- Bitcoin ETFs pulled in $667M in a single day, with BlackRock, Fidelity, and ARK leading the charge.

- Ether ETFs added $13.66M quietly, with all of it coming from BlackRock’s ETHA.

- Total net assets for Bitcoin and Ether ETFs now sit at $124.97B and $8.72B, showing strong investor confidence.

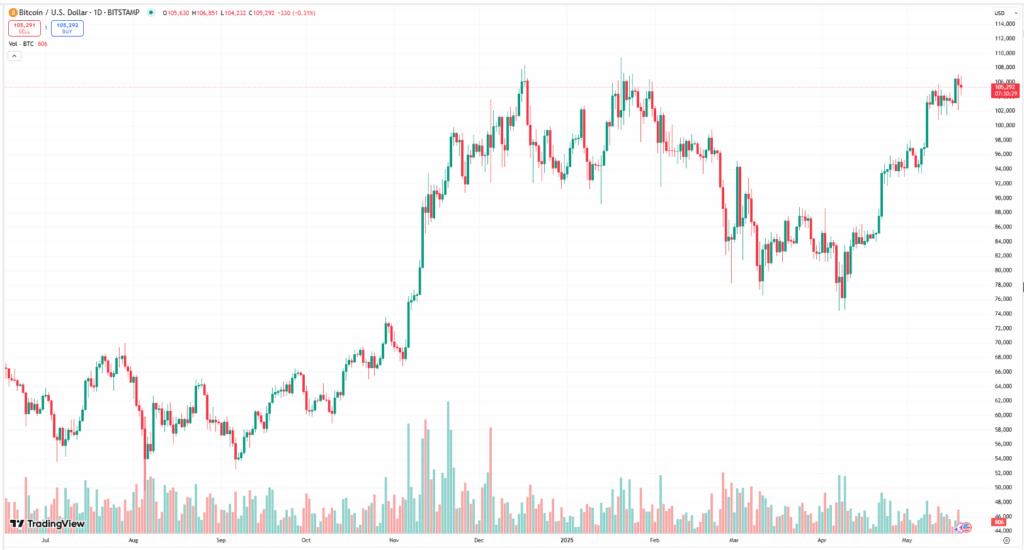

Bitcoin ETFs started the week on fire—pulling in a massive $667 million net inflow in just a day. That marks the fourth straight trading session in the green, showing some serious institutional appetite. Leading the charge? No surprises here—BlackRock’s IBIT brought in $305.92 million alone. Fidelity’s FBTC followed closely with $188.08 million, and ARK 21Shares’ ARKB added $155.25 million to the mix. The momentum feels loud, fast—and deliberate.

Big Players Dominate While One ETF Buckles

The rest of the field chipped in too. Bitwise’s BITB added $16.02 million, and VanEck’s HODL ETF saw a more modest $7.44 million in gains. On the flip side, Invesco’s BTCO posted the only outflow of the day—just $5.27 million, a drop in the ocean compared to the inflows elsewhere. Overall, bitcoin ETFs clocked in $3.63 billion in trading volume, and net assets have now ballooned to nearly $125 billion. That’s a hefty signal of growing confidence in digital assets from the TradFi world.

Ether ETFs Tag Along—Quiet But Green

While Bitcoin stole the spotlight, Ether ETFs quietly joined the rally. BlackRock’s ETHA was the only product to log inflows, but it did so impressively—adding $13.66 million. No outflows from any Ether ETFs were reported, hinting at a steadier, more cautious bullishness building in the ETH market. The total volume hit $468.73 million and net assets wrapped up at $8.72 billion—not groundbreaking, but not nothing either.

Market Vibes: Bullish But Watchful

The vibes right now? Optimistic—but not reckless. Bitcoin’s ETF momentum feels almost electric, while Ether’s slower pace reflects more of a wait-and-see mood. The fact that BTC funds are pulling in more than miners can produce is part of the story—demand’s clearly outpacing supply. And with big names like BlackRock and Fidelity still backing up the truck, you get the feeling this run has more room to stretch.

What’s Next?

With crypto ETFs moving in sync and some serious money flowing in, the big question is—how long can this trend stick? If macro conditions don’t throw a wrench in the mix, and Bitcoin keeps flirting with new highs, we might just be watching the early innings of another leg up.