- Bitcoin has broken above its 200-day EMA, signaling a shift in market momentum toward the bulls.

- If BTC clears $87,683 resistance, the path to $92,000 becomes much more likely.

- RSI shows room for growth, and rising volume suggests this breakout could be the real deal.

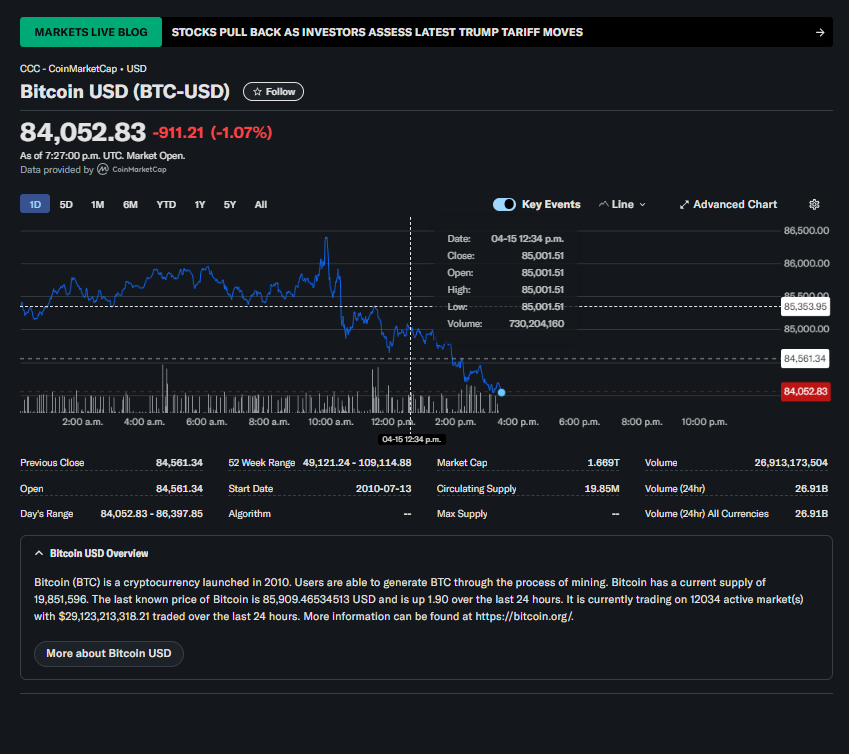

Bitcoin’s making noise again—this time, not from hype but from actual chart action. The big deal? It finally pushed past the 200-day Exponential Moving Average (EMA), a level that had been capping progress since the market cooled off earlier this year. As of now, BTC is trading around $85,872, creeping ever closer to the next psychological milestone: $86,000.

This breakout above the 200 EMA could be a signal that the bulls are regaining serious control. That line had acted as a ceiling during the chop-fest of early 2025, but now that it’s cracked, things could get a whole lot more interesting.

Next up? The $87,683 zone. Bitcoin’s bumped its head there a few times in the past, so if it breaks through cleanly, the path to $92K becomes a whole lot clearer. On the flip side, if the market takes a breather, $83,500 looks like solid ground—it’s a prior local top and sits right near the 100 EMA (black line), making it a likely bounce spot.

Now, as far as momentum goes—indicators like the RSI are still pointing up, but haven’t crossed into “uh-oh, overbought” territory yet. That gives the bulls room to keep pushing. Volume’s also rising post-breakout, which is a good sign—it means this might be legit demand, not just a fakeout pump.

If sentiment holds and macro conditions don’t throw a wrench in things, this move could be just the start of something bigger. $86K? Yeah, that might just be the warm-up.