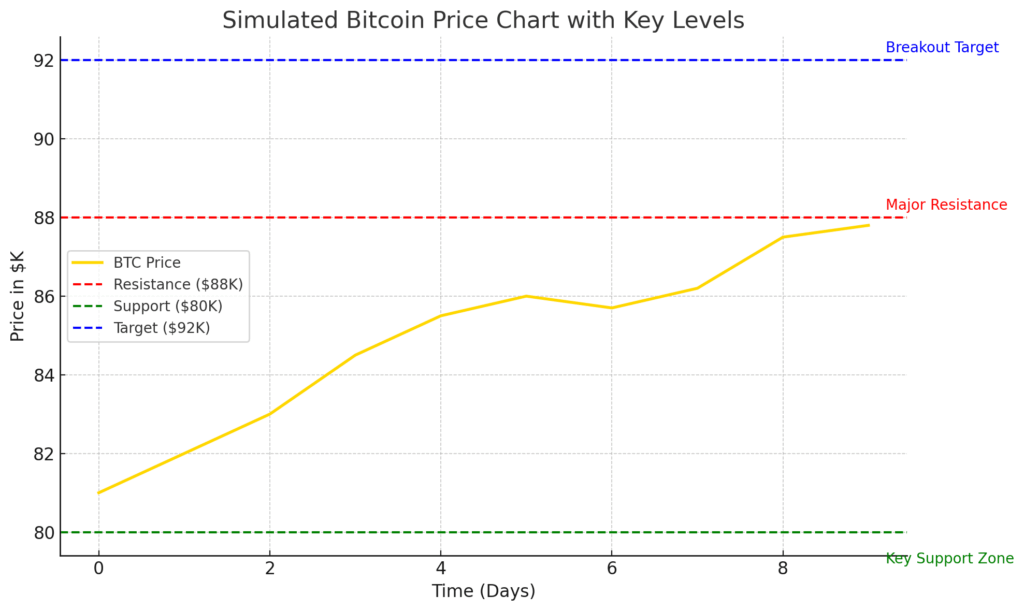

- Bitcoin is stuck just below the $88K resistance and 200-day moving average, with bulls needing a strong daily close above to target $92K–$100K.

- 4-hour chart shows bullish structure, but momentum is shaky with repeated rejections at $86K; RSI suggests bulls still have some room to run.

- Open interest is rising near $28B, hinting at incoming volatility—either a breakout fueled by long positions or a sharp liquidation if price reverses.

Bitcoin’s been teasing a breakout for weeks now—but so far? Still stuck in that stubborn consolidation range. It’s been slowly inching higher, trying to reclaim the 200-day moving average, but price action remains hesitant. The market’s tense, and with leverage building up fast in the futures arena, whatever happens next could get loud.

Daily Chart: Hovering Below Resistance, But the Setup’s There

Zooming out to the daily chart—Bitcoin has clawed its way back from the March sell-off. Right now, it’s dancing just under the 200-day moving average, sitting around $88K. That line is acting like a brick wall. BTC’s printing slightly higher highs and higher lows, which is nice… but it’s still capped beneath that $88K mark.

A daily close above $88K? That would be a game-changer. It could open the door for a clean push to $92K, and maybe even a shot at $100K if momentum sticks. But if it gets slapped down again, watch the $80K level closely—that’s the zone bulls need to defend to keep the recovery narrative intact.

4-Hour Chart: Bullish Signs, But Momentum’s Sluggish

Now, the 4-hour chart tells a slightly different story. BTC broke out of a long-term descending trendline, which is usually a bullish signal. It’s consolidating just below the $86K–$88K supply zone—not ideal, but also not bearish. The structure’s still showing higher highs and higher lows.

Here’s the thing, though: price action’s been messy. Repeated rejections from the $86K level suggest bulls are testing the waters—but haven’t fully committed. RSI is creeping up, but it’s not in overbought territory yet. So, bulls probably still have gas in the tank… they just need to floor it.

If BTC does break above $88K, don’t be surprised if we see a quick leg up. This range is tight, and pressure’s building.

Open Interest: The Calm Before the Storm?

Open interest is climbing again—currently around $28 billion, right as Bitcoin trades in that mid-$85K range. Historically, this kind of slow grind higher in price paired with growing leverage tends to precede a volatile breakout. And not always to the upside.

If BTC breaks out, stacked long positions could supercharge the move with a nice little short squeeze. But if price stalls and pulls back, you might see a long liquidation flush that drags everything down hard, fast.

In short: volatility is coming. It’s just a matter of which direction hits first.