- Bearish Momentum Building: Cardano’s price is down around $0.65 after a 6% drop in two days, with negative funding rates and falling daily active addresses suggesting weakening demand and sentiment.

- Technical Indicators Flash Red: The RSI sits at 46 and MACD shows a bearish crossover, signaling downside risk. ADA could retest support near $0.615 if the decline continues.

- Upside Still Possible: If ADA manages to close above the $0.746 resistance level, a rally toward $0.810 could be back on the table.

Cardano’s (ADA) price has been in a bit of a funk lately, hanging around $0.65 after slipping nearly 6% over the past couple of days. And, well, it’s not just the price that’s looking shaky — on-chain data and technical indicators are both flashing some red lights.

Network Activity Dips, Funding Rates Turn Sour

Let’s talk numbers. According to Coinglass, the OI-Weighted Funding Rate for ADA is sitting in the red at -0.0017%. What does that mean? Basically, more traders are betting against ADA than betting on it. Shorts are paying longs, which usually hints that the overall vibe in the market is… kinda gloomy.

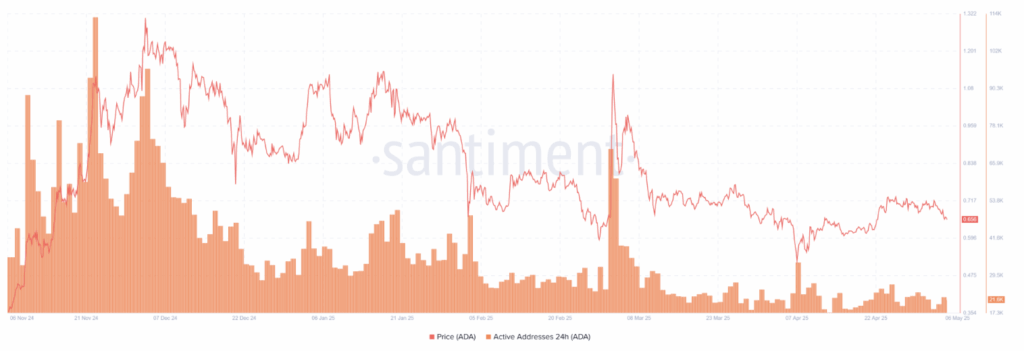

Then there’s Cardano’s network activity, which isn’t painting a prettier picture either. Daily active addresses — a rough way to track how much the network’s being used — have been in a slow drip downward since March. As of Tuesday, it’s down to about 21,600 active addresses. Less activity usually means less demand, and that, in turn, can put pressure on the price.

Technicals Aren’t Looking Great, Either

From a technical angle, ADA’s been struggling. It failed to push past that $0.746 resistance mark back on April 24, and since then, it’s slipped more than 8%. At the moment, it’s hovering near $0.66, trying to find its footing.

The RSI (Relative Strength Index) is down to 46, below the neutral 50 line — not catastrophic, but it’s a bearish tilt for sure. The MACD also doesn’t help the bull case: it gave a bearish crossover just yesterday, which traders often take as a signal to hit the brakes.

So… What Now?

If ADA keeps dipping, a retest of the April 22 low at $0.615 is definitely on the cards. That level might serve as a safety net, or, well, it might just be a pit stop on the way down.

But — and it’s a big but — if Cardano somehow manages to reclaim that $0.746 weekly resistance level and close above it, it could flip the script. In that case, a rally toward $0.810 might be back in play.