- Massive Options Expiry: $2.02B in Bitcoin and $280M in Ethereum options are set to expire, potentially sparking major price volatility.

- Bitcoin Outlook: BTC is trading near $84.5K with bullish sentiment from institutional investors and positive on-chain data. Whale accumulation suggests post-expiry upside.

- Ethereum Under Pressure: ETH is trading below $1,600 with bearish sentiment and large exchange inflows from whales, hinting at possible sell pressure and more volatility ahead.

Things are getting tense in the crypto market as a whopping $2.02 billion in Bitcoin options and $280 million in Ethereum options are set to expire today. Historically, big expiries like this don’t go quietly—they often shake things up, pushing prices into sudden, unpredictable swings.

Traders are scrambling, repositioning quickly—either to guard what they’ve got or to squeeze out every last bit of profit. And with sentiment split and open interest climbing, both BTC and ETH could be in for a choppy ride today.

Bitcoin: Holding Steady or Ready to Pop?

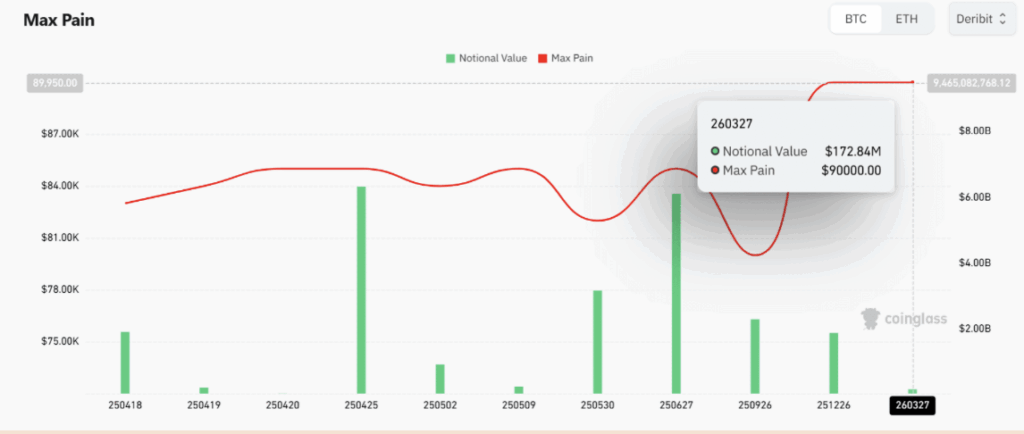

At the time of writing, Bitcoin is floating just below $84.5K, down a modest 0.34%. But the real eye-opener? Max pain’s sitting near $90K. That’s the level where market makers are least likely to lose money—and often, price gravitates toward it as expiry closes in.

Open Interest in BTC has also jumped 1.81% to $54.73 billion. More participants = more volatility, especially when emotions are running high.

What’s interesting is how retail vs. smart money is shaping up. According to MarketProphet:

- Retail sentiment: -0.20 (a little gloomy)

- Smart money sentiment: +0.92 (pretty darn optimistic)

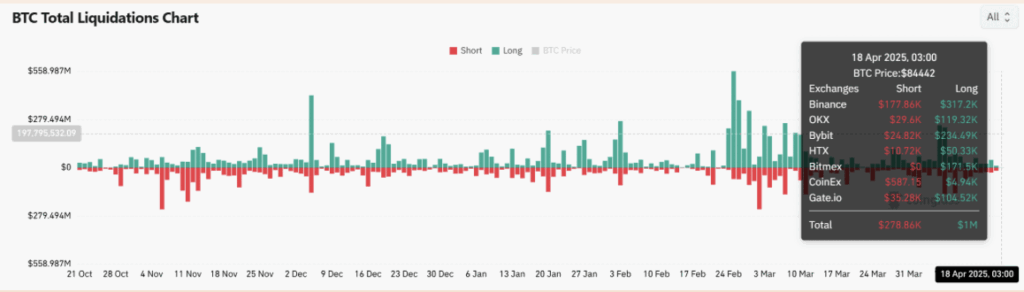

So, while retail’s playing it safe, the big players seem to think BTC’s still got legs. And the liquidation data? Kind of supports that—$1 million in long positions have been liquidated, versus just $278K in shorts. Could mean longs were overleveraged, but also… they’re getting cleared out for a reset.

Ethereum: Slipping Into Uncertainty

Ethereum isn’t faring quite as well. It’s trading just below $1,600, down about 1.54%, and hanging under its Max Pain level of—you guessed it—$1,600.

But the sentiment here tells a different story. While Bitcoin’s smart money is feeling confident, ETH’s not getting the same love:

- Retail: -0.15

- Smart money: -1.67 (ouch)

That’s a pretty steep bearish lean, especially with price already sagging. Unless something major shifts soon—like improved fundamentals or a surprise catalyst—ETH might keep dragging sideways… or worse.

Whale Behavior: The Bigger Picture

If you want to know what might happen next, it helps to watch the whales. This past week, 15,000 BTC were pulled off exchanges. That’s usually a bullish signal—big holders moving into cold wallets often means they’re in no rush to sell.

So, BTC’s got some backing here. If it can hold its ground after expiry, we could see a move upward, especially if sentiment stays intact.

ETH though… not so lucky. Over the past six days, Galaxy Digital deposited 62,181 ETH (roughly $99.4 million) to exchanges. Even worse? $20 million of that hit Binance just eight hours ago.

When whales move that kind of money onto exchanges, it usually spells sell pressure or at the very least, hedging. Combined with the already bearish outlook, it’s not looking super rosy for ETH in the near term.

Final Take

So here’s where we’re at:

- BTC is holding up surprisingly well, with smart money showing signs of strength and whales backing off from exchanges.

- ETH, meanwhile, is facing more pressure, both technically and from whale activity, which could lead to more volatility ahead.

Today’s expiry could be a turning point—or just more fuel on the fire. Either way, it’s a day to keep your eyes on the charts and your stops tight.