- XRP Rebounds Slightly, but Technicals Remain Mixed: After dropping 9% on Thursday, XRP bounced back to $2.17, though it still trades below key moving averages, and technical signals suggest caution is warranted.

- U.S. Jobs Report Adds Economic Context: May’s job gains exceeded expectations with 139,000 added and unemployment steady at 4.2%, but inflation risks tied to Trump’s tariffs could complicate the Fed’s next move.

- Short-Term Rally Possible if Resistance Breaks: XRP’s RSI and MACD show hints of bullish momentum, but a decisive break above $2.26 is needed to target $2.50 or higher; otherwise, consolidation or further downside remains likely.

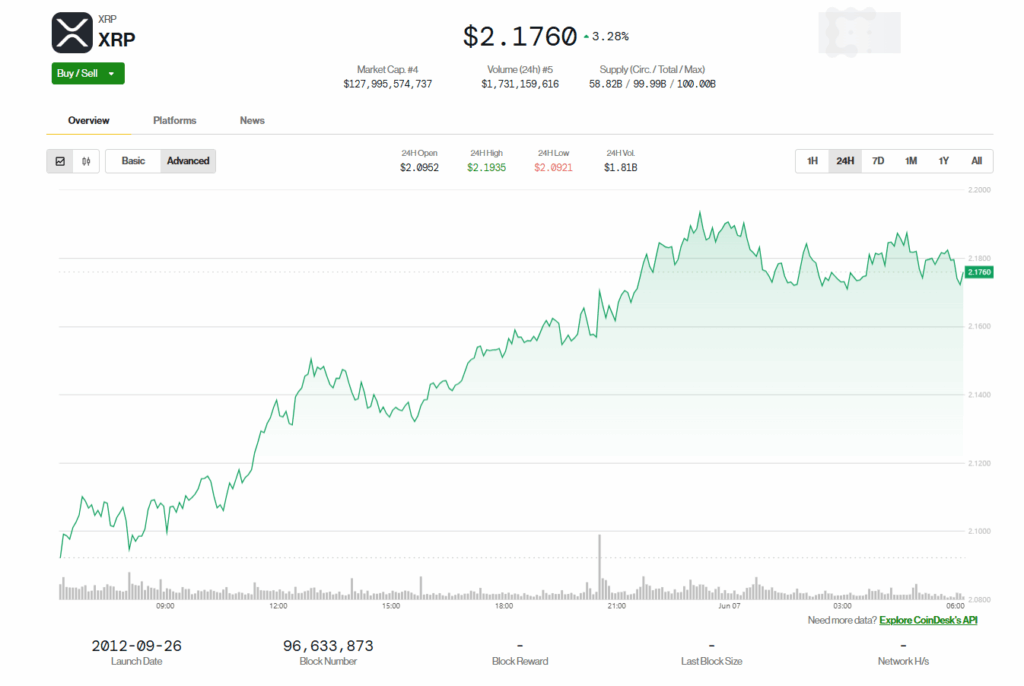

XRP is back on the rise after a rough Thursday that saw it dip nearly 9%, tagging that crucial 200-day EMA line before bouncing to around $2.17 by Friday. Despite the rally, things aren’t crystal clear just yet — multiple technical indicators still flash warning signs. Traders are keeping a close watch as momentum builds toward the weekend, with bulls eyeing a potential move up to $2.50, assuming market sentiment holds steady.

US Job Gains Add to Optimism, but Clouds Remain

The broader economic backdrop is adding to the crypto intrigue. The U.S. added 139,000 jobs in May — a decent beat over expectations — while unemployment held at 4.2%, near historic lows. Still, there’s this quiet hum of concern in the air. Fed watchers, including Chairman Jerome Powell, have flagged Trump’s tariffs as a potential long-term drag on both growth and inflation. Economists like Mark Zandi are sounding the alarm too, pointing to rising costs and a slowdown that may not be fully priced in yet.

The Fed has a tough call ahead. With inflation pressures rising and global trade on shaky ground (thanks in part to legal wrangling over tariffs), their next interest rate decision could go either way. And that uncertainty? It’s bleeding into the crypto markets as well.

XRP’s Technical Setup: Bullish Flicker or Just a Tease?

From a technical perspective, XRP holding above its 200-day EMA at $2.08 is a decent sign for now. The RSI hovering near the 50 level suggests a neutral stance, maybe even leaning bullish if momentum keeps building. Traders are also watching for a buy signal from the MACD indicator, which would reinforce the idea of a short-term rally.

Still, let’s not get ahead of ourselves. XRP is stuck under a triple-layer of moving averages — the 50-day, 100-day, and 200-day EMAs — which usually means caution is warranted. There’s a key barrier at $2.26, and unless bulls can punch through that, we might see more sideways action or even another pullback.

Market Sentiment Remains Fragile

On the 4-hour chart, XRP’s RSI is tiptoeing around the 50 midline — a typical inflection point. While that might reinforce the idea of a short-term rally, the lack of a firm MACD crossover means we’re still in wait-and-see mode. Plus, the fact that XRP trades below all major EMAs suggests the bears are still lurking.

So, is XRP set for a clean breakout? Maybe. But with a jittery macro backdrop, mixed technicals, and political noise swirling around markets, don’t be surprised if the price stutters — or even takes a step back — before making a real move. Keep your eyes peeled, and don’t trade with both feet in just yet.