- Massive DOGE Transfer Amid Bullish Sentiment: A transfer of 793 million DOGE (worth $153 million) between unknown wallets coincides with a 12.16% price rally to $0.2062, raising speculation of potential whale moves.

- On-Chain and Derivatives Activity: While sentiment indicators show optimism, on-chain activity remains subdued with Daily Active Addresses at 70,913 and Transaction Count at 52,071. Meanwhile, derivatives volume surged 126.06% to $6.2 billion, indicating heightened speculative activity.

- Technical Analysis – Next Target $0.286: DOGE broke out of a consolidation zone near $0.203, with RSI now at 70.57 (overbought) and Parabolic SAR remaining below the price, suggesting continued bullish momentum toward the $0.286 resistance level.

A whopping 793 million Dogecoin (worth over $153 million) just moved between two unknown wallets, grabbing the market’s attention. The timing? Right in the middle of a fresh 12.16% rally that’s pushed DOGE to $0.2062 as of today. While big transfers like this often hint at whale moves, sentiment indicators are suddenly leaning bullish too.

Sentiment Turns Positive, But On-Chain Data Remains Subdued

Market Prophit shows both crowd and smart money sentiment scoring above 1.3, suggesting confidence from both retail and institutional players. Yet, on-chain activity isn’t exactly screaming bullish just yet.

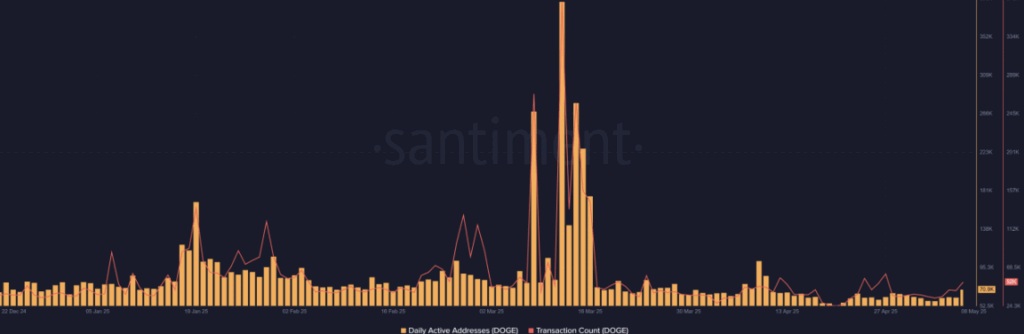

Daily Active Addresses sit at 70,913, and Transaction Count is hovering around 52,071. Yes, those numbers are up slightly from April’s lows, but they’re still far below March peaks, where both metrics topped 300,000. So, while the mood is lifting, DOGE’s on-chain activity is more of a cautious rebound than a confirmed uptrend.

Valuation Analysis – What’s Driving This Rally?

From a valuation perspective, DOGE still looks like it’s in favorable territory. The MVRV Z-Score is sitting at 0.70, indicating that most holders aren’t in significant profit, limiting the risk of mass sell-offs. But there’s a twist — the Stock-to-Flow Ratio has dropped to zero. That’s right. Zero.

This sharp decline might hint at mining stagnation or a temporary supply freeze, which could introduce scarcity dynamics. If DOGE supply stays tight and demand remains strong, it could create upward price pressure, especially during speculative runs.

Derivatives and Market Sentiment – Repositioning or Breakout?

Speculation in the derivatives market is heating up. Trading volume surged 126.06% to $6.2 billion, and Open Interest jumped 17.10% to $2.2 billion. But there’s a catch. Options Volume rose 55.13%, while Options Open Interest dropped 53.96%. That suggests short-term repositioning, not long-term conviction.

Meanwhile, Santiment’s Weighted Sentiment indicator climbed to +0.59, indicating that bullish commentary is gaining traction. Historically, this kind of shift often precedes major price action, reinforcing the potential for further gains.

Technical Analysis – Eyes on $0.286

DOGE recently broke out of a multi-week consolidation zone near $0.203, forming a double-bottom pattern around $0.144. With the neckline now acting as support, momentum indicators are pointing higher.

The RSI is up to 70.57 — technically overbought, but also a sign of strong bullish pressure. Meanwhile, the Parabolic SAR continues to print below the price, suggesting the uptrend is intact.

If bulls maintain control, the next big resistance level to watch is $0.286. A clean break above that zone could open the door for even more upside, potentially solidifying DOGE’s current rally into a broader uptrend.