- Cardano (ADA) has climbed back above $0.70, gaining over 12% in a week, with analysts watching for a potential breakout above $0.74 that could open a move toward $0.88.

- Whale accumulation is rising, and speculation around a possible spot ADA ETF approval (with odds around 51%) is boosting investor optimism for further upside.

- Technical indicators like a Golden Cross and rising Money Flow Index (MFI) suggest bullish momentum, but ADA still faces tough resistance between $0.70–$0.72 before any major rally can unfold.

Cardano (ADA) is starting to stir some real excitement again. After weeks of sluggish price action, the token has bounced back above $0.70 for the first time since March, and traders are starting to eye that magical $1 mark once more. But — and it’s a big but — there are some key resistance zones ahead that could either fuel the next leg up… or slam the brakes hard.

A Strong Push, But Big Tests Ahead

According to crypto analyst Ali Charts, Cardano’s price is approaching a major resistance wall at $0.74. If ADA can crack through it, there’s a real shot at a rally toward $0.88. Over the past week, ADA’s up more than 12%, which is already drawing fresh attention from investors.

Trading volume’s spiked too — rising 33% in the last 24 hours to hit about $723 million. That’s usually a good sign, showing that buyers are stepping back in. Still, if ADA can’t break above that sticky $0.7150–$0.7200 range soon, the price might slip back down to $0.6800 for a bit of a reset.

Right now, Cardano’s floating around $0.7088, gaining about 2% on the day. It’s a steady recovery from the recent dip to $0.65 — but some technical indicators are flashing that momentum could be cooling off as it approaches these critical resistance zones.

Whale Activity and ETF Buzz Stir Hopes

Meanwhile, there’s been some sneaky whale action going on. Data from Santiment shows that wallets holding between 10 million and 100 million ADA have grown their share of the total supply to 35.5%, up from 33% at the start of the year. Even smaller whale wallets (between 1 million and 10 million ADA) have bumped up their holdings too.

This accumulation phase is usually a bullish signal — when big players are buying, it’s often because they see something good on the horizon.

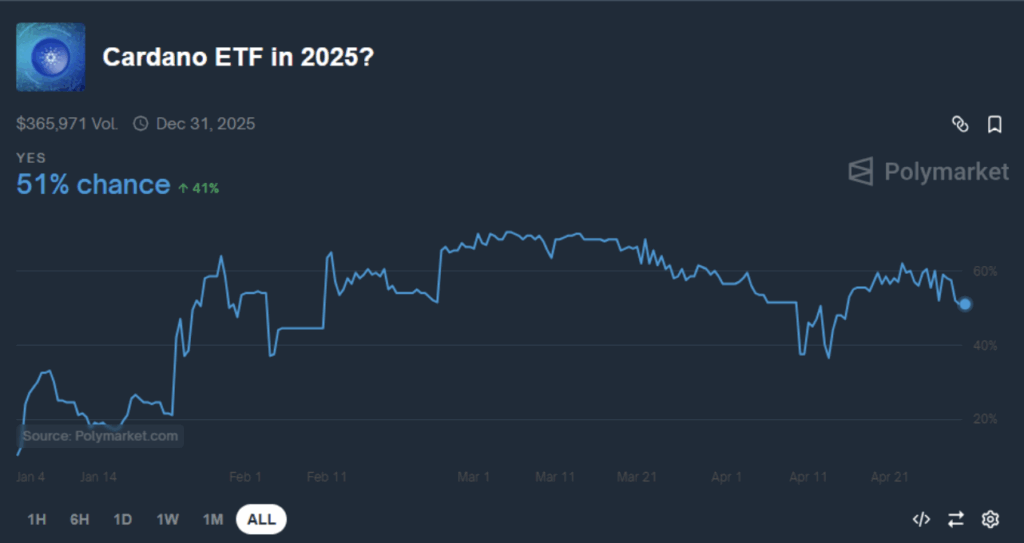

Adding even more spice to the mix, talk about a potential spot ADA ETF has started gaining real traction. Since Paul Atkins took over as the new SEC chair, optimism around crypto ETFs has shot up. In fact, Polymarket now shows a 51% chance of an ADA ETF approval this year. If it happens, that could pour a ton of new money into the Cardano ecosystem.

Technicals Point to a Bullish Setup

On the technical side, things are looking… cautiously optimistic. A Golden Cross just flashed on the 4-hour chart, with the 50-period SMA acting as fresh support after the crossover. Higher highs and higher lows are stacking up too — classic ingredients for an uptrend.

The Money Flow Index (MFI) is sitting at 55.33 — not overheated, not oversold. It’s kind of neutral, but leaning slightly bullish, leaving room for ADA to grind higher if momentum sticks.

Zooming out a bit, Cardano’s price is still moving within a falling channel that started earlier in 2025. It recently bounced off the bottom of the channel and now looks to be heading toward the midline — maybe even the top edge if the bulls really get moving.

According to Ali Charts, if ADA can break above the upper Bollinger Band (somewhere around $0.77–$0.78), it could clear the path for that move up toward $0.88. Resistance, for now, sits heavy between $0.70–$0.72, while stronger support is found lower, between $0.55–$0.57.

Futures Markets Show Rising Interest

Over in the derivatives market, Cardano’s open interest (OI) in futures contracts jumped about 1.5% intraday, hitting $796.15 million. The overall derivatives volume for ADA also surged — up 22.5% to reach $1.56 billion.

All in all, Cardano seems to be gathering some serious energy again — but it’s crunch time now. Bulls need to smash through resistance… or risk slipping back and regrouping.