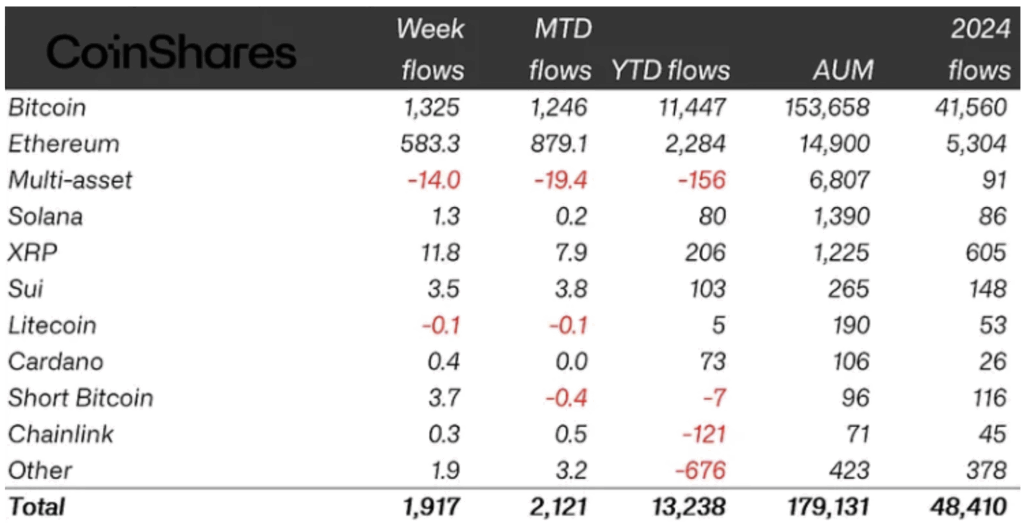

- Crypto ETPs saw $1.9 billion in inflows last week, extending a nine-week streak and setting a record $13.2B YTD.

- Bitcoin led the charge with $1.3B, while Ether followed with its biggest inflow week since February, including a $256M single-day spike.

- Despite war tensions, crypto markets held strong, with both BTC and ETH starting the week in recovery mode.

Crypto funds have been soaking up cash like crazy lately—again. Even as geopolitical jitters rattle broader markets, digital assets seem to be riding their own wave. Bitcoin’s hugging new highs, Ether briefly broke $2,800 last week, and investment products tied to them are having a moment.

According to CoinShares, crypto exchange-traded products (ETPs) pulled in $1.9 billion in the past week, pushing their nine-week inflow streak to a total of $12.9 billion. That brings 2025’s year-to-date tally to a record-breaking $13.2 billion. Assets under management? They climbed too—now at a hefty $179 billion, up from $175.9B a week ago.

Bitcoin Back in Front, Ether Close Behind

After a couple of weeks of small outflows, Bitcoin products bounced back strong, hauling in $1.3 billion—yep, back at the top. Even short-Bitcoin positions saw $3.7 million in inflows, though they’re still small overall at $96 million AUM.

Ether didn’t do too bad either. In fact, it saw its best week since February. ETH ETPs brought in $583 million, including their single biggest day of inflows in months. Not too shabby for an asset still shaking off its midweek dip.

Meanwhile, XRP ended a rough patch with $11.8 million coming in after three straight weeks of outflows. SUI joined the party with $3.5 million in fresh inflows as well.

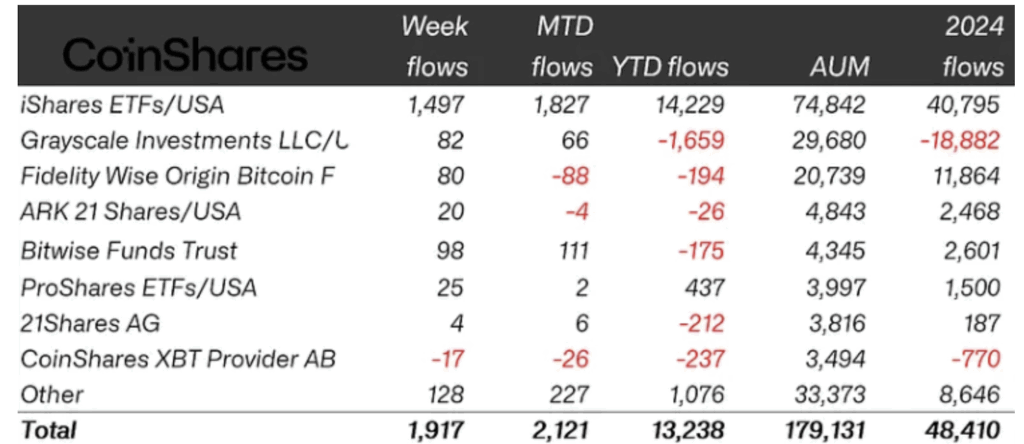

BlackRock Leads, Grayscale Lags

BlackRock’s crypto ETFs are leading the charge. They posted $1.5 billion in inflows last week, bringing their yearly total to over $14.2 billion—way ahead of the rest of the pack. U.S.-issued ETFs overall had more modest gains of around $95 million, while Europe’s CoinShares XBT Provider saw a slight $17 million outflow.

Still, most ETF issuers are underwater for the year. Grayscale, in particular, continues to struggle with a painful $1.6 billion YTD outflow. One bright spot? ProShares. It’s the only U.S. issuer still in the green this year with $437 million in net inflows.

Ethereum Keeps Building Despite Turmoil

Even with war tensions escalating—particularly between Israel and Iran—digital assets held up. Bitcoin dipped to $103,000 after Israel’s airstrikes last Thursday, but quickly snapped back to $106,000 by the weekend. Gold, as usual in times like these, also popped—hitting $3,448 per ounce.

Ethereum, though, quietly kept momentum going. After peaking at $2,869 midweek and dipping to $2,473 the next day, it still ended strong. CoinShares says ETH products have now seen eight straight weeks of inflows, totaling $1.9 billion. Wednesday alone saw $256 million—their best day since December.

Now both Bitcoin and Ether are kicking off the new week on a solid note. At the time of writing, BTC trades around $107,171, while ETH hovers near $2,628.