- Stablecoins already drive up to 30% of Ethereum’s fee volume.

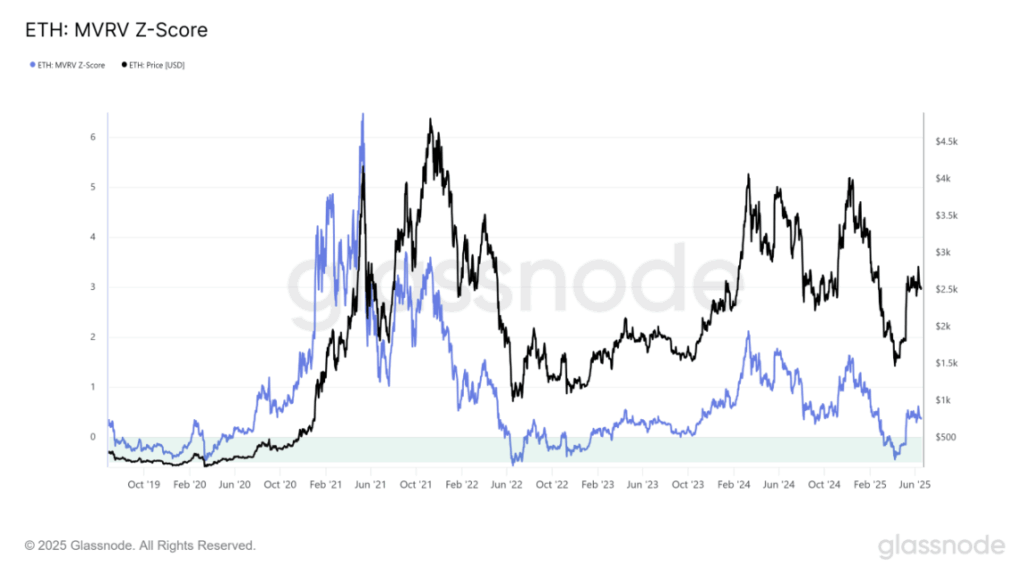

- ETH’s MVRV Z-score suggests it’s undervalued at $2.5k.

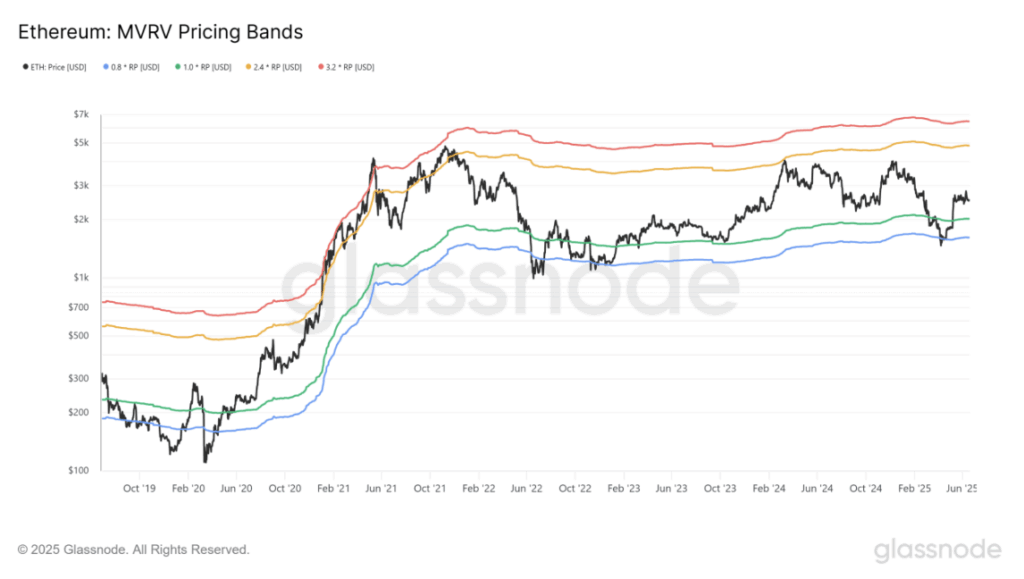

- If stablecoin adoption explodes, Ethereum could push toward $4.8k or even $6.4k this cycle.

Ethereum could be majorly undervalued right now—like, way more than people think—if the stablecoin market really does balloon to $3.7 trillion by 2030. That’s the big take from Tom Lee, Fundstrat’s Chief Analyst. He chimed in after U.S. Treasury Secretary Scott Bessent dropped a bold prediction: stablecoins surging 15x by the end of the decade.

Lee didn’t hold back. He pointed out that stablecoins like USDT and USDC already make up somewhere around 25% to 30% of all Ethereum network fees. That’s not small. He added that if this kind of growth happens, “Ethereum is a direct beneficiary of the GENIUS Act and the coming surge in stablecoins.” His words, not ours—but he might be onto something.

ETH Didn’t Pump… Yet

Here’s the weird part. Even after the GENIUS Act passed, ETH didn’t exactly jump out of its seat. Prices stayed pretty flat. Meanwhile, Circle’s CRCL and Coinbase’s COIN both went flying—double-digit gains, easy. ETH just kind of stood still, which feels off considering it’s the backbone of all this.

Maybe the lack of excitement came down to timing. The market had its eyes glued to bigger stuff—rising tensions between Israel and Iran took over the headlines. People weren’t paying attention to bills and tokens. It happens.

Still, Lee’s point about Ethereum raking in stablecoin-related fees holds up. Over the past 30 days, Circle and Tether combined poured more than $700 million into Ethereum fees. And who topped the chart? Yep—Tether, Circle, and Ethena. All stablecoin giants.

So, Is ETH Dirt Cheap Right Now?

If stablecoins do go full rocket mode, Ethereum could get flooded with new network traffic. More usage = more fees. That’s kind of the whole value driver. And right now? ETH’s sitting at about $2.5k. Which… might be low, honestly.

The MVRV Z-score—basically a way to spot undervalued or overhyped moments—sits at 0.4. That’s low. Really low. Historically, when that score hits 2 or 1.5, ETH peaks. In this cycle, that would land the price somewhere around $4k. Maybe more.

But wait—Glassnode’s pricing bands add a bit more spice. If ETH follows past trends, it could top out closer to $4.8k… or even $6.4k. Yeah, that’s a big leap. But not impossible.

Stablecoins Could Be ETH’s Hidden Ace

So where does that leave us? If the stablecoin market explodes like Lee and Bessent are forecasting, ETH might not just ride the wave—it could help power it. The GENIUS Act is just one piece, but if USDC and USDT keep dominating fees, and if those numbers scale with a $3.7T market cap? Ethereum won’t stay this cheap for long.