- Bitcoin gained 60% over the past year, while Solana lagged at just 7%

- Solana boasts faster tech and growing use cases but suffers from outages and inflation

- Bitcoin’s scarcity, ETF success, and institutional backing still make it the safer long-term play

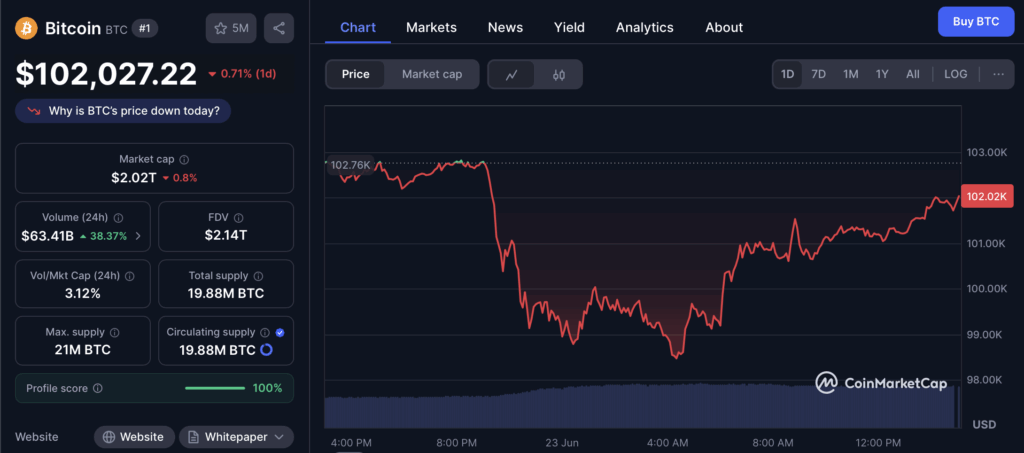

Bitcoin’s had quite the year. Up around 60% in the last 12 months, it’s now trading just 7% shy of its all-time high. A big chunk of that rally came from a flood of money into spot ETFs, a softer regulatory stance under the Trump administration, and the creation of a Strategic Bitcoin Reserve. Investors also seem to be warming up to Bitcoin as a hedge — against inflation, war, shaky economies, you name it. And yeah, with interest rates looking like they’ll trend lower, crypto’s back on the menu.

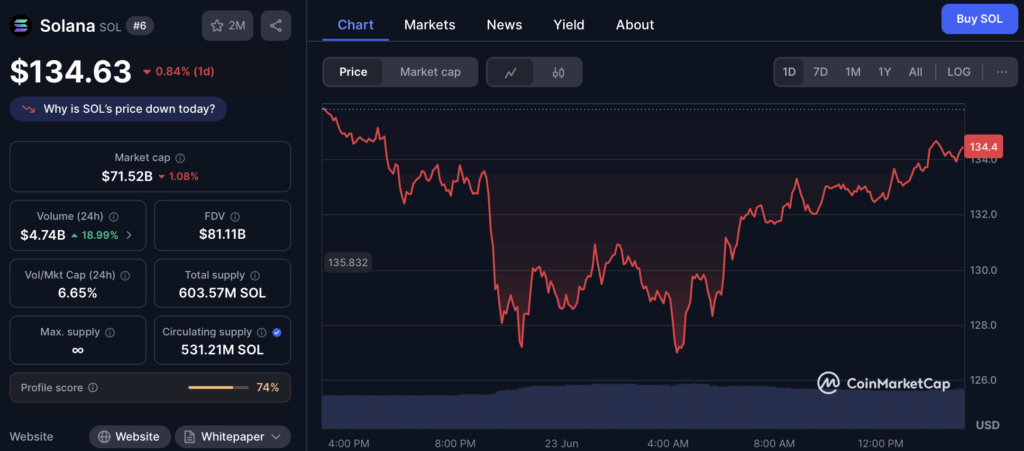

But not all coins got the same love. Take Solana, for example. Despite being one of the more talked-about projects, it’s only gained about 7% this past year. That leaves it still more than 50% below its peak. So what’s holding Solana back — and could that make it a better buy than Bitcoin moving forward?

PoS vs. PoW: A Look at the Underlying Tech

Solana runs on a proof-of-stake (PoS) system — meaning coins get staked for rewards, not mined like Bitcoin. That’s good news for energy use. PoS blockchains like Solana can also run smart contracts, which makes ’em more versatile than Bitcoin’s proof-of-work (PoW) setup. Think NFTs, games, dApps — all that stuff.

Now here’s where things get tricky: Solana’s an inflationary asset. No cap on how many tokens can exist. Currently, about 528 million SOL are in circulation, with its inflation rate dropping gradually until it settles at 1.5% annually. Compare that to Bitcoin — deflationary, capped at 21 million tokens, most of which are already mined. That scarcity has always been a major part of BTC’s appeal, especially as digital gold.

Solana’s Tech Is Fast, but Still Playing Catch-Up

Solana isn’t your average PoS token — it’s got its own chain and a unique thing called proof-of-history (PoH), which boosts transaction speeds. On paper, it can handle up to 65,000 TPS. In practice? More like 600–1,500. Still fast, especially when you pit it against Ethereum’s 15 TPS on Layer 1. But Ethereum has Layer 2 rollups — they bundle transactions off-chain and process ’em together, reaching 4,000 TPS or more.

The flip side for Solana: it’s got fewer developers, doesn’t play nice with other blockchains, and uses harder-to-learn coding languages. Plus, network outages? Yeah, those have happened more than once — and people noticed.

What’s in the Pipeline for Solana?

Even with those bumps, Solana’s not down for the count. Big names like Visa and Shopify are already using Solana Pay for super-fast stablecoin payments. New games, dApps, and even decentralized tools like wireless networks and GPU sharing are all being built on the platform. And new updates should reduce congestion — finally.

There’s also talk of Solana ETFs. If those get the green light from the SEC, institutional money could start flowing in heavy. That could be a real game-changer — if.

Final Thoughts: Stick With BTC or Bet on SOL?

So here’s the bottom line: Solana’s got speed, a growing ecosystem, and real-world adoption going for it. But it’s still inflationary, fighting stiff competition from Ethereum’s L2s, and stuck in its own silo when it comes to blockchain compatibility. Bitcoin? It’s still the gold standard — scarce, simple, and growing in institutional appeal.