- American Bitcoin Merges with Gryphon, Eyes Nasdaq Listing: Trump-backed American Bitcoin will go public under the ticker “ABTC” after merging with Gryphon Digital Mining, aiming to expand Bitcoin mining infrastructure across the U.S. while scaling its accumulation strategy.

- Hut 8 Retains Control as Infrastructure Partner: Despite the merger, Hut 8 will maintain its infrastructure and operations role, securing ongoing revenue streams and retaining 80% equity in the newly formed entity.

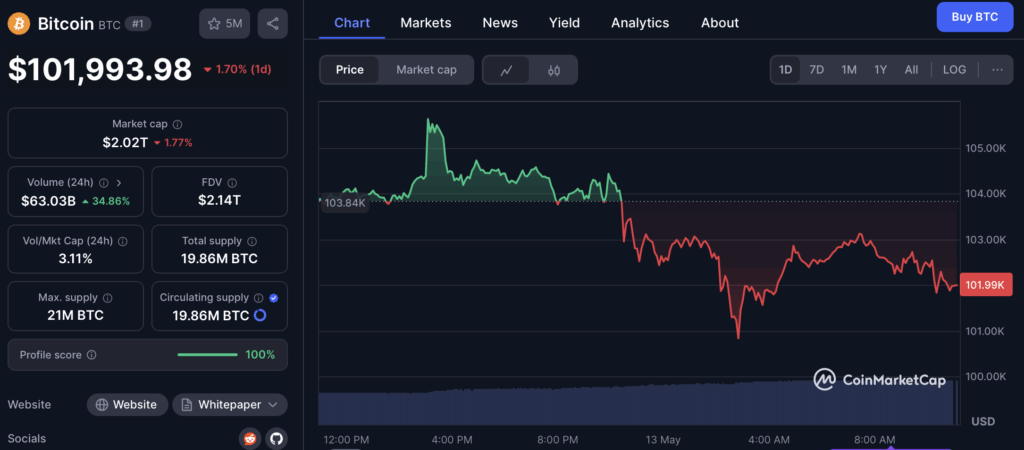

- Bitcoin Faces Profit-Taking Amid Merger News: Bitcoin briefly hit $105,800 before pulling back to $101,809 as traders locked in profits, though steady buy orders at $101K suggest ongoing support despite increased market volatility.

Trump-backed American Bitcoin is taking a big leap forward, merging with Nasdaq-listed Gryphon Digital Mining to go public under the ticker “ABTC.” The all-stock deal, announced Monday, aims to supercharge the company’s Bitcoin accumulation strategy while scaling its mining infrastructure across the U.S. The merger is slated to close in Q3 2025, pending regulatory green lights.

“This transaction marks the next step in scaling American Bitcoin as a purpose-built vehicle for low-cost Bitcoin accumulation at scale,” said Hut 8 CEO Asher Genoot.

Under the terms, American Bitcoin shareholders will hold onto 98% of the merged entity, with Hut 8 staying in the driver’s seat as the majority shareholder.

Hut 8 Keeps Control as Infrastructure Partner

Even after the merger, Hut 8 will maintain its grip as the exclusive infrastructure and operations partner for American Bitcoin. The deal secures commercial agreements that guarantee ongoing revenue streams through its power and digital assets divisions.

This isn’t Hut 8’s first move to consolidate its position. Back in March, it formed American Bitcoin through a merger with American Data Centers (ADC), a venture led by Eric Trump and Donald Trump Jr.

Eric Trump is set to join the new entity’s leadership team, alongside Mike Ho, Justin Mateen, and Michael Broukhim. The combined operation is marketing itself as a low-cost Bitcoin accumulator, leveraging public capital markets to fuel its growth.

What’s Next for American Bitcoin?

The Nasdaq listing gives American Bitcoin access to U.S. capital markets, positioning it as a key player in the Bitcoin mining and infrastructure space. With Hut 8 holding over 10,000 BTC and retaining 80% equity in the merged firm, it keeps a solid footing in the Bitcoin market while minimizing balance sheet exposure.

Bitcoin Price Action — Profit Taking or Just a Pause?

Meanwhile, Bitcoin hit an intraday high of $105,800 on Binance before pulling back to $101,809 — down 3% on the day. The retreat suggests some profit-taking after last week’s rally, but steady buy orders around the $101K level indicate underlying support remains strong.

Volatility remains elevated, with structural shifts in the mining sector and fresh capital flows adding to the mix. Traders are keeping a close watch as the market digests the American Bitcoin merger news and broader macroeconomic signals