- Telegaon predicts BNB could hit over $5,400 by 2035 if trends hold steady

- Forecasts bank on Binance’s growth, dApp adoption, and ongoing token burns

- But as always in crypto—expect the unexpected, and don’t bet the farm

BNB Coin—yep, the one tied to Binance and its ever-growing ecosystem—has stayed pretty high on the crypto ladder. It’s not just another coin riding hype cycles; it’s got actual use cases in the Binance exchange and the BNB Chain, which is seeing more adoption by the day. But now that everyone’s eyes are on what comes next, long-term price predictions are getting… well, kind of wild.

Telegaon’s forecast has stirred up chatter, and for good reason. They’ve dropped some big numbers when looking at BNB’s growth over the next decade. Still, predictions are predictions, and there’s a lot that can change in between.

Year-by-Year Breakdown: Big Numbers, Big Hopes

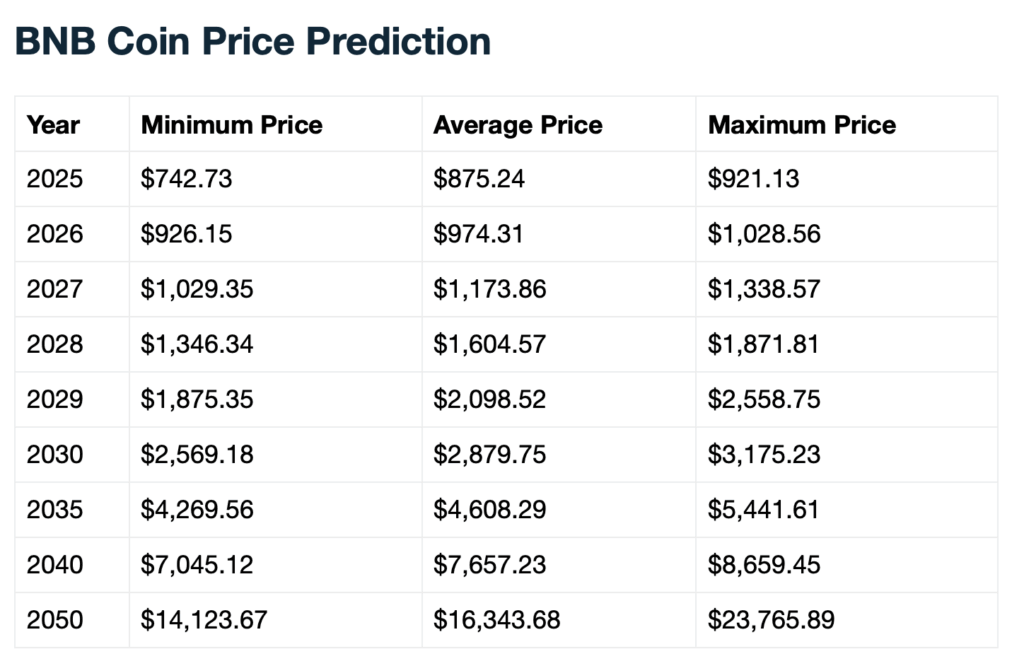

Starting with 2025, Telegaon thinks BNB could swing between $742 and $921, with an average right around $875. Decent, right? If that trend holds, 2026 might see it nudge past that oh-so-psychological $1,000 mark—hovering somewhere between $926 and $1,028. Then by 2027, we’re looking at possible prices from $1,029 all the way to $1,338.

And it just keeps climbing. In 2028, BNB could trade between $1,346 and $1,871, while 2029 might crack the $2K barrier, aiming for as high as $2,558. By the time 2030 rolls around, we’re talking a potential max of $3,175. That’s a lot of upside—on paper.

Stretching Into 2035: Moonshot or Reasonable Bet?

Here’s where it gets real ambitious. Telegaon’s longer-range outlook shoots for prices between $4,269 and $5,441 by 2035. The average? Around $4,608. If that plays out, early holders would be sitting on some serious gains. But let’s not get ahead of ourselves just yet.

This bullish stance comes from confidence in the Binance brand, the growing utility of BNB in DeFi and dApps, and the whole deflationary coin-burn thing Binance has going. It’s a solid thesis—if the ecosystem keeps expanding and demand stays strong.

Not All Smooth Sailing From Here

But hey, let’s not forget that crypto’s still one of the most volatile asset classes out there. These price targets sound great, but they rest on a bunch of moving parts—market cycles, global regulation, investor sentiment, and whether Binance can stay out of hot water. Basically, nothing is guaranteed.

So yeah, the BNB outlook might look shiny, but investors should tread with a bit of caution. Optimism is great… but only if it comes with a healthy dose of realism.