- Whale activity has cooled off, with daily BTC outflows dropping from 800K to 300K, driven more by capitulation than confidence.

- Miners are under pressure, offloading 15K BTC amid shrinking margins and high hashrates, contributing to the market’s instability.

- CryptoQuant sees low sentiment, with its Bull Score stuck at 20, suggesting Bitcoin may stay range-bound unless accumulation and sentiment sharply improve.

Things aren’t looking super bright for Bitcoin lately. According to a new report from CryptoQuant, daily outflows from major BTC holders — the whales — have dropped significantly, sliding from around 800,000 BTC in late February to just 300,000 now. But before you assume that’s bullish, hold on. Analysts say this isn’t because of stronger conviction… it’s more like capitulation. They’re just done holding for now.

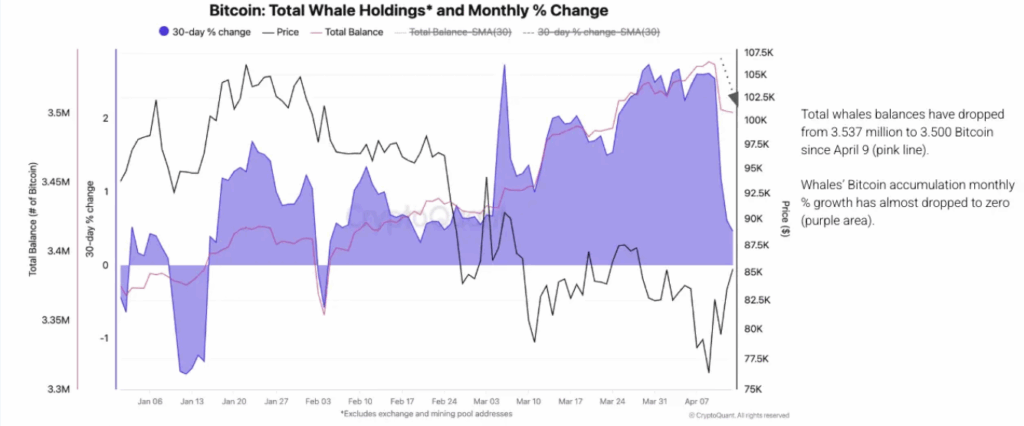

Whales have been realizing losses ever since BTC slipped under $80K. Over the past week alone, their collective stash has shrunk by roughly 30,000 BTC. Not exactly confidence-inspiring.

Accumulation Slows, Miner Activity Spikes

Zooming out a bit, the bigger picture doesn’t offer much comfort either. CryptoQuant’s dashboards show that the monthly accumulation rate has slowed to 0.5% — the weakest pace since Feb. 20. That’s a long way from the accumulation bursts we saw earlier in the year.

Miners, meanwhile, seem to be feeling the heat. On April 7, about 15,000 BTC was moved out — the third-largest miner outflow so far in 2025. Why? Profit margins are thinning. In late January, miner profitability sat at a healthy 53%. Now? It’s down to just 33%, squeezed by an all-time high hashrate and, yeah, pretty lame transaction fees.

Sentiment? Still Bearish

CryptoQuant’s Bull Score Index — a sort of “mood tracker” for the market — is sitting at 20. That’s… low. And worse, it’s been under 50 for 58 out of the last 60 days. The only other time that’s happened recently? The tail end of the 2022 bear market. So, not exactly reassuring.

The analysts also pointed to macro jitters, particularly the ongoing U.S.-China tariff tensions. Apparently, whales tend to pull back during times of trade uncertainty — and this seems no different. When risk appetite fades, so does accumulation.

What Now? Range-Bound Likely, for a While

At this stage, CryptoQuant’s outlook is clear: until whales start buying again and miners chill out on the selling, Bitcoin’s probably gonna stay range-bound. Maybe some little pumps here and there, but they’ll be fragile — easily crushed by renewed selling.

That said, if BTC dips further, whales could step in and scoop up the discount. But don’t expect fireworks until the Bull Score crosses 40. That would be the real signal of a sentiment shift — but for now, it’s just not there.

So yeah… maybe time to stay cautious. At least for a bit.