- SHIB’s stuck in a downtrend, trading near $0.0000119 with low volume and heavy resistance around $0.0000128—signaling more downside if bulls can’t break through soon.

- Bearish momentum dominates, with 62% of top traders shorting SHIB and a strong chance of a 30% drop if the price fails to hold above key support levels.

- Despite a recent attempt to break out, SHIB remains below both its 50 and 200-day EMAs, showing no real bullish strength unless sentiment shifts fast.

Shiba Inu (SHIB) seems to be losing steam again, with price action tilting bearish—and yeah, things could get a bit rough if current trends hold.

At the moment, the broader crypto market is wobbling. Volatility’s high, sentiment’s shaky, and traders are hesitant to jump into riskier assets like memecoins. That’s not exactly helping SHIB’s case.

Over the last 24 hours, SHIB slipped by around 3.5%, landing just under the $0.000012 mark. It was trading close to $0.0000119 when last checked. Not dramatic, but not great either.

To make things worse, trading volume fell by over 17%, which isn’t just a random dip—it shows fewer folks are even bothering with SHIB right now. That’s both retail and maybe even some whales stepping back.

Price Structure: Still Stuck in That Downward Channel

From a technical standpoint, SHIB’s been in a downward-sloping channel since way back in December 2024. Lower highs, lower lows—it’s textbook bearish.

There was a brief attempt to break out recently, riding on a short-lived market bounce, but… nope. SHIB didn’t make it past that key resistance.

Right now, it’s hovering dangerously close to the top edge of the channel. Historically, that’s where price has flipped and headed back down. If that pattern repeats (and it often does), we could be staring at a 30% drop—possibly all the way to $0.0000084.

Oh, and don’t ignore the volume: it’s low. And low volume during a downtrend? That’s a recipe for a sharp fall if sellers get aggressive again.

Still Under Both EMAs

Zooming out a bit—yeah, SHIB’s still trading below both the 50 and 200-day Exponential Moving Averages. Not ideal. That setup usually means there’s little to no bullish momentum in the short-term. Not unless something major shifts in the broader market.

For SHIB to flip bullish again, a couple things would need to happen fast:

- A big wave of optimism in the market.

- And a daily close above $0.0000128. Otherwise, sellers stay in control.

Most Traders Are Betting Against SHIB

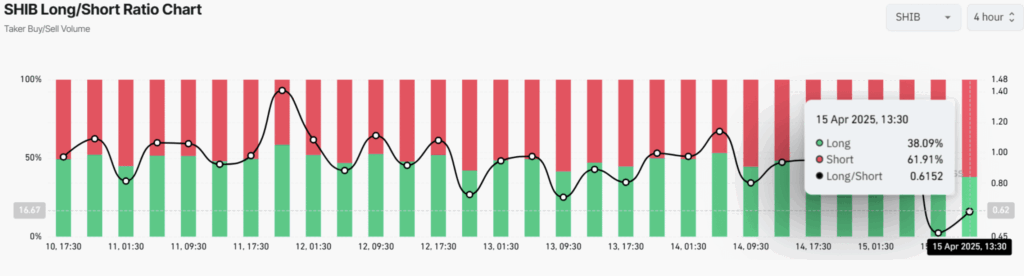

According to Coinglass, the sentiment among traders isn’t looking too hot either. The Long/Short Ratio sits at just 0.615, meaning bearish traders have the upper hand right now.

In fact, about 62% of top traders are shorting SHIB. Only 38% are holding long positions, which tells you where the majority thinks this is headed.

Leverage data shows some serious activity at two key levels: $0.0000117 (support) and $0.00001245 (resistance). And with short positions nearing $952K compared to $375K in longs… yeah, the bears are clearly in charge for now.

Final Thoughts

Unless something changes dramatically—either on the chart or in overall market sentiment—Shiba Inu could be heading lower. The descending channel is still intact, volume’s drying up, and the big players are shorting hard.

So, for anyone holding SHIB, this might be a wait-and-watch moment. And for traders… well, be careful trying to catch a falling knife.