- HBAR Price Surge and Breakout: Hedera Hashgraph (HBAR) jumped 60% from its April lows, hitting $0.2063 on Friday, driven by a bullish breakout from a falling wedge pattern and an inverse head and shoulders setup, with a target of $0.3200 if momentum holds.

- Market Catalysts – Stablecoin Activity and TVL Growth: Stablecoin transactions on Hedera surged to $131 million from $40 million in January, while the total value locked (TVL) in Hedera’s ecosystem rose to $193 million, led by projects like Stader, SaucerSwap, and Bonzo Finance.

- Potential ETF Approval and Key Levels: Rumors of potential HBAR ETFs from Canary Capital and Grayscale add to the bullish narrative, but the $0.1700 support level remains critical to maintaining the upward trend, with $0.3200 and $0.4027 as key resistance targets.

Hedera Hashgraph (HBAR) just staged a serious comeback, jumping to $0.2063 on Friday — its highest price since early March. The token has surged over 60% from its lowest point this year as the broader crypto market gains momentum.

HBAR Technical Analysis — Bullish Patterns Emerging

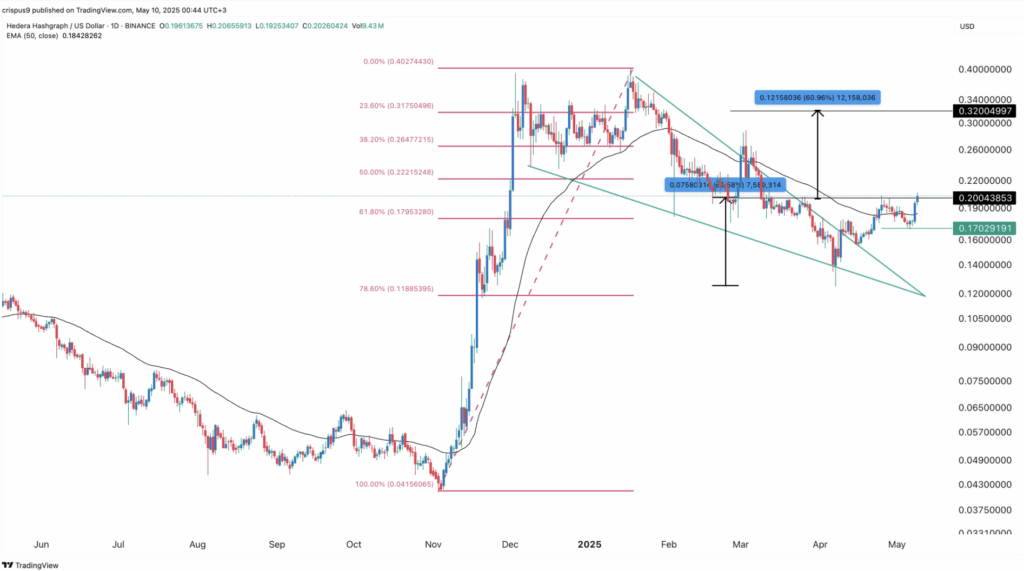

Looking at the daily chart, HBAR peaked at $0.4027 back in January when the Trump administration floated the idea of building a stockpile of altcoins for government reserves. Since then, the price has been in a falling wedge pattern, characterized by two descending, converging trendlines.

Falling wedges often signal bullish reversals, and HBAR just confirmed the breakout, jumping 60% off its April lows. But that’s not all. The token also formed an inverse head and shoulders pattern, a classic bullish setup. The neckline sits at $0.20, and now that HBAR is trading above it, the next target is around $0.3200 — a level that coincides with the 23.60% Fibonacci Retracement.

However, if HBAR drops below the $0.1700 support (the right shoulder of the pattern), the bullish outlook could get invalidated.

Why Is HBAR Pumping?

Several factors are pushing HBAR higher. First, Bitcoin’s explosive move above $100,000 has lifted sentiment across the crypto space. If BTC breaks its all-time high of $109,300, the entire market could see more gains, including HBAR.

Second, the stablecoin market on Hedera is heating up. Data shows stablecoin activity on the network has gone parabolic, climbing to $131 million — a dramatic rise from just $40 million in January. Lower fees and faster transaction speeds are drawing investors to the network, adding to HBAR’s bullish case.

Lastly, the total value locked (TVL) in Hedera’s ecosystem has jumped to over $193 million, driven by major players like Stader, SaucerSwap, Bonzo Finance, and HbarSuite. And with rumors swirling that the SEC may approve HBAR ETFs from Canary Capital and Grayscale, the hype could keep building.

Key Levels to Watch

- Support: $0.1700 (right shoulder support)

- Resistance: $0.3200 (23.60% Fib), $0.4027 (January high)

A confirmed breakout above $0.3200 could pave the way for a run toward $0.4027. But a dip below $0.1700 would invalidate the bullish setup, potentially sending HBAR back to previous lows. Stay tuned — things could get interesting.