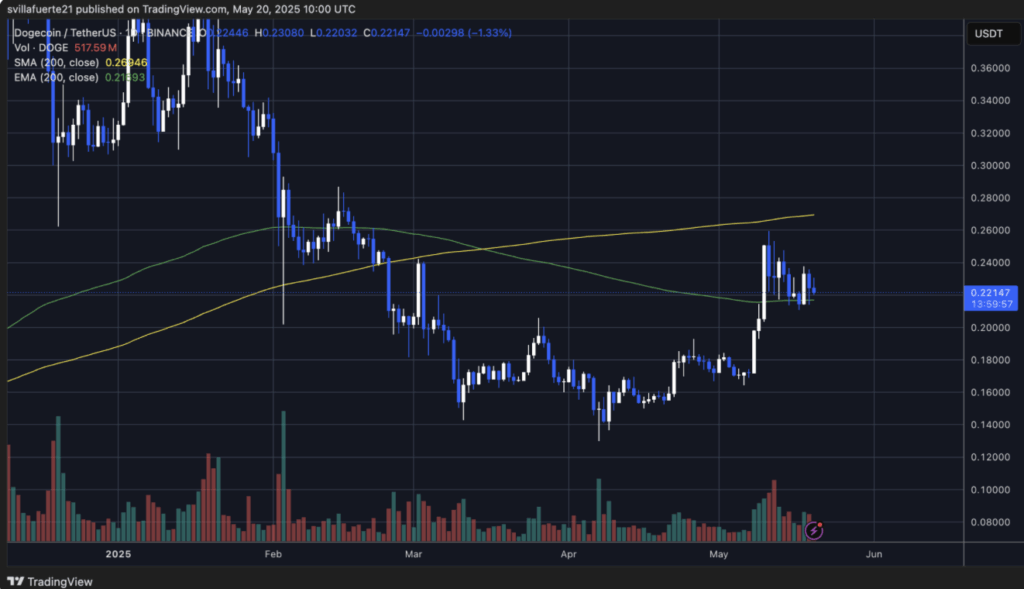

- Recent Drop: DOGE has fallen over 18% since May 10 after failing to break $0.26, with current support near $0.219–$0.221.

- Technical Risks: Indicators show weakening momentum; if support breaks, price could fall to $0.213 or even $0.19.

- Bullish Scenario: Reclaiming the 200-day SMA at $0.269 could reignite bullish momentum, but for now, consolidation risks turning into a deeper correction.

Dogecoin is in a tricky spot right now — stuck under the $0.26 resistance and wobbling after getting rejected hard last week. Since peaking on May 10, DOGE has dropped over 18%, giving back a good chunk of the gains from its big rally that kicked off in early April. Back then, it blasted past $0.13 and doubled in a month. But now? That fire’s looking a bit dimmer.

Holding or Slipping?

Traders are watching closely to see if DOGE can hang on at these levels or if more downside’s on the way. Analyst Ali Martinez thinks we might see a dip back down to $0.213 — a zone that’s been both resistance and support in the past.

While some optimism’s still in the air, bulls need to step up. If they don’t, things could slide further. The next few sessions might set the tone for Dogecoin’s midterm trend, especially with volatility lurking.

Speculators Still Hopeful, But DOGE Is Under Pressure

When the market corrected recently, meme coins like DOGE got hit the hardest. From May 10, DOGE dropped sharply, breaking the bullish streak it had been riding since April. That 100% move from $0.13 was impressive — but short-lived.

Still, Dogecoin remains on the radar. In past cycles, it’s been one of the top performers when things go full risk-on. If the market stabilizes and flips bullish, DOGE could rally hard again. But right now, it’s sitting just above key support, and if that breaks, we could see a steeper fall.

Martinez points out $0.213 as a likely target if support gives out. It’s a level that previously acted as a launchpad during the April surge — so yeah, important spot.

Technical Breakdown: Testing Demand

DOGE tried to push past $0.26 earlier this month but couldn’t hold. Now it’s consolidating around $0.221, hovering above the 200-day EMA ($0.219) and below the 200-day SMA ($0.269). This zone has become a bit of a tug-of-war.

Volume’s dropped off since the May breakout — never a great sign. If DOGE falls below $0.219–$0.220, that $0.213 level comes back into play fast. Drop further? $0.19 could be next.

If bulls show up and manage to reclaim the 200-day SMA ($0.269), that’d be a strong bullish signal. But right now, the momentum’s stalled, and the market’s uncertain. Without a spark, consolidation could shift into correction.

Bottom line: Dogecoin’s at a make-or-break level. Bulls better act soon, or the next move might not be pretty.