- Bitcoin touched $108,500 but cautious trader sentiment and macro headwinds are holding it back from a clean breakout.

- BTC’s 82% correlation with the S&P 500 keeps it tethered to broader market risks, dampening its role as a hedge.

- If U.S. debt concerns worsen, Bitcoin could see capital inflows that push it beyond $150,000—even in a shaky economy.

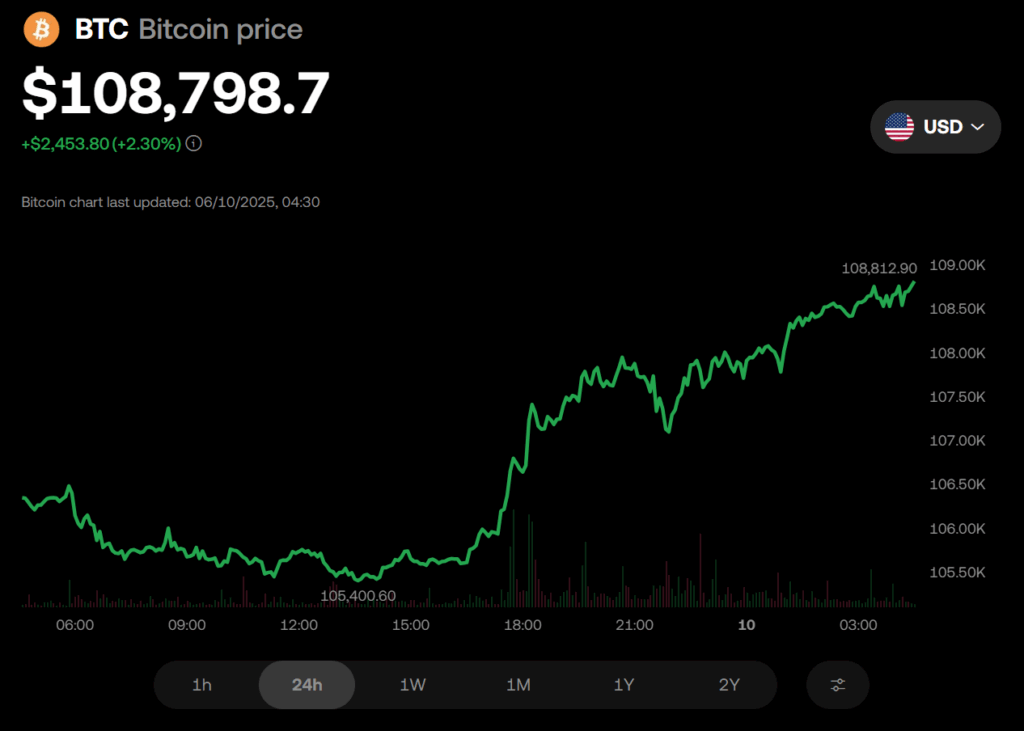

Bitcoin surged 3.5% between June 7 and 9, hitting close to $108,500. Even with this gain, pro traders aren’t fully convinced. Derivatives markets show a lukewarm sentiment, with BTC futures premiums hanging near a neutral 5%. Despite being just 3% shy of its all-time high, broader market anxieties are keeping expectations in check.

Some speculate that the U.S. debt ceiling increase could push BTC as high as $150K. But with muted enthusiasm in futures and no signs of a leverage-fueled rally, the rally feels cautious—possibly waiting for stronger macro signals before making a real move.

Stock Market Correlation Weighs on Bitcoin

BTC’s price remains tightly linked with equities, especially the S&P 500. Right now, the 50-day correlation between BTC and the S&P 500 sits at a solid 82%, showing they’ve been moving almost in lockstep. This pattern makes Bitcoin more of a “risk-on” asset than a hedge, leaving it vulnerable if stocks turn south.

If recession fears keep brewing, Bitcoin could struggle to hold above $110,000. Traders are hesitant, not because of weak fundamentals, but because the traditional finance system still casts a long shadow over crypto sentiment.

Potential Catalysts and Market Confidence

Margin data at OKX shows a long-to-short ratio of 4:1 in favor of bulls. While that’s not overly aggressive, it’s not enough to suggest an impending breakout either. However, no major indicators currently hint at a dramatic sell-off.

Long term, if trust in U.S. fiscal stability erodes and Treasury yields look less appealing, some capital could shift toward Bitcoin. Even a tiny percentage of outflows from the $50 trillion S&P 500 or $22.5 trillion gold market could catapult BTC to $150,000.