- AAVE is showing signs of recovery, jumping 3.34% in 24 hours after a rough month, driven by improved liquidity and a promising upgrade proposal.

- Aave V3 may soon expand to Aptos, a high-speed chain (150,000 TPS), potentially boosting user growth and adoption.

- Rising TVL and wallet activity indicate stronger investor confidence, with large AAVE purchases and a shift toward long-term holding. Derivatives data also shows bullish momentum building.

Looks like buyers are slowly getting back into Aave [AAVE], with the token jumping 3.34% in just the past 24 hours. That’s a welcome change after AAVE slipped nearly 19% over the last month. The mood’s shifting, and it’s not just price action—liquidity is picking up, and a big protocol upgrade might be pulling in some fresh attention.

Aave V3 Expansion: Aptos Could Be a Game Changer

Aave V3 is making moves. The protocol’s latest proposal, which is still under governance vote, could see Aave launching on Aptos [APT]—its first non-Ethereum-compatible chain. If it passes, this could open some serious doors.

Why Aptos? Well, it boasts speeds of up to 150,000 transactions per second. Compare that to Ethereum’s 12 to 15 TPS… yeah, that’s a huge jump. This could mean faster trades, more users, and deeper liquidity pools. No surprise then that sentiment has turned bullish. Everyone’s watching to see where this goes.

TVL Ticks Up: Liquidity Flows into AAVE

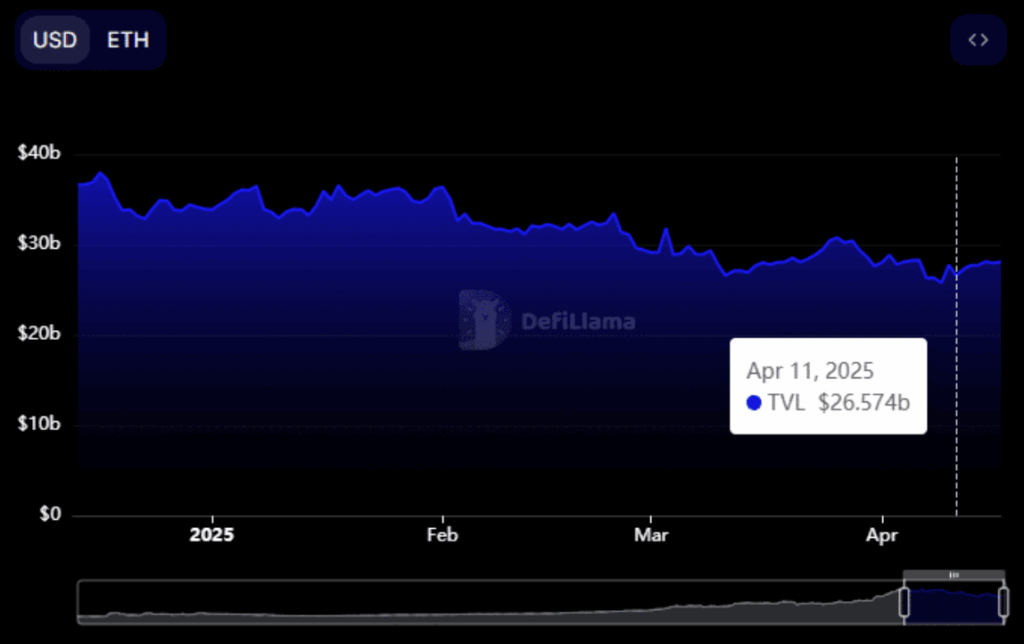

You can’t fake confidence, and Total Value Locked (TVL) numbers tell the story. Since April 11th, Aave V3’s TVL has risen from $26.57 billion to just over $28 billion—a solid $1.5 billion gain. TVL isn’t just a vanity stat—it shows how much money people are locking into Aave’s smart contracts. The higher it goes, the more trust there seems to be.

New Wallets, New Money: Retail’s Back

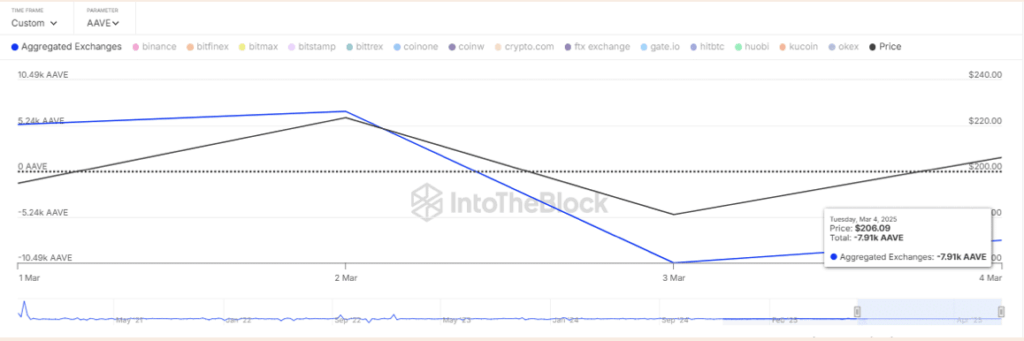

On-chain activity shows people are paying attention. IntoTheBlock data shows over 174,000 active AAVE addresses recently. That’s a spike in retail interest. Plus, around 7,910 AAVE (worth a bit over $1 million) were snapped up in the last 24 hours. Not only that—Exchange Netflows turned negative, meaning those tokens got pulled off exchanges and into wallets. That usually signals holders are thinking long-term, not just chasing quick flips.

Derivatives Market Siding with the Bulls

Futures traders seem to agree with the broader optimism. The OI-Weighted Funding Rate remains in positive territory, a metric that combines open interest with funding rates to get a sense of where traders lean. Positive readings typically mean more long positions than shorts—traders are betting the price keeps climbing.