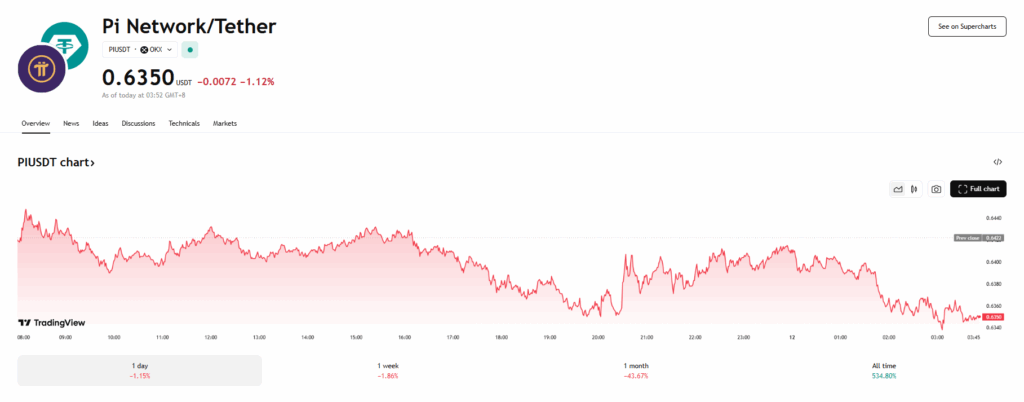

- Pi Coin is down nearly 58% in a month, underperforming the wider crypto market and dropping to 36th by market cap.

- Analysts predict further downside, with CoinCodex eyeing a 24% drop to $0.48 by September.

- A Fed rate cut or Bitcoin hitting new highs could potentially reignite bullish momentum for PI.

Pi Coin (PI) isn’t catching the same break as the rest of the market. While Bitcoin has bounced back over the $109K mark, PI continues to struggle, shedding nearly 58% of its value over the past month and slipping to 36th place by market cap. Its latest dip—down 0.4% on the day—adds to a troubling short-term trend that has investors asking whether it’s time to buy or bail.

From Hero to Hesitant: PI’s Fall from Its All-Time High

Earlier this year, PI was red-hot. It hit an all-time high of $2.99 back in February, riding the wave of early 2025’s crypto euphoria. But since then, it’s dropped nearly 79%, with analysts pointing to a shift in investor preference toward safer, more established assets. As Bitcoin reclaims territory, altcoins like PI may be bearing the cost of a cautious market.

Bearish Forecasts, but a Glimmer of Hope?

CoinCodex isn’t painting a pretty picture either, forecasting PI will drop another 24% to around $0.48 by early September. Still, not all hope is lost. If macro factors shift—like a long-speculated Federal Reserve rate cut or Bitcoin blasting through its all-time high—PI might catch a second wind as risk appetite returns.

Will PI Ride the Next Wave?

While the odds aren’t currently in PI’s favor, crypto has a habit of flipping the script. If BTC continues upward or if the Fed injects some dovish energy into the markets, PI could rebound faster than expected. Until then, caution is the name of the game—but so is opportunity.