- Ethereum dropped 2% in 24 hours but saw $274M in whale accumulation

- Stablecoin deposits rose nearly $30M, hinting at growing user and investor activity

- ETH still trails far behind Bitcoin and the S&P 500 in year-to-date returns, raising concerns for broader appeal

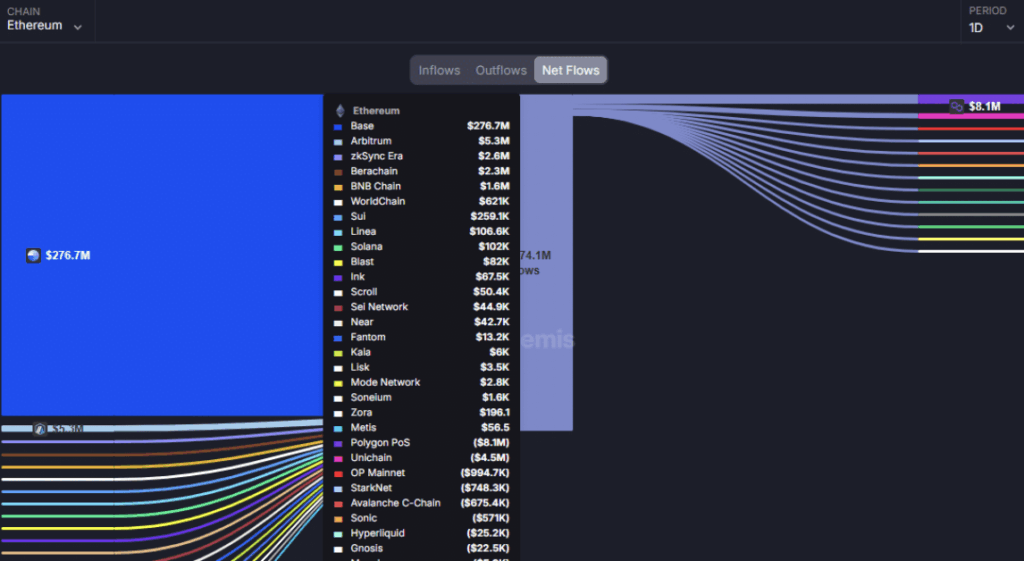

Ethereum didn’t exactly have a great day — it dropped around 2% in the last 24 hours, caught up in the broader market tumble. Still, there’s a twist in the tale. Despite the price dip, whales have been quietly scooping up ETH. In fact, more than $274 million flowed into Ethereum just recently, mostly through cross-chain purchases. That’s a hefty amount, and it’s raising eyebrows.

Layer 2s like Base and Arbitrum were buzzing, contributing big chunks of the liquidity influx. And that wasn’t the only bullish sign — stablecoin supply on Ethereum jumped by nearly $30 million in the same timeframe. Those kinds of moves usually point to rising user engagement and anticipation of bigger plays ahead.

Weekend Moves, Monday Momentum?

It’s interesting timing. These kinds of weekend moves — especially big netflows and stablecoin activity — often come just before a strong Monday open. Could whales be front-running some institutional plays? Possibly. There’s been chatter about spot Ethereum ETFs influencing market sentiment on Mondays before. So if this weekend’s rhythm follows past patterns, we might be in for a surprise bounce when the new week kicks in.

But of course, nothing’s guaranteed in crypto. The market’s moody, and optimism alone doesn’t always move price. Still, this kind of capital rotation suggests that smart money isn’t running away from ETH — if anything, it’s setting up shop early.

Ethereum vs. the Big Dogs: A Tough Comparison

Now, zooming out a bit — Ethereum’s performance doesn’t look so hot next to its rivals. Compared to Bitcoin and the S&P 500, ETH is kinda lagging behind. Bitcoin’s up over 58% this year, the S&P’s gained a modest 10%, and Ethereum? Down 35%. That’s not a great look for anyone trying to pitch ETH as a leading investment right now.

The underperformance might spook some investors, especially those looking for safer plays. With Bitcoin now being talked about more like gold — a digital store of value — ETH starts to look a bit more speculative by comparison. It’s still a tech play, not yet a safe haven.

Where Does ETH Go From Here?

It’s a mixed bag for Ethereum. Price is down, but on-chain behavior and whale activity are showing confidence. If you’re bullish, you might argue that this is just accumulation before the next leg up. If you’re more cautious, the underperformance compared to BTC and legacy markets might have you thinking twice.