- 21Shares filed with the SEC to launch a SUI ETF, sending the token price up nearly 11%.

- SUI, a layer-1 blockchain from ex-Meta engineers, now holds an $11.8B market cap.

- The Sui Foundation partnered with Fireblocks to boost institutional access and DeFi integration.

Swiss asset manager 21Shares just filed an S-1 registration with the SEC to launch a SUI exchange-traded fund (ETF) — a move that quickly stirred up some excitement in the market.

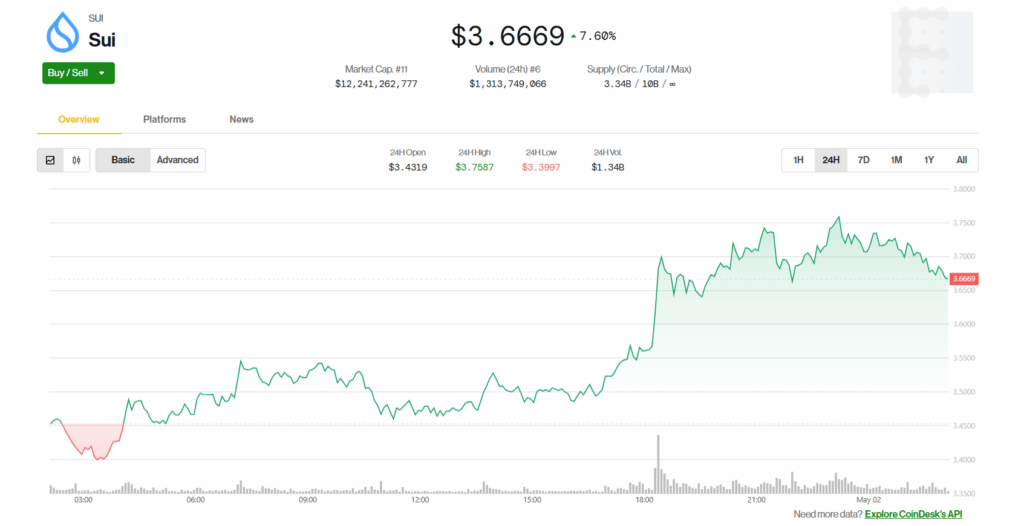

Almost instantly, the price of SUI jumped. It’s now sitting around $3.68, up nearly 11% in the past 24 hours, with a good chunk of that coming right after the filing appeared on the SEC’s website. Coincidence? Probably not.

Speaking at Sui’s annual Basecamp conference, Duncan Moir, President of 21Shares, shared his optimism: “Since our earliest research into Sui, we believed it could become one of the most exciting blockchains in the industry, and we’re seeing that thesis play out.”

SUI: The New Layer-1 Contender?

For those not fully up to speed—SUI is a layer-1 blockchain built by a team of former Meta engineers. The network’s native token has climbed to a market cap of $11.8 billion, which puts it just shy of cracking the top 10 list.

This filing from 21Shares also follows a similar move made about six weeks ago by Canary Capital, which also wants to launch a SUI-focused ETF. So, clearly, SUI’s catching the eyes of the big players.

Boosting Infrastructure for the Big Leagues

On top of all that, the Sui Foundation dropped more news on Thursday: it’s teaming up with Fireblocks, a well-known name when it comes to institutional crypto infrastructure.

The idea? Make it easier—and safer—for big institutions to interact with the Sui network. This includes things like native SUI custody and smoother access to DeFi protocols running on the platform.

Between the ETF buzz, the price spike, and this new Fireblocks partnership… SUI might be about to have its moment. Or at least it’s trying pretty hard to get there.