- Bitcoin surged 11% this week to around $95K, marking its strongest weekly performance since Trump’s 2024 win, fueled by $2.7B in ETF inflows.

- Institutional interest is exploding, with companies like Twenty One Capital and whales aggressively stacking Bitcoin as liquidity dries up in the spot market.

- Analysts predict BTC could hit $133K–$136K by late 2025, despite short-term swings, signaling the start of Bitcoin’s final bull run wave.

Bitcoin’s been on an absolute heater this week — and it’s shaping up to be its strongest weekly rally since Donald Trump snagged the presidency back in November 2024.

BTC Charges Past $95K as Spring Rally Heats Up

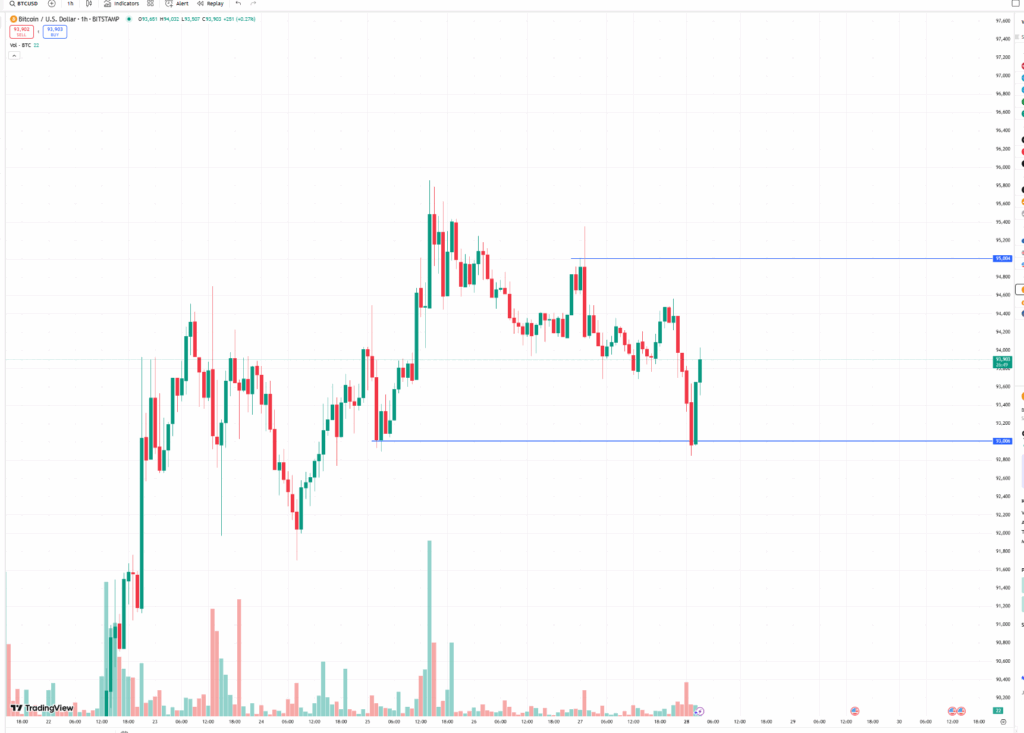

As of Friday afternoon, Bitcoin (BTC) was holding strong around $95,000, marking a 1.8% gain over the past 24 hours. Ethereum (ETH) wasn’t far behind either, climbing 2% to just a touch above $1,800.

In fact, it’s not just the big dogs. Altcoins like SUI, Bitcoin Cash (BCH), and Hedera (HBAR) were also popping off inside the broader CoinDesk 20 Index.

This week alone, Bitcoin is up over 11%, putting it on pace for the best week it’s had since Trump’s election shook up markets and set off a crypto boom.

ETF Inflows Hit $2.7 Billion — Appetite Reignited

One of the big drivers? U.S.-listed spot Bitcoin ETFs have absolutely crushed it this week, pulling in a massive $2.68 billion in net inflows — the biggest since December, according to SoSoValue.

We’ll get Friday’s final numbers soon, but yeah, the appetite is back in full force.

Bitcoin Decoupling From Stocks and Gold?

Another interesting twist: Bitcoin’s been flexing its muscles against traditional markets like stocks and gold.

David Duong, Coinbase Institutional’s head of research, said in a report Friday that we might actually be witnessing a major inflection point in real-time — something you usually only recognize looking back.

According to Duong, Bitcoin’s behaving more like a “store of value” now, standing tall even as traditional markets wobble.

Corporates Jumping In, Markets Getting Thinner

Following Strategy’s Bitcoin-first strategy, new players like Twenty One Capital — backed by Tether, Bitfinex, SoftBank, and others — plan to stack 42,000 BTC right out the gate.

Meanwhile, liquidity in Bitcoin’s spot markets has been drying up fast, making the market “thin and fragile,” says Dr. Kirill Kretov from CoinPanel. In other words, it doesn’t take much anymore to send Bitcoin swinging 10% either way.

$133K Bitcoin in Sight?

Despite all the ups and downs, John Glover from Ledn is feeling pretty bullish.

Using Elliott Wave theory, he believes Bitcoin’s just kicked off the final big wave of its bull market — and says we could be looking at $133K to $136K by the end of 2025 or start of 2026.

Sure, a dip back to $75K isn’t off the table in the short term, but the bigger picture? It’s looking brighter than ever for BTC.