- Bitcoin outperformed all assets in Russia’s financial markets in April 2025, rising 11.2% according to the Central Bank of Russia.

- Since 2022, Bitcoin has delivered a 121.3% cumulative return, far surpassing stocks, bonds, and gold.

- Saudi Arabia’s central bank acquired MicroStrategy shares, aiming for indirect exposure to Bitcoin’s rising value.

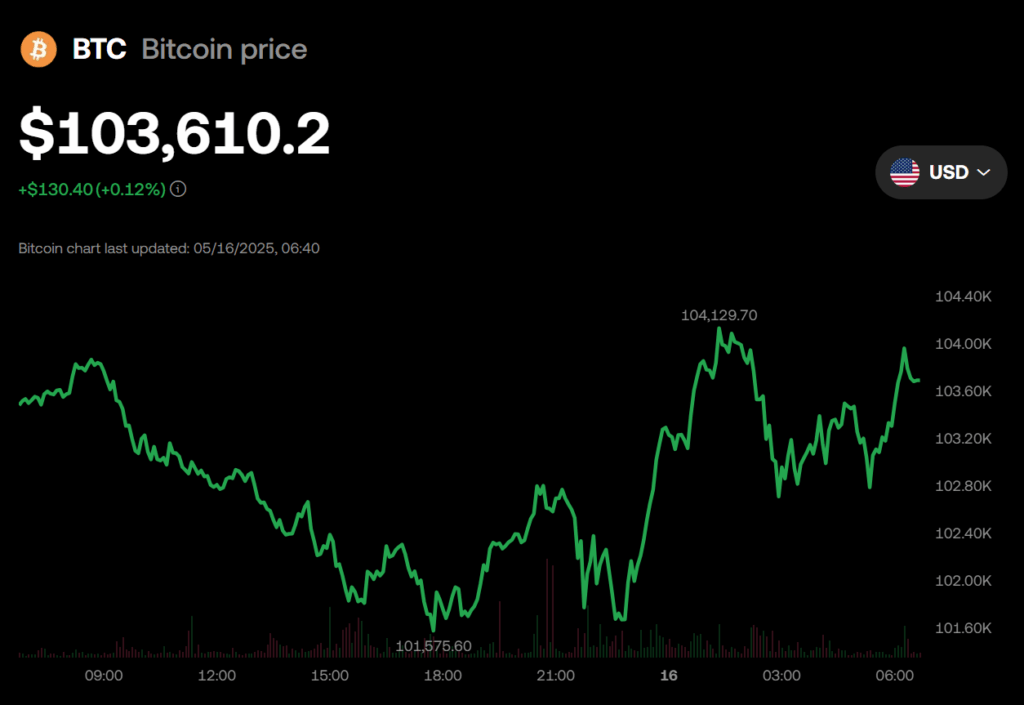

Bitcoin has emerged as the top-performing asset in Russia’s financial markets for April 2025, with an 11.2% surge, according to the Central Bank of Russia. Despite some volatility earlier in the year, Bitcoin has delivered a year-to-date return of 17.6%, outpacing traditional assets like stocks, bonds, and gold.

Bitcoin’s Dominance – A Multi-Year Winning Streak

Since 2022, Bitcoin has maintained its position as the top global investment, boasting a cumulative return of 121.3%. Over the past year alone, the cryptocurrency has delivered a 38% gain, reinforcing its status as the most profitable investment identified by the Russian central bank.

Institutional Moves – Saudi Arabia Eyes Bitcoin Exposure

In a related development, the Saudi Arabia Central Bank disclosed its acquisition of MicroStrategy shares, signaling a strategic play to gain indirect exposure to Bitcoin through the company’s substantial holdings in the digital asset.

This move underscores a growing trend of institutions seeking Bitcoin exposure amid its continued outperformance.