- Crypto short traders faced $1.12 billion in liquidations as Ethereum’s 25% rally led to $439 million in losses.

- Bitcoin surged to $102,858, triggering $307 million in liquidations, including a single $11.97 million short position.

- Ethereum’s Pectra upgrade fueled a 29% price surge to $2,400, marking its biggest rally since the Merge in 2022.

It’s been a brutal 24 hours for short traders in the crypto market. With prices of top assets skyrocketing, a staggering $1.12 billion worth of positions got wiped out, according to CoinGlass. And the vast majority? Shorts. Nearly $777 million worth of bearish bets were liquidated, while $350 million in longs also got zapped.

Ethereum traders took the hardest hit, racking up $439 million in liquidations as ETH shot up nearly 25% in a week, climbing to $2,448 on Friday — its highest in two months. The rally comes on the heels of the Pectra network upgrade, a move developers are calling the “most ambitious” since the Merge.

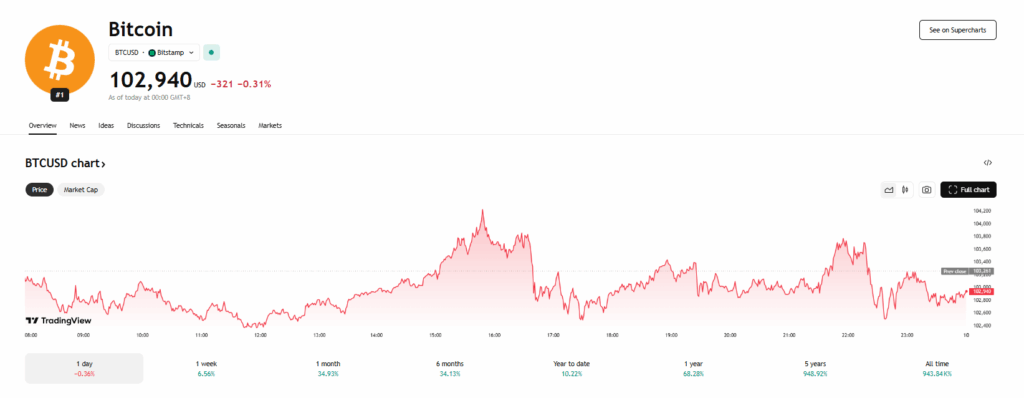

Bitcoin Breaks $100K, Shorts Suffer Massive Losses

Bitcoin wasn’t far behind, spiking 5% to $102,858 and briefly touching $103,890 earlier Friday. The surge led to $307 million in BTC liquidations, including one trader who lost a jaw-dropping $11.97 million on a single short position.

Meanwhile, Solana and Dogecoin also saw big moves, rising 12% and 11%, respectively. Solana accounted for $40 million in liquidations, while Dogecoin followed with $19 million — a reminder that the market’s wild swings are hitting everyone, bulls and bears alike.

Ethereum’s Big Bounce — Pectra Upgrade Fuels 29% Rally

Ethereum’s the star of the show, though. The second-largest crypto surged from $1,939 to over $2,400, a 28.9% gain fueled by the Pectra upgrade. Now trading at $2,339, ETH is up 20.4% on the day, with developers calling Pectra the “most ambitious upgrade” since the Merge in 2022.

But as ETH climbs, traders betting against it are getting crushed, with ETH liquidations surpassing even Bitcoin’s — a rare sight in the crypto space.