- Bitcoin dips below $103K as US-China trade deal boosts stocks and the US Dollar Index, holding BTC back.

- Key support levels for Bitcoin are $100K and $97,238, while resistance sits between $107K and $109,588.

- Altcoins show mixed signals – ETH eyes $3K, SOL targets $210, while DOGE struggles to hold $0.21.

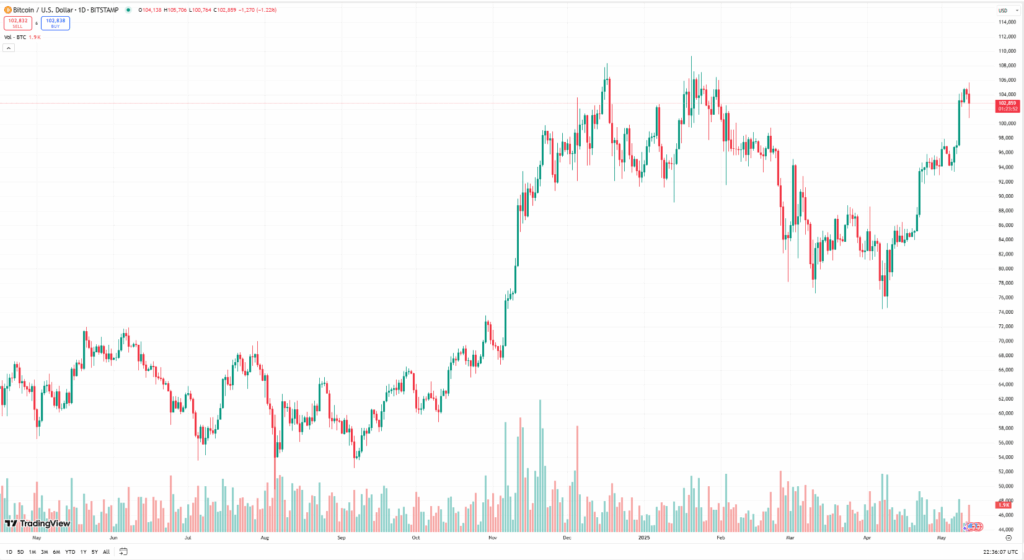

Bitcoin kicked off the week on a cautious note, sliding below $103,000 despite upbeat headlines about a US-China trade deal. The S&P 500 and US Dollar Index both surged, riding the optimism, but Bitcoin seemed to lag behind. Some analysts think BTC might be taking a breather after its recent 24% rally, while others suggest the dollar’s sharp rise could be holding it back.

Meanwhile, Bitwise’s André Dragosch pointed out that the firm’s proprietary indicator hit its highest level since 2024. Historically, such levels have led to sideways action or even brief corrections, suggesting BTC could be in for a pause.

Bitcoin’s Key Levels – Bulls and Bears in a Tug-of-War

Bitcoin’s recent drop from $105,819 highlights the stiff resistance in the $107,000 to $109,588 zone. The first line of defense on the downside is $100,000, followed by the 20-day EMA at $97,238. If BTC bounces off these levels, bulls might push for another attempt at $109,588. Otherwise, a deeper pullback to $93,000 or even the 50-day SMA at $89,302 could be in play.

Altcoins Face Mixed Signals – What’s Next?

- Ether (ETH): ETH bulls are battling to keep the price above $2,550, but bears are selling into rallies. If $2,320 holds as support, a move toward $3,000 is possible. Otherwise, $2,111 could be the next target.

- XRP: XRP broke above $2.50 but is now facing resistance at $2.65. A rally to $3 is possible if $2.65 is cleared, but a break below the 20-day EMA at $2.27 could trigger consolidation.

- BNB: BNB is struggling near $700, with support at $644. If buyers defend $644, a push to $745 is on the cards, but a drop below $621 could shift momentum to the bears.

- Solana (SOL): SOL hit resistance at $180, but the shallow pullback suggests bulls aren’t giving up. A break above $180 could spark a rally to $210, but a drop below $168 could lead to $155.

- Dogecoin (DOGE): DOGE pulled back from $0.26 but is holding the $0.21 support. If bulls flip $0.21 into support, a rally to $0.31 is possible, but a break below $0.21 could open the door to $0.14.

- Cardano (ADA): ADA is pushing against $0.86 but needs to hold $0.72 to keep the uptrend intact. If buyers clear $0.856, $1.01 could be the next target.

- Sui (SUI): SUI is facing selling pressure at $4.25 but remains above the $3.90 breakout level. If buyers defend $3.90, a move to $5 is on the table, but a drop below $3.90 could signal a deeper correction.

Overall, the market’s in a bit of a holding pattern as traders await fresh catalysts – and with inflation data and economic reports on deck, volatility could be just around the corner.