- HBAR is trading around $0.193, just below critical resistance at $0.20, with positive momentum and bullish sentiment shown by two weeks of positive funding rates and a heavy dominance of long contracts.

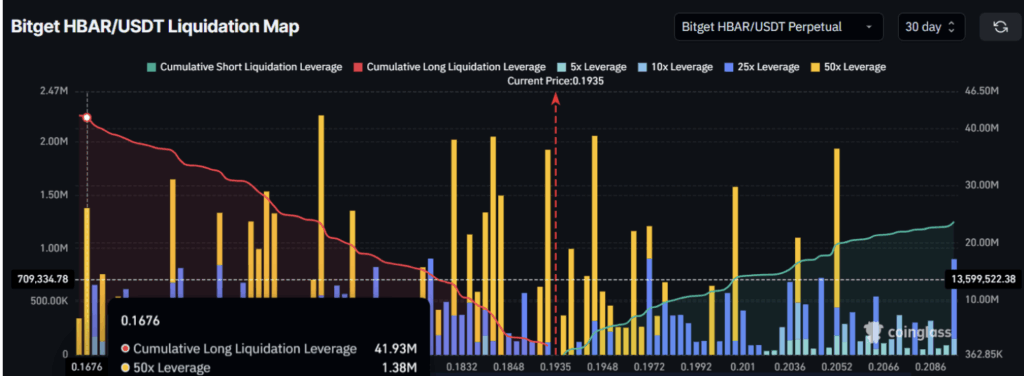

- Around $42 million worth of long contracts are at risk if HBAR fails to hold current levels and falls toward $0.167, making the $0.200 resistance a pivotal make-or-break point.

- If HBAR breaks above $0.20, it could target $0.222 next, but failure to do so may trigger a deeper decline, starting with a drop to $0.182 and potentially intensifying if liquidation cascades kick in.

HBAR’s been making some real noise lately. After a strong rally, the altcoin has clawed its way back into a key consolidation zone, sitting just below that critical $0.20 level. Momentum’s looking pretty strong right now — but whether HBAR can actually break through is the real question hanging over traders’ heads.

A clean break above $0.20 could be the start of something bigger, if bullish vibes across the market stick around to back it up.

Traders Are Feeling Good — But Risks Are Lurking

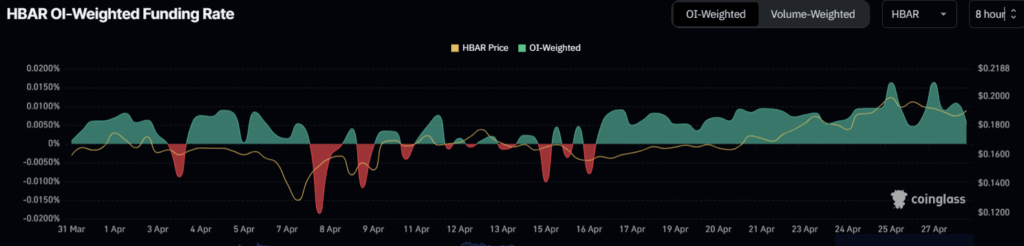

Sentiment around HBAR is buzzing. You can see it in the funding rates — they’ve stayed positive for almost two straight weeks. When funding rates are up like that, it usually means traders are confident and loading up on long positions, expecting higher prices.

Coinglass data shows the dominance of long contracts is pretty overwhelming right now, adding more fuel to the idea that traders are positioning for a breakout.

That said, it’s not all smooth sailing.

The liquidation map reveals a big red flag: about $42 million worth of long contracts could get wiped out if HBAR dips to $0.167.

So yeah, that $0.20 resistance? It’s not just a psychological line — it’s basically make or break for now.

If buyers lose their nerve here, it could lead to a nasty cascade of liquidations.

HBAR Price Action: Staring Down a Pivotal Level

At the time of writing, HBAR’s trading around $0.193 — just a breath away from that stubborn $0.200 resistance.

This isn’t the first time either — HBAR’s been rejected at this level multiple times over the past month and a half.

And historically? Repeated failures to smash through a major resistance often end badly… usually with a pretty rough pullback.

If HBAR can’t break $0.200 soon, it risks slipping back to $0.182, and if that support cracks too, we’re probably looking at a slide toward $0.167 — which, again, would set off that $42 million liquidation bomb.

Bullish Scenario Still in Play — If $0.20 Falls

But hey, it’s not all gloom. If market conditions stay favorable and investors keep showing up with buy pressure, there’s still a real shot at HBAR finally busting through $0.20.

If it does?

The next big target would be around $0.222, and breaking that resistance could kickstart a fresh wave of bullish momentum — putting the bears on the back foot for once.

Final Thoughts: Crunch Time for HBAR

HBAR’s sitting at a major crossroads right now. The next few days could decide whether it’s heading for a breakout run or slipping into another rough patch.

One thing’s for sure though — with funding rates high, bullish traders locked in, and liquidation risks looming, it’s shaping up to be a pretty wild ride.