- Mark Cuban warns that Trump’s crypto projects could undermine the industry’s credibility, calling them a “bad example.”

- Senate Democrat Richard Blumenthal launched an inquiry into potential conflicts of interest in Trump’s crypto ventures.

- Despite his criticism, Cuban supports the administration’s regulatory efforts, praising recent SEC changes.

U.S. crypto entrepreneurs are mostly buzzing with excitement over having a president openly embracing digital assets. But billionaire investor Mark Cuban? Not so much. He’s waving a red flag, warning that Trump’s direct involvement in crypto projects could backfire.

“Memecoins and gaming TVL sets a bad example to people who want to try to understand the utility and value of crypto,” Cuban told The Block on Wednesday. He was referring to Trump’s recent push into the DeFi platform World Liberty Financial and the launch of a controversial memecoin that grants top holders access to the former president.

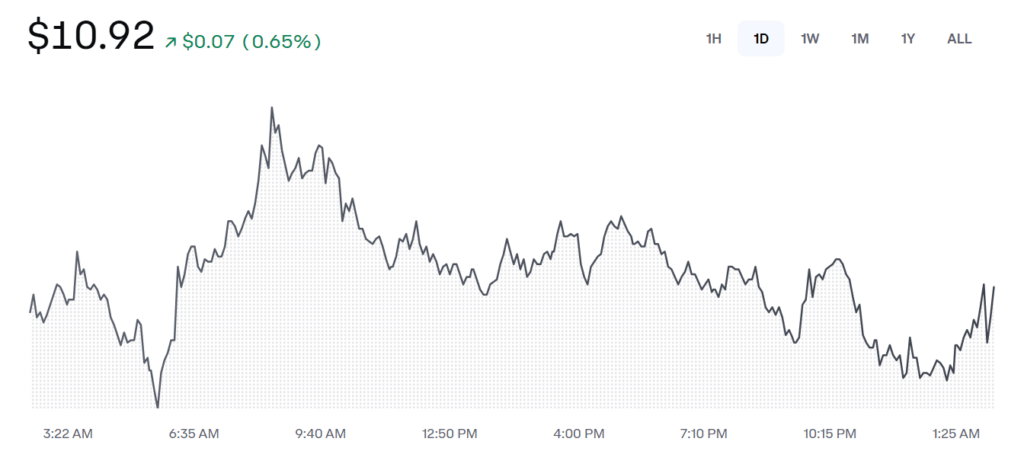

Trump’s crypto ventures, initially seen as a potential boost for the industry, are now treading murky waters. The TRUMP token, for instance, shot up in value after Trump announced a gala dinner with token holders — a move that drew backlash from Democrats. Bloomberg reported that most top holders of the token, those likely to attend the exclusive event, are based outside the U.S.

Trump Memecoin: Gains for Some, Losses for Most

According to Chainalysis data, Trump’s memecoin isn’t exactly spreading wealth equally. Of the 2 million wallets that bought in, just 58 have raked in over $10 million, with total gains exceeding $1 billion. Meanwhile, 764,000 wallets are in the red, CNBC noted.

Back in January, when the token first launched, Cuban didn’t mince words. “Hello every scam targeted at everyone and anyone who has no clue about crypto,” he blasted on X. “Goodbye whatever hope the crypto industry had of legitimizing itself.”

Stablecoin Sparks D.C. Inquiry

While Trump’s memecoin has drawn plenty of attention, it’s World Liberty Financial’s stablecoin that’s really making waves. The USD1 stablecoin recently got a nod from MGX, an Abu Dhabi investment firm, which plans to use it to close a $2 billion investment in Binance. That deal, though, has some in Washington raising eyebrows.

On Tuesday, Senate Democrat Richard Blumenthal fired off letters to Fight Fight Fight LLC, the company behind the memecoin, and World Liberty Financial, announcing a probe into potential conflicts of interest and legal violations tied to Trump’s crypto ventures.

Neither Fight Fight Fight nor World Liberty Financial responded to requests for comment.

Cuban Cheers Regulatory Moves

Despite his criticism of Trump’s personal crypto dealings, Cuban still found a silver lining in the administration’s regulatory efforts. “I’m glad to see what he has done from a regulatory perspective,” Cuban said. “I’m thrilled to see changes at the SEC. They are long overdue.”