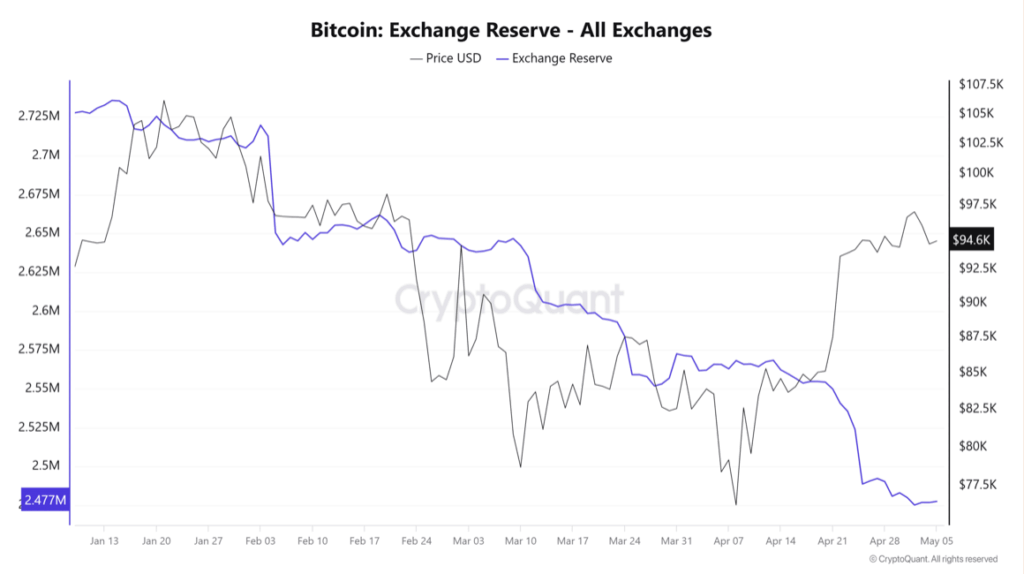

- Exchange Reserves Dropping: Only 2.47 million BTC remain on exchanges, signaling strong accumulation and long-term holding behavior, especially from institutional investors via spot ETFs.

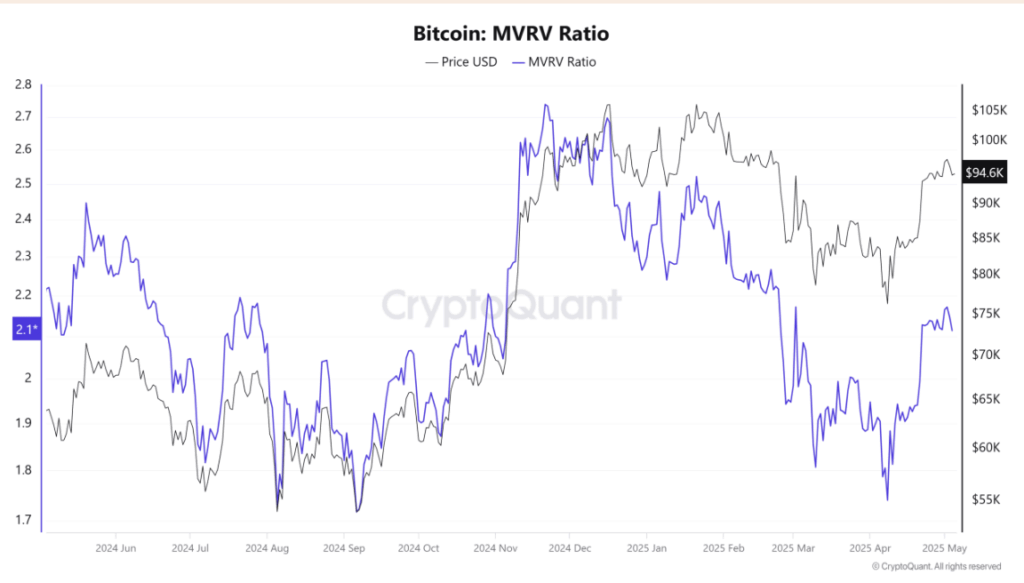

- MVRV Metric Shows More Room to Grow: Bitcoin’s MVRV ratio is at 2.1, well below the typical market top zone around 3.7, suggesting there’s still upside potential.

- Whales Are Buying Again: Large buyers are stepping back in, with increased spot order sizes showing renewed whale accumulation—supporting a possible push toward $100K in May.

Bitcoin’s been quietly making waves again—up 13% over the past month—and while it’s still floating just under that massive $100,000 milestone, signs are starting to point toward a strong upward push. If recent market behavior keeps up, we could be looking at BTC making a serious move soon.

Fewer Coins on Exchanges = Bullish Vibes

Let’s talk exchange reserves. Basically, when Bitcoin starts disappearing from centralized exchanges, it usually means one thing—investors are loading up and stashing it away for the long haul.

Right now, there’s only about 2.47 million BTC left on exchanges. That’s a low we haven’t seen in a while and suggests folks aren’t planning to sell anytime soon. They’re either moving to cold wallets or alternative custody setups. Either way, it’s a bullish indicator.

And it’s not just retail. Institutional players have been quietly stacking too, especially through spot ETFs. Since early April, there’s been a steady stream of ETF inflows. Sure, there was a minor hiccup on April 30 with a $56 million outflow, but let’s be honest—that’s peanuts compared to the $4.49 billion worth of BTC scooped up in the same stretch.

MVRV Shows There’s Still Room to Run

If you’re wondering whether we’ve hit the top, the Market Value to Realized Value (MVRV) metric says… not quite. Sitting at around 2.1, BTC’s MVRV suggests we’ve got breathing room. Historically, Bitcoin doesn’t flash its top until this ratio hits somewhere near 3.7.

So yeah, we’re not even close.

Whales Are Back at the Buffet

Digging deeper, one of the more telling signs is that whale activity is ramping back up. The Spot Average Order Size—basically a way to tell if big money is making moves—has jumped, meaning the big players are back in accumulation mode.

This combo—shrinking exchange reserves, consistent ETF buying, a modest MVRV, and fat whale orders—has all the makings of a classic Bitcoin breakout. If momentum holds, breaking into six-figure territory might just be on the cards this May.