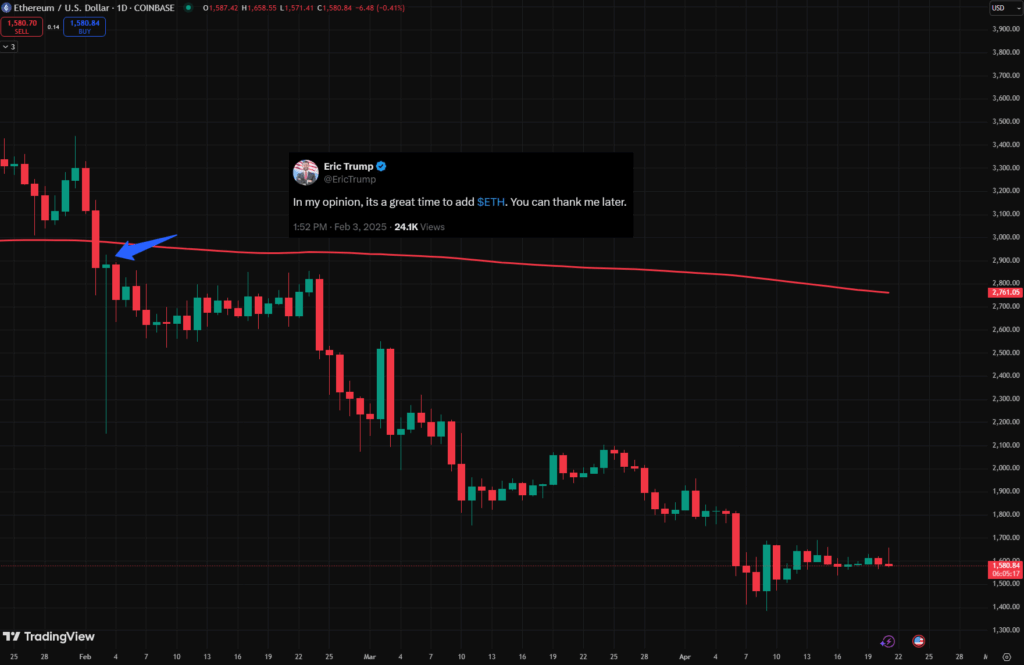

Daily Chart: Holding On—But Barely

ETH is still clinging above the $1,500 support, a level that’s held the line since January 2023. But the way things look right now? The market’s sleepwalking. Volume’s dried up. No momentum. Just sideways chop. Neither bulls nor bears seem confident enough to commit.

That kind of apathy is dangerous. It usually means the market’s just waiting for a catalyst—any excuse to move. And if that excuse shows up as renewed sell pressure, ETH could slice right through $1,500. And if that happens? $1,100 is the next major support on the radar.

There’s still a chance of a quick relief bounce up to $1,800, especially if shorts get squeezed. But that could just be a setup for the next leg down. Honestly, the next few days will be critical.

4-Hour Chart: Calm Before the Storm?

Zooming in, the 4H chart tells a similar story. ETH’s stuck between $1,500 on the bottom and about $1,600 on top—forming a super tight range within a descending channel.

It’s textbook equilibrium. Buyers and sellers are basically at a standoff.

If ETH breaks out above $1,600, we might get a quick shot at $1,800. But a breakdown below $1,500? That could trigger some real panic—and $1,100 becomes way more likely in that case.

Onchain Analysis: Smart Money’s Watching

Now here’s where it gets a bit more interesting. Looking at funding rates in the futures market, we’re seeing a repeat of what happened back in late 2024—flat funding, boring price action, low confidence… and then? Boom, a big rally.

Right now, funding is hovering around zero. That usually means the market’s neutral—but it could also suggest that smart money is quietly loading up while retail traders are exhausted or getting washed out.

Still, even in accumulation phases like this, prices can fall further. A dip below support might just be one last shakeout before things turn bullish again. If you’re in it for the long haul, that could be a pretty decent opportunity.

Bottom Line

Ethereum is in no man’s land—drifting, quiet, and right on top of key support. A break below $1,500 could open the door to $1,100 real fast. But… if history repeats, this might also be the silent stage before a strong recovery.

Either way, this isn’t the time to fall asleep on ETH. Keep your eyes on the charts.

Let me know if you want a chart breakdown or a tweet-thread version next!