- BNB is trading at $644, recovering above its 100-day EMA, but faces resistance at the $700 level.

- RSI is picking up, and the EMAs remain bullishly aligned, but a drop below $624 could drag it down to $600 or lower.

- Despite the price rebound, open interest and funding rates in derivatives signal growing bearish pressure from short sellers.

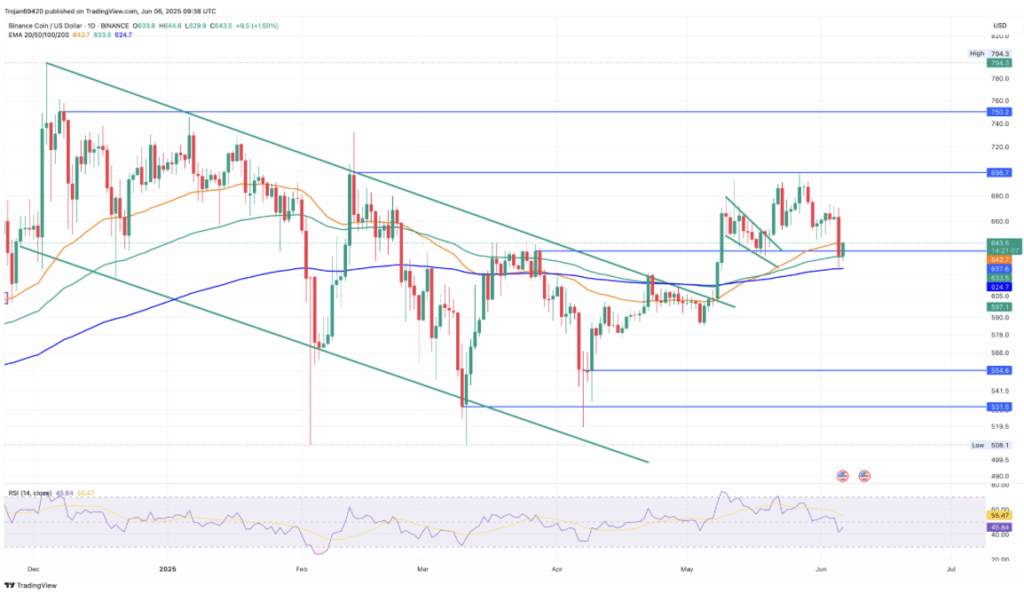

Binance Coin (BNB) is showing signs of life again after the recent market-wide wreck. It’s trading at $644—just above that 100-day EMA line, which is acting like a thin lifeline right now. After Thursday’s rough 4.4% dip, BNB bounced about 2% on Friday, but let’s be honest—it’s still got work to do.

Traders are watching closely to see if this mini bounce has enough steam to get BNB back near the $700 mark. That’s a major psychological barrier, and so far, the coin’s been getting rejected hard before it can even sniff it. Still, with the price hovering above the 50-day and 100-day EMAs, there’s at least a glimmer of hope for bulls hanging in there.

Technicals Show a Tug-of-War in Motion

On the daily chart, BNB’s price structure is sending mixed signals. After getting knocked around last week, losing over 1%, and dipping another 2.5% early this week, the coin is clawing its way back. Friday’s intraday push helped it stick above that 100-day EMA at $633, and it’s also barely clearing the 50-day EMA at $642.

Momentum-wise, RSI dipped below neutral but is curling back up—if it can climb above that halfway point again, it could confirm a possible short-term bounce. The EMAs (50, 100, 200) are still aligned in a bullish order, so that’s at least something to hang onto.

If BNB can get a strong daily close above $642, bulls might start gearing up for another shot at $700. But if the floor falls through and price slips under the 200-day EMA at $624? Things could unravel fast, with $600—or even $554—coming back into play.

Derivatives Market Hints at Trouble Under the Hood

Now here’s where it gets a bit shaky. Even with the spot price recovering, the derivatives market isn’t buying the bounce. Open interest is down 3.61%, landing at around $757 million. That’s not just noise—it shows some traders are backing away.

Liquidations are also stacking up—$2.18 million wiped in just 24 hours. Longs got torched. The long/short ratio is down to 0.7361, which basically means shorts are flooding in. And with the funding rate dropping to 0.0178%, it’s clear that bears are willing to cough up fees just to stay short.

So yeah, BNB’s holding ground for now, but the foundation? It’s looking a little shaky.