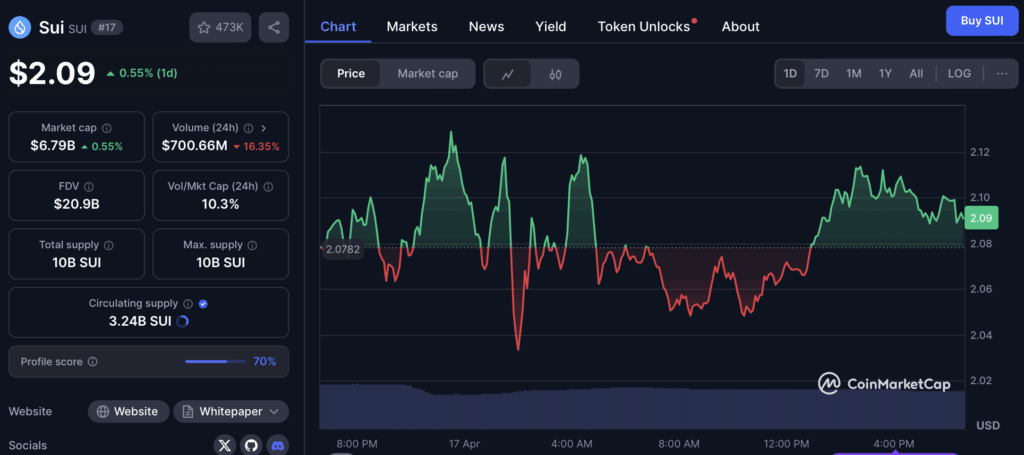

- SUI is consolidating near $2 after a sharp drop from $5, with technicals showing a potential breakout forming inside an ascending channel.

- Network fundamentals remain strong, with $1.22B in TVL, $250M+ in daily DEX volume, and $45M in annualized revenue supporting long-term confidence.

- Sentiment is cautiously bullish, and a breakout above key trendline resistance could trigger the next rally — but traders are watching for confirmation first.

SUI crypto has been riding a bumpy wave in early 2025. After lighting things up late last year, it’s now stuck under a tough resistance line and moving sideways. Some traders are feeling cautious, others are eyeing a breakout — and honestly, both camps might have a point.

Let’s dive into the mess and see what’s really going on.

From $5 Highs to Hovering at $2 — What’s Up With SUI?

So far this year, SUI has slipped into correction mode, chilling around the $2 mark after peaking close to $5 not too long ago. If you’re looking at the 12-hour chart, the picture’s clear — a solid downtrend is in play, but there’s a twist.

SUI seems to be coiling up inside an ascending channel, and according to the old Elliott Wave believers, that big move earlier could’ve completed a full wave cycle. If so, we might be sitting near the bottom of the correction.

Key levels to watch? $3.6 and $3.2 on the Fibonacci scale — both have acted as critical zones during this cool-off. If the price can stay inside this structure, we could see a springboard-type move soon.

Fundamentals Are Holding Strong — Maybe Even Too Strong to Ignore

While the price has cooled, the network activity definitely hasn’t. SUI’s TVL is sitting at $1.22 billion, and daily DEX volume has cleared $250 million — that’s not small potatoes. Even better, the protocol is clocking around $45 million in annualized revenue.

That kind of revenue usually only shows up when people are actually using the chain, which… they are. Between zkLogin, sponsored transactions, and native NFT integrations, SUI has kept its utility pretty sticky.

So even if the chart’s indecisive, the fundamentals are screaming, “We’re not done here.”

Sentiment’s Warming Up — Just Needs a Spark

Despite the chop, SUI’s up 5.8% over the past week, outperforming coins like TON, which dropped around 4.6%. But zoom out, and it’s still down 4% today, with volume also slipping by 16% — so we’re in this weird space where both fear and optimism are hanging in the air.

A lot of eyes are on one thing: that annoying trendline resistance. It’s been holding strong — but the more SUI taps it, the weaker it becomes. If price can finally pop above and stay there? That’s a clean breakout signal.

If not, we could see a short-term pullback to retest those Fib support zones.

SUI’s Got the Setup — But Can It Deliver?

With its $6.8 billion market cap and ranking among the top 20 cryptos (thanks, CoinGecko), SUI’s not some underdog project trying to prove itself. It’s already proven a lot.

The question now is whether it’s got the strength — or the volume — to break out of this consolidation and ride the next leg up.

Final Take

SUI isn’t screaming “buy now,” but it’s whispering something close. It’s bottoming out technically, building energy under resistance, and backed by strong fundamentals. If the broader market firms up — and sentiment tips bullish — this could be one of those moves people look back on thinking, “Yep, that was the setup.”

Still… wait for confirmation. Breakouts without volume? Paper tigers. But with the right spark? SUI could surprise everyone.