- Whales Accumulate DOGE as Resistance Looms: Dogecoin whales holding 100 million to 1 billion DOGE have added 1.4 billion DOGE worth over $300 million in the past month, bringing their holdings to just under 26 billion DOGE.

- On-Chain Activity Surges: Daily active addresses spiked to over 680,000 on May 12-13, while large transactions above $1 million also surged, indicating increased big-money interest despite DOGE trading at $0.2277.

- Key Resistance at $0.24-$0.26: Despite whale accumulation and rising network activity, DOGE faces strong resistance between $0.24 and $0.26. A breakout above this zone could open the door to $0.30, but a rejection risks a slide back to $0.17.

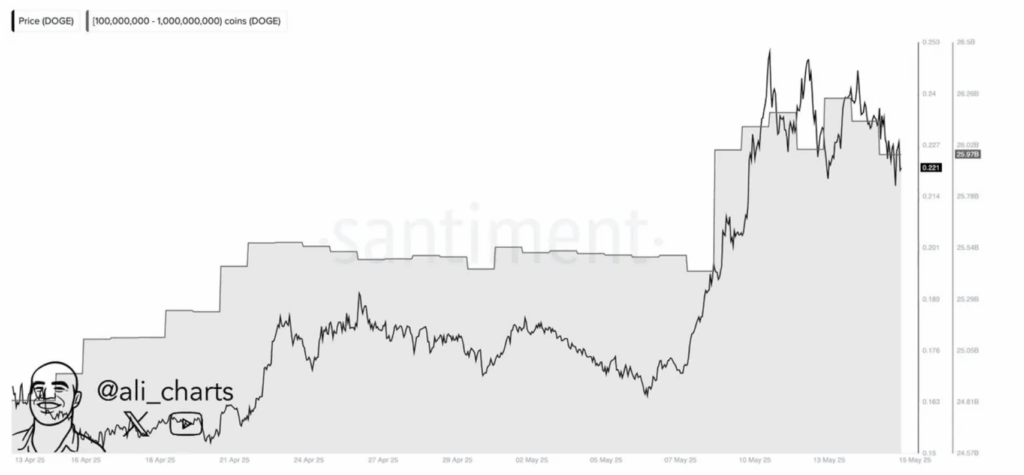

Dogecoin whales are making moves – and they’re doing it quietly. Fresh data from Santiment, highlighted by Ali Martinez, shows that the biggest DOGE holders have been busy accumulating over the past month, just as the memecoin grinds toward a crucial resistance level.

Whales Stock Up on DOGE

Martinez points to the group of wallets holding between 100 million and 1 billion DOGE – the so-called “mid-tier whales.” On April 13, these whales held about 24.6 billion DOGE. Fast forward to May 13, and that number had climbed to just under 26 billion DOGE. That’s a gain of 1.4 billion DOGE, worth over $300 million at current prices.

Interestingly, these whales hit a peak of 26.5 billion DOGE on May 10 before trimming some of their holdings. But the accumulation trend is still intact – and that’s got some analysts eyeing the charts for a potential breakout.

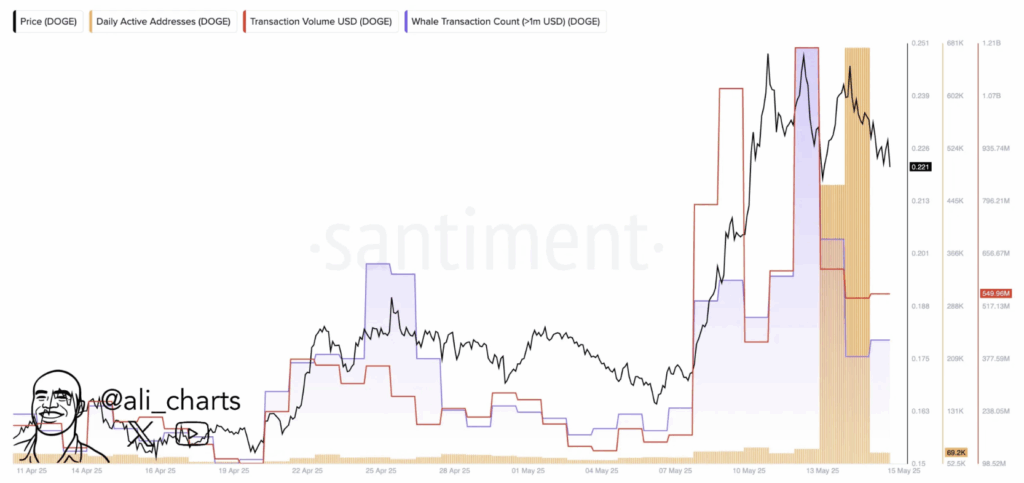

On-Chain Activity Picks Up

The whale buying spree coincides with a spike in network activity. Santiment’s data shows daily active addresses shooting up from the low five-figure range in mid-April to over 680,000 by May 12-13. That’s a massive surge – though it’s since cooled to around 69,200 by May 15.

Transaction volume in dollar terms also jumped, hitting $1.21 billion at its peak and still sitting at a solid $549.96 million in the latest reading. But the real kicker? Large transactions over $1 million spiked as well, showing that much of this activity is driven by big-money players rather than retail traders.

Dogecoin Faces Critical Resistance

Despite all the action on-chain, the price chart isn’t quite as convincing – yet. On the three-day chart shared by Martinez, DOGE is trading at $0.2277, pressing into a key resistance zone between $0.24 and $0.26.

This zone was major support throughout December 2024 but flipped to resistance after February’s breakdown. Several rejection attempts have already occurred, and another one this week saw DOGE pierce the zone intraday but fail to close above it.

Martinez says a solid close above $0.26 could open the door to a run toward $0.30 – a move that might trigger a new bull rally. But failure to break through could send DOGE sliding back to the $0.17 region, where the April basing structure started.

Bottom Line – Whales Are Betting Big

The big wallets are buying. The on-chain metrics are heating up. But for now, DOGE’s price is still stuck under that $0.24-$0.26 ceiling. If the whales are right and DOGE can push through, we could see a quick run to $0.30. If not? Well, that $0.17 zone could come back into play fast. Stay tuned – the next move could be a big one.