- Crypto Market Remains Steady Amid Trade Talks: The broader crypto market held firm as US-China trade discussions progressed, with Bitcoin stabilizing above $104,000 and the total market cap hovering around $3.3 trillion.

- VIRTUAL Targets 380% Upside Amid Cup-and-Handle Pattern: Virtuals Protocol (VIRTUAL) surged to $2, forming a cup-and-handle structure with a breakout target of $9.55 — a potential 380% rally if the bullish setup holds.

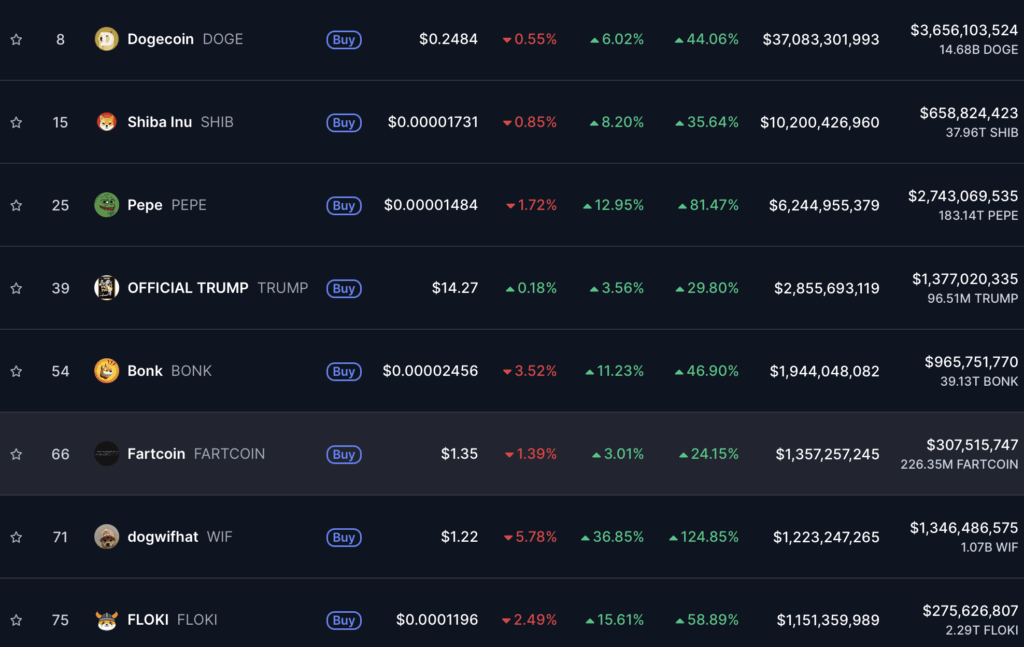

- Moo Deng and Bonk Show Mixed Signals: Moo Deng skyrocketed 1,240% to $0.33, but its RSI hit 95, signaling overbought conditions and a potential drop to $0.048. Meanwhile, Bonk broke above its double-bottom neckline, eyeing a 45% gain to $0.0000347.

The crypto market started the week on solid ground as investors cheered progress in the ongoing trade talks between the US and China. Bitcoin is holding above $104,000, keeping the market cap of all cryptocurrencies around $3.3 trillion. Meanwhile, several altcoins are making notable moves, including Virtuals Protocol (VIRTUAL), Moo Deng (MOODENG), and Bonk (BONK). Let’s dive into the action.

Virtuals Protocol — Eyeing a Major Breakout

Virtuals Protocol has been catching eyes lately as it positions itself at the intersection of AI and crypto. The platform helps developers launch AI agents, and its ecosystem tokens — including aixbt, Ribbita, GAME, VaderAI, and Luna — have pushed its market cap close to $2 billion.

After bottoming out at $0.4213 in April, VIRTUAL is now trading at $2, its highest since January 31. The token has climbed above the 50-day EMA and is forming a textbook cup-and-handle pattern. The top of this structure sits at $5.10 — that’s 152% above current levels.

If the pattern plays out, VIRTUAL could jump to $9.55, marking a 380% upside from current prices. The target is calculated by measuring the depth of the cup and projecting that distance above the handle. But, of course, crypto markets are never that predictable — traders will want to keep a close eye on volume and broader market sentiment.

Moo Deng — Parabolic Rally Raises Red Flags

Moo Deng, a meme coin built on Solana, has gone absolutely nuts this month. The token surged to $0.33, its highest since January 7, gaining over 1,240% from its 2025 low. With a market cap now above $277 million and a 24-hour trading volume of $1.35 billion, Moo Deng is clearly attracting a ton of attention — and a fair bit of FOMO.

But here’s the kicker: the Relative Strength Index (RSI) has spiked to 95, a dangerously overbought level. And with the coin showing signs of entering the markup phase of the Wyckoff Theory, a pullback seems almost inevitable.

If the price reverses, the key support to watch is $0.048 — a brutal 82% drop from current levels. That’s a massive risk for anyone jumping in now. The bulls are in control for now, but they might not be for long.

Bonk — Setting Up for a Double-Bottom Breakout?

Bonk is another memecoin making moves, forming a double-bottom pattern at $0.000008870 between March and April. The token has since broken above the neckline at $0.00001550, confirming the bullish breakout.

Now, BONK is trading above the 23.6% Fibonacci Retracement level and nearing a mini golden cross, where the 100-day and 50-day moving averages are set to cross. If bulls can maintain momentum, the next target is the 38.2% retracement level at $0.00002855 — a 20% gain from current levels.

A breakout there could open the door to the 50% retracement level at $0.0000347, representing a potential 45% upside. But like with Moo Deng, any sharp pullback in the broader market could turn this bullish setup into a bear trap.

Bottom Line — Altcoin Mania or Trap?

VIRTUAL, Moo Deng, and Bonk are all flashing some pretty wild setups right now, but they’re also trading in extremely volatile conditions. VIRTUAL has a clean cup-and-handle pattern, Moo Deng is in overbought territory, and Bonk is on the brink of a potential double-bottom breakout. For traders, the key will be keeping risk tight and staying nimble — because in crypto, nothing ever moves in a straight line.