- Bitcoin dipped toward $101K after hitting a record $111K, but quickly bounced back, keeping traders on edge.

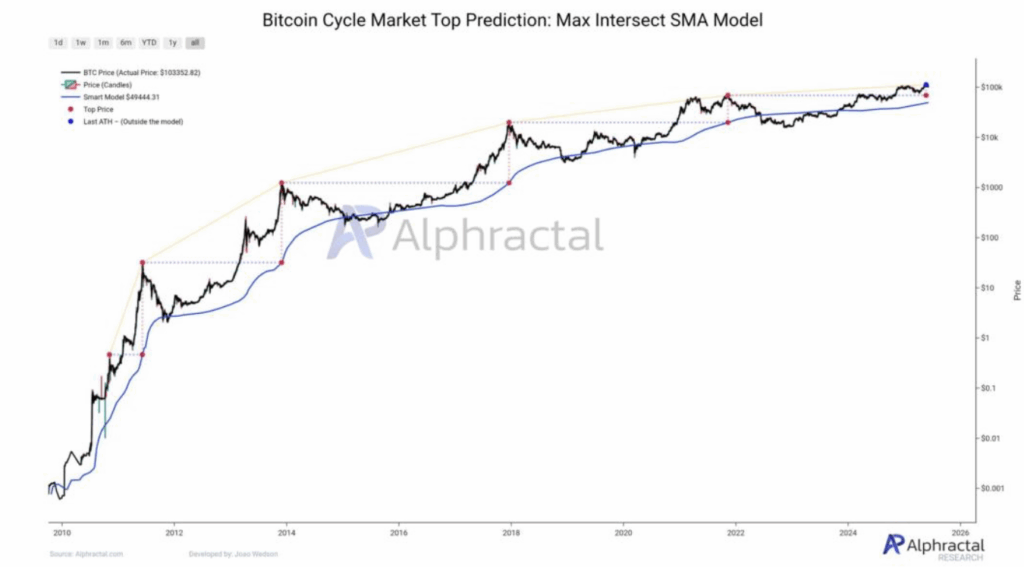

- Analyst Joao Wedson says BTC could climb for four more months based on the Max Intersect SMA Model, which predicted past cycle tops.

- Despite recent consolidation, BTC is holding around $104,400 with a modest 2% daily gain, suggesting the rally might not be over yet.

The week’s been choppy for Bitcoin — no denying that. After recently tagging a fresh all-time high around $111,814, BTC dipped toward $101K on June 6. The slide shook up traders a bit, for sure. Volatility’s been flexing again, and some folks are wondering if that big run is already behind us. But maybe not just yet.

A Model Suggests 4 More Months of Growth

According to crypto analyst Joao Wedson, we might not be at the finish line. He pointed to the Max Intersect SMA Model — a mouthful, yeah, but this thing’s nailed past BTC peaks before. His latest post on X claims we’ve got about four more months of runway before things really top out. Basically, whenever this blue line (the SMA) hits the price peak from the last cycle, the party’s just about over.

That happened in 2021 when the model hit $19K — right before BTC shot to $69K. If history’s rhyming again, we’ll peak once this SMA hits $69K. It hasn’t yet. So maybe we’re not done.

Still Wobbling but Hanging On

Right now, Bitcoin’s not exactly surging. It’s been mostly crabbing sideways since that ATH. Market watchers are getting a little restless. BTC only moved up 0.2% over the past week, according to CoinGecko. At the time of writing, it’s trading around $104,400 — up 2% today, but that’s not setting hearts on fire.

So yeah, things are uncertain. But if this cycle model holds up, Bitcoin might still have some fire left — we’re not out of fuel just yet.