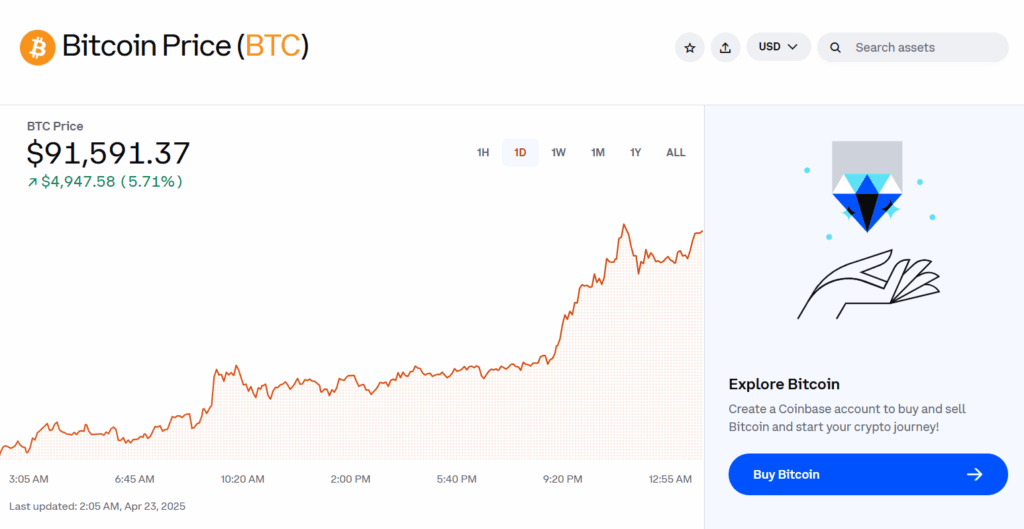

- Bitcoin is closing in on $89K while traditional markets slump under Trump’s tariffs and Fed drama.

- Trump’s threats to fire Fed Chair Powell are adding fuel to economic uncertainty, but BTC seems to be thriving.

- Analysts say Bitcoin is regaining its role as a hedge, with ETF inflows and rising dominance hinting at more upside.

So, here we are again—Bitcoin rising while the rest of the financial world seems to be sliding into chaos. On Monday, BTC crept close to $89,000, while U.S. markets had a rough day, largely due to the drama unfolding around Trump’s tariff push and the uncertainty that comes with it.

Markets Stumble, Bitcoin Keeps Its Cool

Let’s talk numbers for a second. The Dow dropped nearly 1,000 points. The Nasdaq fell over 2.5%. The S&P 500 slid too. Tech giants? Took a beating. Tesla down almost 6%, Nvidia slipped over 4%, and Amazon, Meta… yeah, they got hit too. Meanwhile, Bitcoin just kept moving up.

A lot of this has to do with the weakening dollar. The DXY hit its lowest point in three years, which, historically, tends to light a fire under Bitcoin. Analyst Ben Werkman called it—“Bitcoin is back on the move.” And he might just be right.

The Trump vs. Powell Show

Now, in the middle of all this, Trump is once again throwing shots at Fed Chair Jerome Powell. On Truth Social, he basically said Powell’s “termination can’t come fast enough.” Yeah, that’s… subtle. Apparently, his team is even looking into whether they can legally fire the guy.

Powell, for his part, has warned that Trump’s tariffs could push inflation higher, making things more complicated for the Fed’s already difficult balancing act. According to him, we’re staring down the barrel of a scenario where high inflation and slow growth crash into each other. Not ideal.

Bitcoin as a Hedge—Again?

With all this noise, Bitcoin is once again being talked about as a hedge—this time not just against inflation but against good ol’ fashioned political chaos. Geoff Kendrick from Standard Chartered said BTC is a hedge against both TradFi collapse and U.S. Treasury drama, especially now that Powell’s job seems like it’s on the chopping block.

He pointed out that Bitcoin stepped up in the face of SVB’s collapse last year, and now, with Treasury yields doing weird things, it might be doing it again.

Sentiment Shifts Slightly Bullish

Over in the Bitwise camp, they’re seeing a tiny mood shift. Their crypto sentiment index flipped slightly bullish, with 8 of 15 indicators showing positive signs. Plus, their Cross Asset Risk Appetite (CARA) index nudged up too—still negative, but not as grim as before.

Interestingly, a good number of altcoins—about 20%—have been outperforming Bitcoin lately. That could be a clue that the market’s getting a little frisky again.

The Bigger Picture

So what’s next? Well, if BTC can punch through that $89K–$90K range, analysts are saying $92K could come pretty quick. There’s resistance up there, sure, but with ETFs seeing their biggest inflows in months ($381M on Monday, by the way), it looks like institutional money is creeping back in.

And with Bitcoin dominance hitting 64.5%—a four-year high—maybe, just maybe, the next leg up isn’t that far off.