- XRP social dominance and sentiment are rising, but on-chain metrics remain soft.

- $2.35 is the critical resistance — a break above could flip the short-term trend bullish.

- Without stronger volume and address activity, any rally risks stalling fast.

Ripple’s XRP is back in the spotlight, with its social dominance rising to 2.92% and sentiment flipping just barely into the green at +0.166, after spending most of June stuck in the red. Traders on Binance seem to be feeling good about it too — over 76% are holding long positions right now. So, yeah… optimism’s in the air.

But here’s the catch: on-chain activity hasn’t quite caught up with the mood, and price action? Still stuck in a downward pattern. The next move could make or break the momentum bulls have managed to scrape together.

XRP Holds at $2.14 — But Resistance Still Looms

XRP bounced nicely off the $2.00–$2.10 demand zone and is now hovering around $2.14. That bounce looked promising, sure, but the token’s still trapped inside a descending wedge. Each time it tries to push up, it gets knocked back down. Sound familiar?

If it can break past $2.35 with some solid volume behind it, we could see a move toward $2.60. But if that upper trendline keeps holding firm, we might see another trip back to $2.00—or worse, even $1.80. Bulls need to step up here. Otherwise? Bears are gonna stay in control of the story.

Hype Is Up, On-Chain Metrics… Not So Much

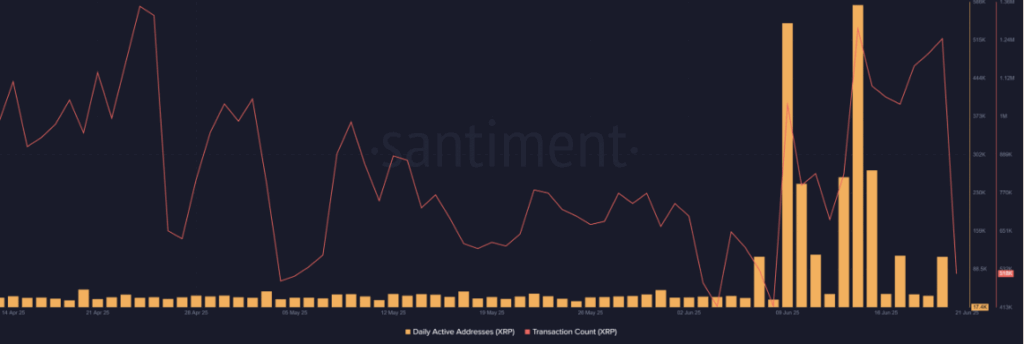

Even though social chatter’s picking up and crowd mood is trending positive, the on-chain stuff just isn’t there yet. Daily Active Addresses are sitting around 17.4K — not terrible, but not great either. Transaction activity had a brief spike earlier in June, then fizzled right back out.

That mismatch between buzz and actual usage? Yeah, it’s kind of a red flag. Without real activity on the network, the hype could just be speculative noise. And if there’s no real demand behind the pump, price might just stall and drift sideways again.

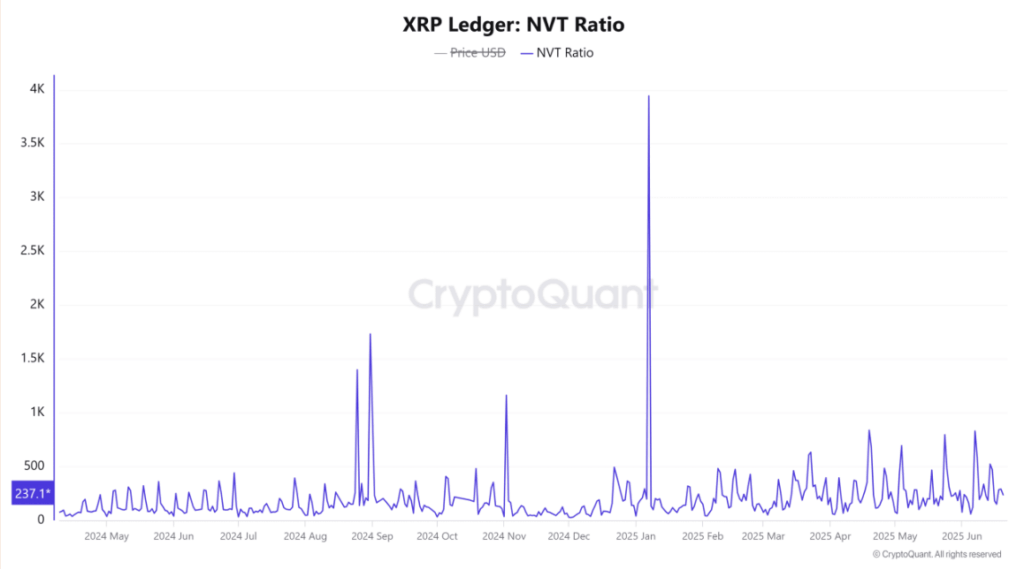

NVT Ratio Dips — But Don’t Get Too Excited

XRP’s NVT ratio — which looks at market cap vs. transaction volume — dropped sharply by 18.43% in the last 24 hours, now sitting at 237.16. In theory, that signals the token’s undervalued… but let’s not jump the gun.

That drop might not actually mean much without stronger engagement metrics. No consistent growth in address activity, no surge in volume — so that NVT shift might just be noise. For it to matter, we’d need to see broader on-chain strength backing it up.

Long-Term Holders Still in the Green — But For How Long?

The MVRV Long/Short Difference sits at +20.99%, meaning long-term holders are still well in profit. That’s great… unless price keeps stalling. When people are sitting on gains like that, they tend to get itchy fingers — especially when there’s resistance right in front of them.

If XRP keeps getting rejected near current levels, some of those holders might start cashing out. That could add even more pressure just when bulls need momentum the most.

Verdict: Breakout Incoming… or Another Letdown?

There’s no doubt the XRP community is fired up. Sentiment’s turning, long positions are heavy, and social buzz is loud. But that’s only half the picture. Price still needs to break $2.35 convincingly, or the rally just won’t stick.

If bulls can push through and volume follows, maybe this breakout gets real. But if they stall — or worse, lose $2.10 — the whole setup could unwind quickly. Without a proper breakout, the hype alone won’t carry XRP much further.