- JPMorgan analysts say Bitcoin is gaining ground over gold as investor money shifts from gold ETFs to crypto funds.

- U.S. states like New Hampshire and Arizona are now adding Bitcoin to their reserves, potentially boosting long-term demand.

- Coinbase, Kraken, and Gemini are expanding into crypto derivatives, signaling growing institutional interest in Bitcoin.

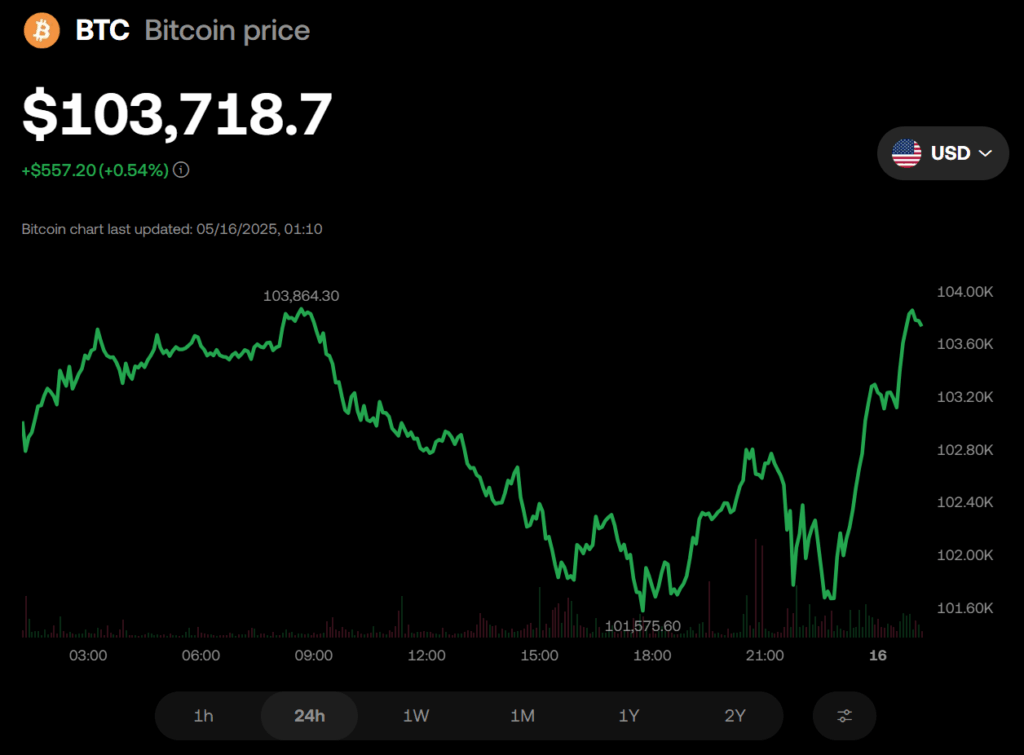

Last year, both gold and Bitcoin surged as investors sought hedges against weakening fiat currencies. But in 2025, that trade has morphed into a zero-sum game, according to JPMorgan analysts led by Nikolaos Panigirtzoglou. Between February and April, gold was the star, climbing while Bitcoin lagged. But now the tide has turned – Bitcoin is up 18% since April 22, while gold has dropped nearly 8%. The analysts expect this tug-of-war to continue, but they’re leaning towards Bitcoin having more upside, driven by crypto-specific catalysts.

Money Flow – Bitcoin Gaining Ground as Gold Slips

Investor flows tell a similar story. Over the past three weeks, money has been moving out of gold ETFs and into spot Bitcoin and crypto funds, according to JPMorgan. Futures data backs this up, showing a drop in gold positions while Bitcoin futures rise. Earlier in the year, it was the opposite – gold was attracting capital as Bitcoin lagged. Now, the momentum is with crypto, partly fueled by aggressive buying from firms like Strategy, which plans to raise another $42 billion for Bitcoin purchases by 2027, having already hit 60% of that target.

States Adding Bitcoin to Reserves – A New Catalyst?

Bitcoin’s rise isn’t just about gold weakening – it’s also about new players entering the crypto space. Some U.S. states are now adding Bitcoin to their reserves. New Hampshire recently allowed up to 5% of state assets to be allocated to Bitcoin and gold, while Arizona is setting up a digital asset reserve backed by staking rewards. With other states considering similar moves, JPMorgan analysts believe this trend could provide a more sustained tailwind for Bitcoin as the year progresses.

Institutional Push – Crypto Derivatives Market Expands

Beyond state adoption, the institutional crypto market is maturing rapidly. Major U.S. exchanges are snapping up key players in the derivatives space – Coinbase acquired Deribit, Kraken took over NinjaTrader, and Gemini secured a European derivatives license. JPMorgan’s report suggests that as regulation tightens and more established players enter the market, institutional confidence in Bitcoin could rise, potentially extending its rally through the second half of 2025.