- Bitcoin may hit $150,000 this cycle, with stablecoin legislation like the GENIUS Act acting as a major catalyst.

- May saw a sharp decline in crypto VC funding, reflecting broader market caution and macroeconomic headwinds.

- Alice Li says 2025’s rally is powered by policy change—not hype—marking a shift in how crypto is maturing.

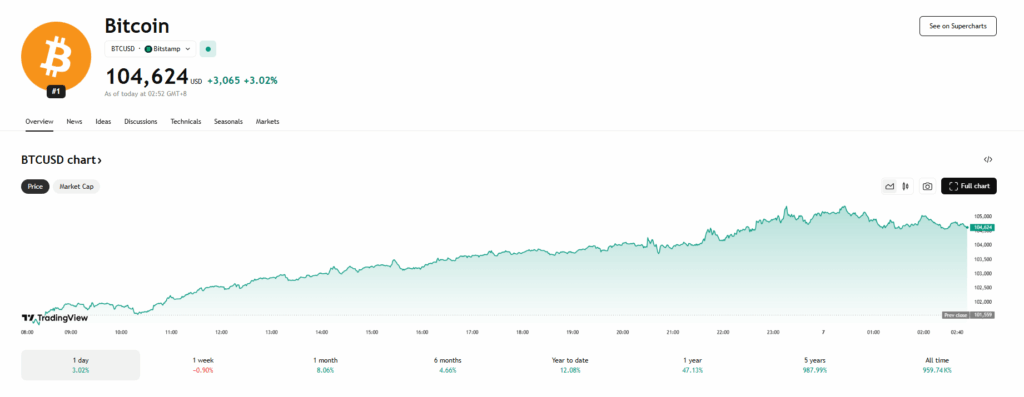

Despite Bitcoin hovering around the $104,000 mark with minimal movement this week, a major shift could be on the horizon. According to Foresight Ventures’ Alice Li, upcoming U.S. stablecoin legislation might be the spark that propels BTC toward a new cycle top above $150,000. Li highlighted the GENIUS Act as a particularly important development, as it proposes regulatory clarity around stablecoin reserves and compliance protocols—potentially laying the groundwork for broader institutional confidence.

VC Fatigue Sets In, but Policy May Reignite Growth

While optimism builds around legislative progress, venture capital interest in crypto seems to be cooling off. May saw the fewest VC deals of the year, with only 62 investment rounds totaling $909 million. Market insiders like Patrick Heusser blamed the downturn on global macro uncertainty—higher interest rates, shaky bond markets, and new tariff threats are all making M&A deals harder to close. The lull suggests a cautious stance among investors waiting for regulatory and market direction.

Policy, Not Hype, Driving 2025’s Crypto Rally

Li emphasized during a June 3 episode of Cointelegraph’s Chain Reaction X that the current rally isn’t driven by hype or pure speculation, but rather real policy changes. She pointed to Trump’s Bitcoin reserve endorsement and evolving stablecoin legislation as critical turning points. These shifts, she argued, are giving long-term investors the confidence to re-enter or double down—especially in sectors like stablecoins, which now appear more sustainable and compliant.