- Nvidia’s stock dropped nearly 7% after the U.S. restricted sales of its H20 AI chip to China.

- The company expects a $5.5 billion charge, cutting into earnings and sparking a broader tech selloff.

- China once made up 20% of Nvidia’s data center revenue, but tighter U.S. export controls are slashing that fast.

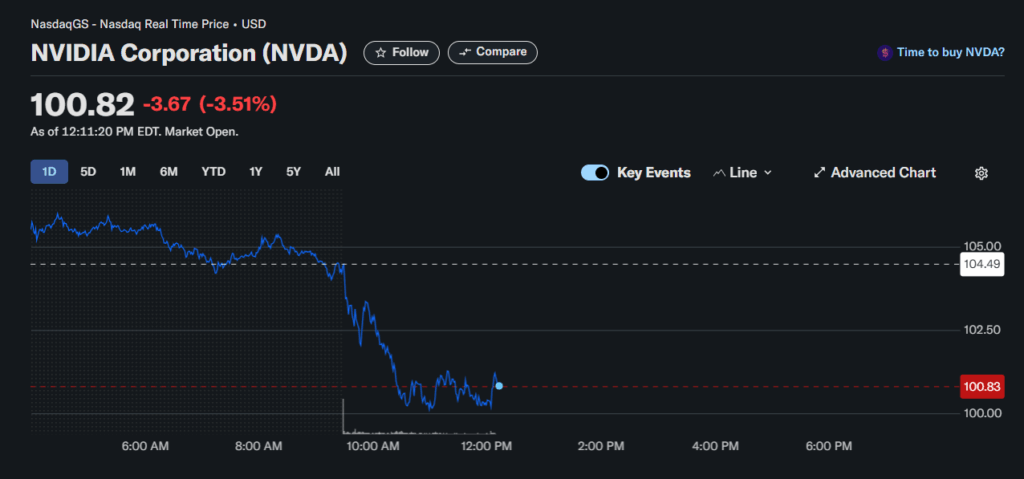

The stock market was cruising for a bit—recovering nicely after the post-Liberation Day dip on April 8. But that rally? Yeah, it took a gut-punch on April 16. The S&P 500 fell 2.2%, while the Nasdaq tumbled even harder, down 3.1%. And the catalyst? You guessed it—Nvidia.

The H20 Problem

So here’s what happened. Nvidia dropped a surprise bombshell: the U.S. government hit it with new export restrictions on its top AI chip, the H20. This chip was specifically made for the Chinese market to avoid triggering export controls. But now? Nvidia needs a special license to sell it in China—which, let’s be honest, probably won’t get approved.

This is a big deal. Nvidia has been riding the AI wave like a pro surfer—its stock’s up 171% this year alone. But the news wiped out nearly 7% of its market value in just one session.

Domino Effect Across Wall Street

Because Nvidia is huge—we’re talking third-biggest in the S&P 500 and Nasdaq 100—this hit didn’t stay contained. Wall Street had to go back to the drawing board, slashing earnings forecasts and resetting valuations. That created a chain reaction in tech stocks.

Powell’s warning about inflation from tariffs didn’t help either. Between that and the Nvidia drop, it was the perfect storm.

China Sales? Slashed.

Let’s talk numbers. Nvidia used to get about 20% of its data center revenue from China. According to CEO Jensen Huang, that’s now more like half that. And the H20 chip? That one was doing some heavy lifting. Chinese giants like ByteDance, Tencent, and Alibaba had reportedly ordered $16 billion worth of those chips just in Q1.

Now that those orders are dead in the water, Nvidia is writing off $5.5 billion worth of inventory. Ouch.

Analysts Are Not Thrilled

Bank of America analysts said this is basically confirmation the H20 is toast in China. They’re projecting a 5% to 10% hit on Nvidia’s FY26 earnings per share, depending on how bad the fallout gets.

But interestingly, they also say the stock is priced fairly attractively now, trading at a P/E of around 20—which is below its usual floor. So, is this the bottom? Maybe. Maybe not.

A Bigger Picture Shift

The AI boom is still on, sure. But folks are starting to wonder if we’ve reached the “too much, too fast” point. Especially now that upstarts like China’s DeepSeek are building ChatGPT-style models using older chips—and way less money.

Combine that with tariff fears, slowing growth, and companies like Amazon and Google tightening their belts on AI spending, and you’ve got a pretty messy situation.

Nvidia may still lead the charge in AI, but with the U.S. tightening chip exports and China finding workarounds, the path forward suddenly looks a bit foggier.