- Whale Activity Signals Trouble: A major investor shorted HYPE with 5x leverage after depositing $6.51M USDC, raising bearish pressure across the market.

- Market Sentiment Weakening: Long liquidations far outpaced shorts, funding rates are flat, and retail interest has dropped—signs that traders are cautious and momentum is fading.

- Key Resistance Blocks Progress: HYPE is stuck below the $22 resistance. If bulls can’t reclaim that level, a drop toward the $18 support zone looks likely.

Well, things just got a bit shaky for HYPE.

A big-time whale recently dropped a hefty 6.51 million USDC into Hyperliquid and opened up a 5x short position—not exactly a bullish vote of confidence. Moves like this tend to rattle the market, and this one’s no different. That short could easily fuel more downside pressure if the dominos start to fall.

Despite the bearish vibes, HYPE is still holding at around $20.54 right now, up about 1.7% in the last 24 hours. But don’t let the green fool you—there’s turbulence under the surface.

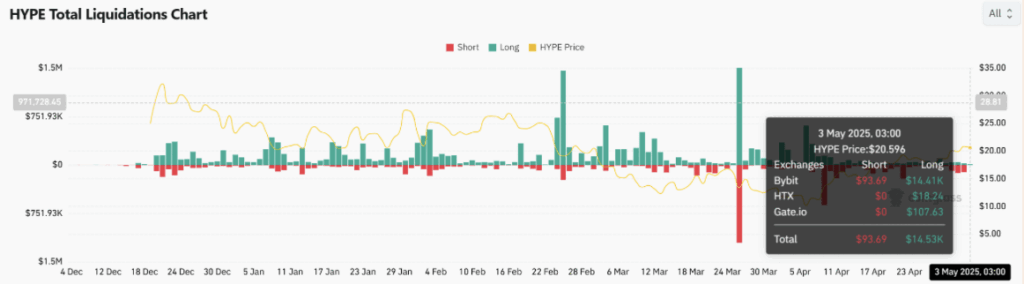

Long Liquidations Pile Up

CoinGlass data shows a pretty nasty imbalance: around $14,000 worth of long positions were liquidated, compared to just $93 in shorts. Ouch.

Basically, bulls are getting rinsed right now. The market’s leaning bearish, and these liquidation numbers are just adding fuel to that fire. If this keeps up, we could see HYPE take another dip—especially if more longs get flushed out.

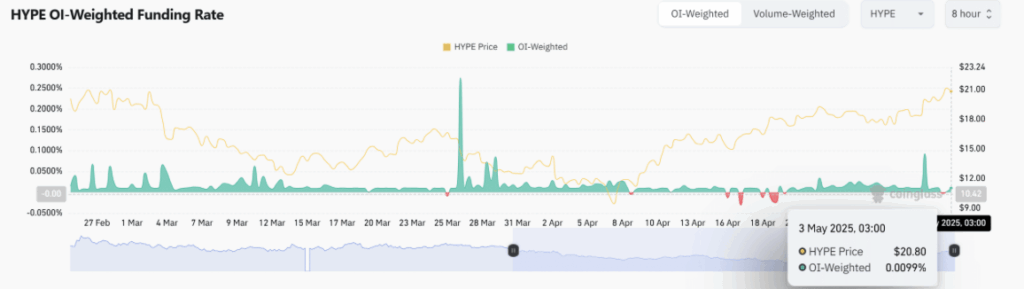

Traders Playing It Safe

Funding rate? Still positive, but barely—sitting at 0.00999% at last check. It’s a sign that traders are being real cautious, not rushing to make big bets in either direction.

This kind of hesitation usually means one thing: chop. Without a clear breakout or breakdown, HYPE might just stay stuck in its current zone. Nobody’s really pulling the trigger yet, and it shows.

That Pesky $22 Wall

HYPE’s been trying (and failing) to break above the $22 resistance zone. It’s kind of like watching someone try to push through a locked door. Every attempt just fizzles out.

Right now, the price is hovering around $20.60, but it’s not making any real progress. Unless bulls manage to muscle past that $22 mark, the path lower—maybe even to $18—seems more likely.

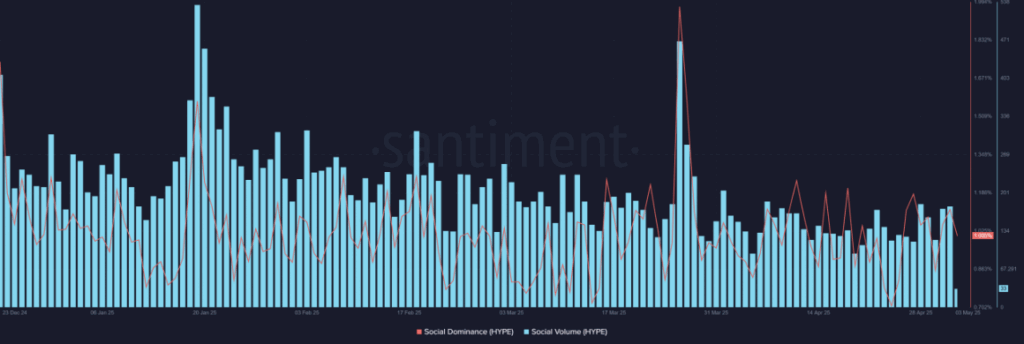

Retail Hype? Not So Much

It’s not just the price action—retail interest is cooling too.

Social Dominance has slipped to 1.00%, and Social Volume is at a low 33. That’s not great. When traders stop talking, it’s often a sign the hype train’s running out of steam.

Without fresh interest from retail crowds, the push needed to reclaim lost ground just isn’t there. This weakening social chatter kinda reinforces the bearish tilt.

Final Take

Right now, the vibe around HYPE is leaning bearish. A big whale shorting, a wave of long liquidations, soft funding rates, and fading retail buzz—it all adds up.

Unless bulls show up in force or we see some kind of breakout above $22, HYPE might just keep drifting toward that $18 support level. For now, it’s a waiting game.