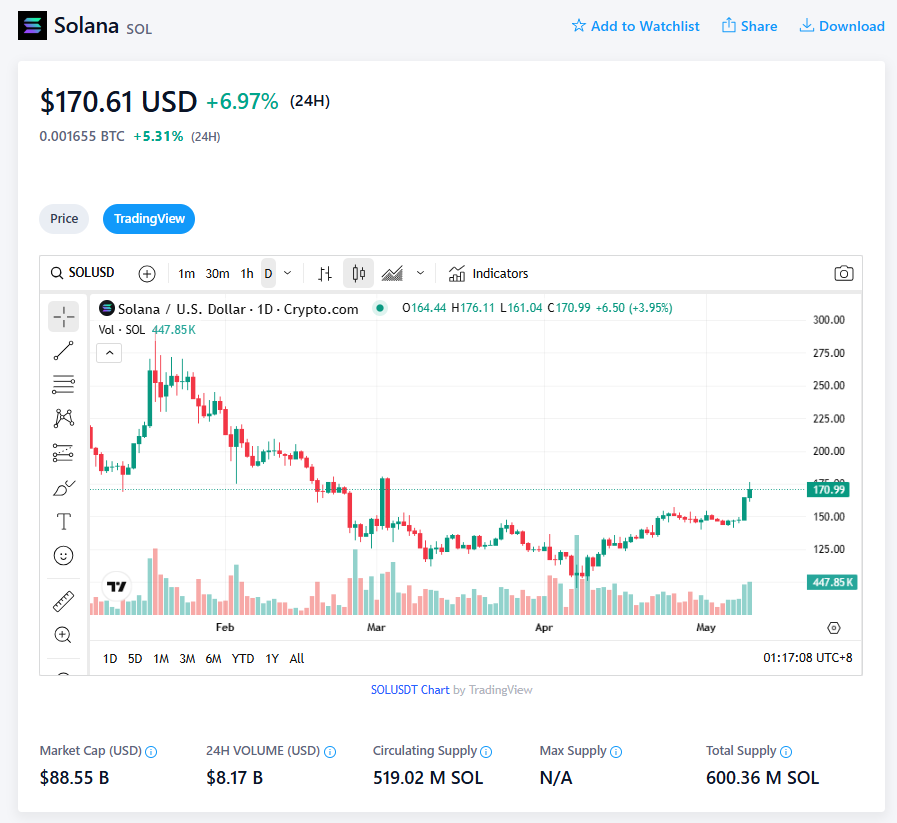

- Solana surged 36% in the past month, buoyed by rising network activity and a broader crypto market rebound.

- SOL’s TVL jumped 25% while open interest in futures climbed to $5.8 billion, signaling increased bullish momentum.

- Analysts warn of a possible 9.45% correction to $136.18 but say a Fed rate cut or Bitcoin’s rally could keep SOL climbing.

Solana’s been on a tear lately, jumping 36% in the past 30 days. The broader crypto market is also heating up, with Bitcoin inching back toward that elusive $100,000 mark. The global market cap ticked up 0.9% in the last 24 hours to hit $3.17 trillion, and SOL is riding the wave — up 3% on the daily, 0.9% on the weekly, and 1.3% over the last two weeks.

This recent surge comes right after Arizona’s governor signed a Bitcoin reserve fund bill into law, a move that brought a sigh of relief to crypto investors — especially with Florida yanking two crypto bills off the table. The ripple effect seems to be giving SOL and other assets a nice little boost.

Network Activity Picking Up — Is $200 on the Horizon?

Solana’s not just moving on hype. Network activity is ramping up too. The total value locked (TVL) on the SOL network shot up 25% in the past month, and DEX volumes have nearly doubled. Sanctum and Raydium are seeing most of the action, with meme coins on Solana stirring up a frenzy once again.

Open interest in SOL futures climbed to 38.7 million contracts, now valued at over $5.8 billion — ranking third in the market. Some analysts say if this momentum keeps up, we could see SOL making a run toward $200 in the not-too-distant future.

Analysts Split on What’s Next — Sideways or Surge?

Despite the bullish signs, not everyone’s convinced the rally will continue. CoinCodex analysts predict a possible 9.45% correction by May 24, potentially pulling SOL down to $136.18.

But then there’s the wildcard — the Federal Reserve. If a rate cut is on the table, risk assets like SOL could get a fresh boost. And if Bitcoin does break past $100,000, Solana could tag along for the ride. For now, it’s a coin flip.