- SUI leads in market cap, adoption, and TVL, boasting $11.9B market cap and $1.6B locked in DeFi, with strong institutional backing and integrations like USDC and VanEck.

- SEI focuses on speed and compatibility, using Cosmos SDK and supporting EVM/CosmWasm, making it easier for Ethereum and Cosmos developers to adopt.

- Technically, SUI offers a novel object-based architecture, while SEI builds on familiar structures with niche growth in trading apps and potential upside from a key support zone.

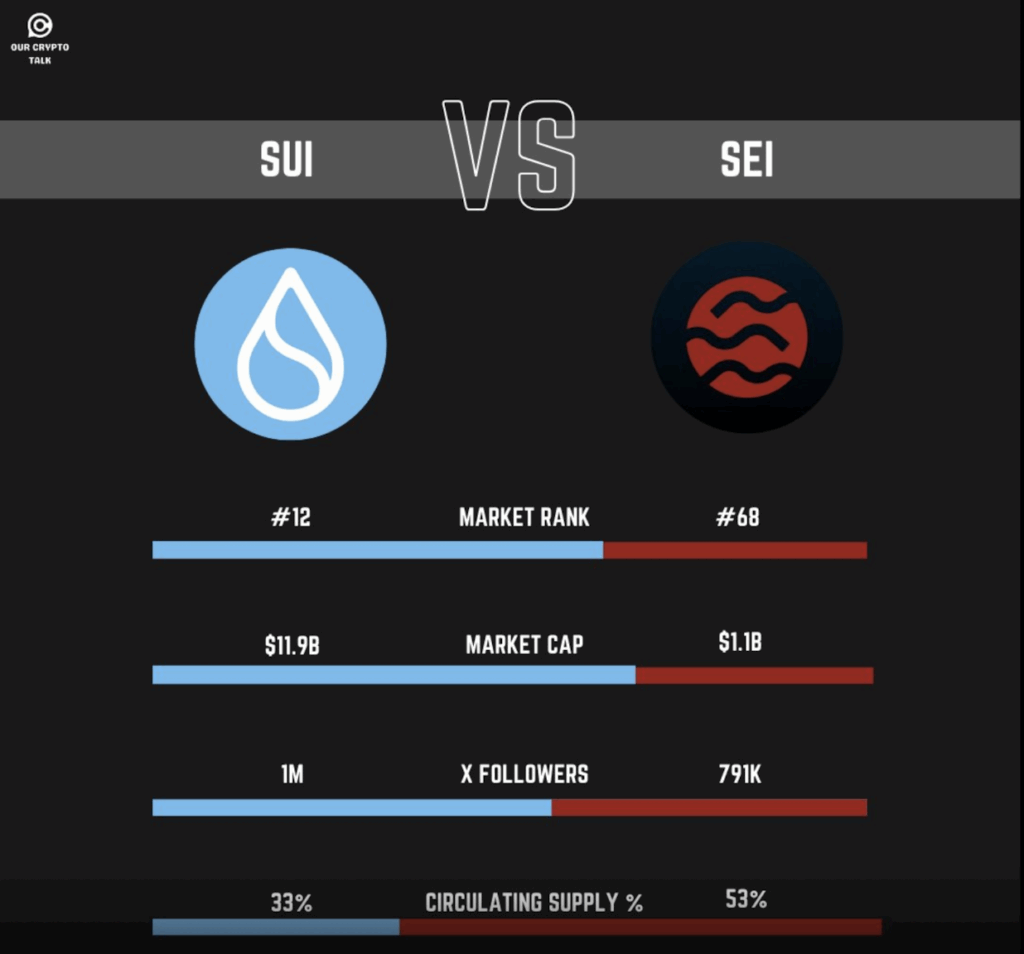

Alright, let’s talk SUI and SEI—two up-and-coming blockchains doing big things but in very different ways. Data pulled from Our Crypto Talk paints a pretty clear picture: SUI’s sitting up high at #12 with a fat market cap of $11.9 billion. Meanwhile, SEI? It’s holding onto #68 with about $1.1 billion. Not exactly a close race.

SUI also wins when it comes to community numbers. It’s got a solid 1 million followers on X (formerly Twitter), while SEI trails a bit at 791K. But here’s where things flip a little—SEI’s got more of its tokens in circulation, about 53%, compared to SUI’s 33%. That’s more liquidity on SEI’s side, which some traders like for obvious reasons.

Under the Hood: Radical vs. Refined

Now for the nerdy part. SUI goes hard on innovation—it ditches the classic account-based structure and rolls with an object-based system instead. This lets it process tons of simple transactions in parallel, which is a fancy way of saying: it’s fast. Sub-second finality? Yep. That’s thanks to something called Narwhal + Mysticeti. Feels like SUI is gunning for everything—DeFi, NFTs, gaming, RWAs… you name it.

SEI’s approach is a little different, but no less cool. It’s built on Cosmos SDK and focuses on speed and performance, especially for trading. Twin-Turbo Consensus keeps finality super snappy, and it’s the first chain to rock a native central limit order book for DeFi. The recent V2 upgrade brought in SeiDB and better parallel execution too. Basically, SUI is new tech all-around, while SEI is about turbocharging something already proven.

Dev Life: New Language vs. Familiar Tools

For devs, SUI might feel like jumping into the deep end—it uses Sui Move, a Rust-based language that’s secure but not exactly beginner-friendly. Still, over 1,400 devs are building on it each month. No EVM compatibility, though, so Ethereum projects gotta do some rewriting.

SEI, on the other hand, plays nice with both EVM and CosmWasm. So if you’re already building on Ethereum or Cosmos, SEI’s way easier to adopt. They’ve even got a $10M dev incentive fund and IBC baked in, making cross-chain stuff less of a headache.

Charts, Trading, and What’s Next

SEI’s chart—shared by Michaël van de Poppe—shows it holding a key support zone after a dip. Traders are eyeing this spot as a base for the “next leg up.” RSI’s neutral, volume’s steady, and buyers seem to be quietly stepping in. It’s a wait-and-see vibe right now.

On the other hand, SUI’s numbers are wild. $1.6B locked in DeFi, $265M average daily DEX volume, and partnerships with big names like USDC, VanEck, and Phantom Wallet. It’s diving into all the sectors—RWAs, NFTs, gaming… the works.

Final Thoughts: Big Toolbox vs. Sharpened Blade

SEI’s narrower but focused. It’s doing well in the trading niche with Vortex and DragonSwap. TVL is $492M, and they’re growing in gaming too, thanks to Galxe and the Creator Fund. And because it’s Cosmos-native, it’s got that cross-chain edge out of the box.

SUI feels like a multi-tool—ambitious, wide-reaching, and built for everything. SEI? More like a precision scalpel, super tuned for speed and trading. Both are solid, just depends what kind of blockchain flavor you’re after.