- Canary Capital has filed with the SEC to launch a staked TRX ETF, aiming to earn staking rewards alongside price exposure.

- The ETF would use BitGo as custodian and marks one of several crypto ETF plans from Canary, including Litecoin, Hedera, and Sui.

- The SEC’s recent friendlier stance under Trump has boosted hopes for more altcoin ETFs, following earlier approvals of Bitcoin and Ethereum funds.

The firm just filed paperwork with the SEC for something it’s calling the Canary Staked TRX ETF… and as you might’ve guessed, it’s not your average passive tracker.

According to the filing dropped Friday, the ETF won’t just mirror TRX’s price—it plans to stake a portion of its holdings too. That means the fund won’t just be sitting on coins; it’ll be actively earning rewards. BitGo Trust is listed as the custodian, which makes sense, given their role in plenty of other digital asset funds.

The fund’s goal? Straightforward enough: give investors exposure to TRX and capture that extra staking yield. From the filing: “The Trust intends to establish a program to stake a portion of the Trust’s assets through one or more staking infrastructure providers.” So yeah—yield farming, but make it ETF.

Now, this isn’t Canary’s only swing at crypto ETFs. They’ve got others in the works—names like Pengu, Sui, Hedera, and even good ol’ Litecoin are reportedly lined up behind TRX. And they’re not alone. A growing list of firms are racing to push through ETFs tied to tokens like XRP and Solana, betting that the post-Gensler SEC is a little more crypto-curious these days.

And honestly, that bet isn’t wild. Under Gary Gensler, the SEC cracked the door open with spot Bitcoin ETFs in Jan 2024, and spot Ethereum ETFs followed in July—thanks in part to Grayscale’s courtroom hustle. But since Trump walked back into the Oval Office in January, things have definitely shifted. Lawsuits have been quietly shelved, and crypto roundtables have become kind of… a thing.

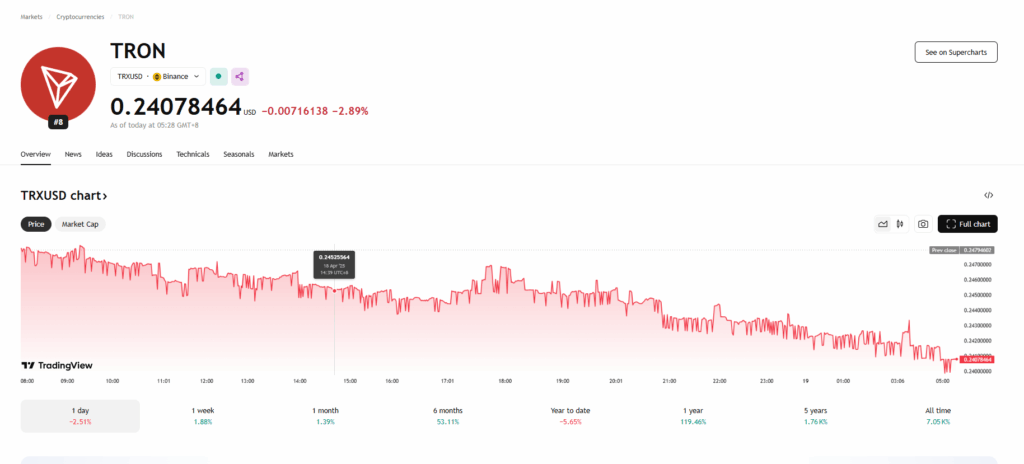

As for TRX? It’s been around for a while now. Launched by Justin Sun, the network built itself as a decentralized alternative for apps and media. These days, it’s sitting pretty with a $22.9 billion market cap—ranking 9th in the world, per The Block’s latest data.

All eyes are now on the SEC. Will they play ball? No guarantees, of course, but this could be yet another sign that crypto ETFs aren’t just a Bitcoin-and-Ethereum story anymore.