- Binance Chain usage is exploding, with daily transactions jumping over 150%—but BNB’s price hasn’t followed (yet).

- Trader confidence is shaky, with Long/Short ratios slipping and indecision rising.

- $700 remains the key resistance; a breakout could push BNB higher, but failure might lead to a retest of $625.

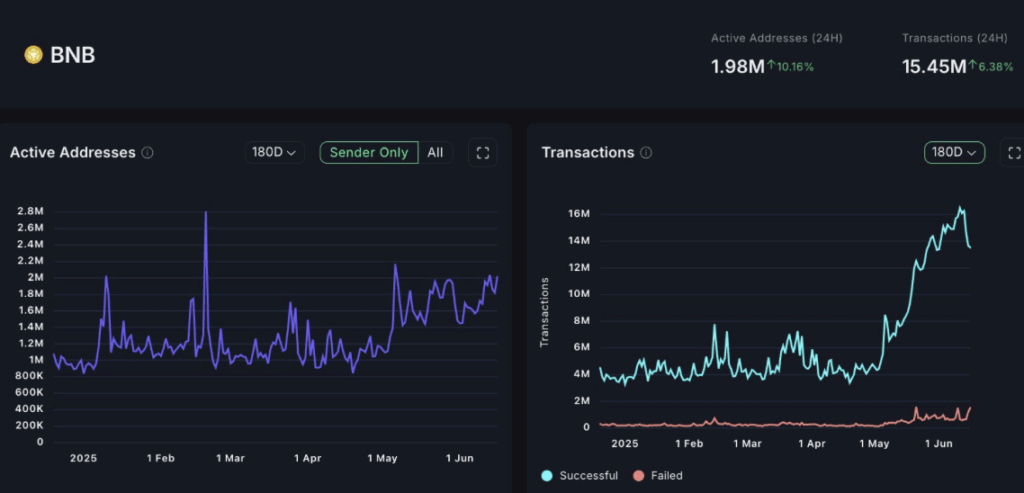

Binance Chain’s had itself a wild few weeks. Daily transactions have more than doubled—going from about 6 million in early May to over 15 million now. That’s a 150%+ jump in activity. At the same time, active addresses are creeping up on 2 million, showing the network’s getting a lot more eyeballs and usage lately.

Even with all that, BNB is trading at around $654.03, which is basically flat on the day—down just 0.09%. Price hasn’t taken off yet, but this kind of usage spike usually isn’t just noise. It could be a signal of growing demand under the surface, waiting to spill into price action sooner or later.

Traders Getting a Bit Wobbly

Now here’s where it gets interesting. Over on Binance, BNB’s Long/Short Ratio sits at 1.70, meaning 63% of traders are still betting long. Bulls are still in control, technically—but the gap’s been shrinking. Traders are flip-flopping more lately, switching between optimism and quick exits.

That kind of indecision can be risky. If this back-and-forth continues, BNB might be set up for some choppy moves ahead. A dip in conviction often means that leveraged positions are easier to rattle—one strong move and it could flip fast in either direction.

Derivatives Market Is Heating Up

Meanwhile, BNB’s derivatives market has been lighting up. Daily volume shot up by nearly 64%, landing at $630 million. Options trading? That’s gone ballistic—up over 100% in volume. Open Interest for Options also climbed nearly 50%, which shows traders are either hedging hard or swinging big with speculative bets.

But here’s the thing: Futures Open Interest only nudged up by 0.67%. So while Options are booming, Futures haven’t kept pace. That mismatch could mean people are more willing to make short-term plays than commit to long positions. Could be a red flag… or just noise. Depends how you see it.

Can BNB Break $700 or Nah?

Right now, BNB is still riding above a solid ascending trendline, and buyers have defended the $625 support pretty well. Eyes are now on the $700 mark. That’s the next big wall to climb. The Stochastic RSI is hanging around 41—not too hot, not too cold—so momentum’s kind of neutral.

If BNB punches through $700 with strong volume, we might see another leg up. But if it stalls? There’s a decent chance we head back to test that $625 zone again, and that level is starting to feel pretty important for near-term direction.